Connecticut Department of Revenue ServicesHartford CT Form

Understanding the Connecticut Department of Revenue Services

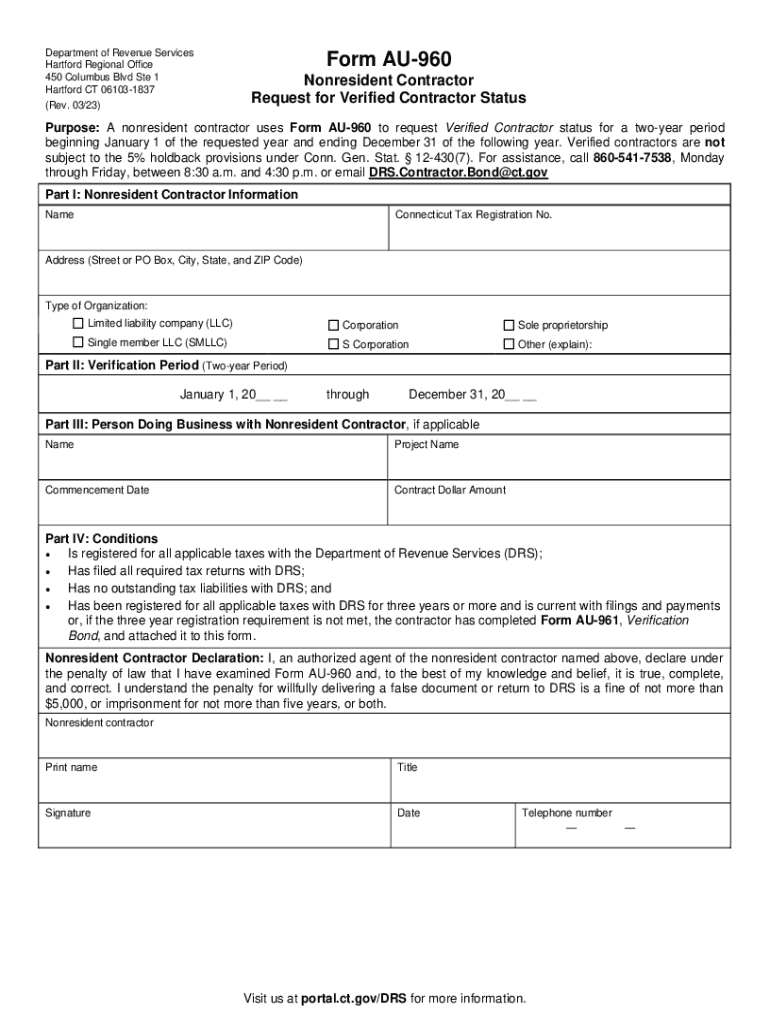

The Connecticut Department of Revenue Services (DRS) is the state agency responsible for administering tax laws and collecting taxes in Connecticut. It plays a crucial role in ensuring compliance with tax regulations and providing resources to assist taxpayers. The DRS oversees various forms, including the AU-960, which is essential for nonresidents conducting business in Connecticut. Understanding the DRS's functions can help individuals and businesses navigate their tax obligations more effectively.

Steps to Complete the AU-960 Nonresident Form

Completing the AU-960 form requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including your identification details and income sources.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form either online or via mail, depending on your preference.

Following these steps can help ensure that your submission is processed smoothly and efficiently.

Required Documents for the AU-960 Submission

When submitting the AU-960 form, certain documents are necessary to support your application. These may include:

- Proof of identity, such as a driver's license or state ID.

- Documentation of income earned in Connecticut.

- Any previous tax filings that may be relevant to your current submission.

Ensuring you have all required documents can help prevent delays in processing your form.

Form Submission Methods for the AU-960

The AU-960 form can be submitted through various methods, providing flexibility for nonresidents. The available options include:

- Online Submission: Users can fill out and submit the form electronically through the Connecticut DRS website.

- Mail Submission: The completed form can be printed and mailed to the appropriate DRS address.

- In-Person Submission: Nonresidents may also choose to visit a DRS office to submit their forms directly.

Selecting the most convenient submission method can help streamline the process.

Eligibility Criteria for the AU-960 Nonresident Form

To qualify for the AU-960 form, individuals must meet specific eligibility criteria. Generally, the requirements include:

- Being a nonresident of Connecticut.

- Having earned income within the state during the tax year.

- Meeting any additional conditions set forth by the Connecticut Department of Revenue Services.

Understanding these criteria is vital to ensure that you are eligible to file the form correctly.

Penalties for Non-Compliance with the AU-960 Form

Failure to comply with the requirements of the AU-960 form can lead to various penalties. These may include:

- Fines for late submissions or inaccuracies in the form.

- Interest on any unpaid taxes owed.

- Potential legal action for continued non-compliance.

Being aware of these penalties can motivate timely and accurate submissions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut department of revenue serviceshartford ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 25 Hartford nonresident service offered by airSlate SignNow?

The 25 Hartford nonresident service by airSlate SignNow allows users to efficiently manage and eSign documents without the need for physical presence. This service is designed to streamline the signing process for nonresidents, making it easier to handle important paperwork remotely.

-

How much does the 25 Hartford nonresident service cost?

Pricing for the 25 Hartford nonresident service varies based on the plan you choose. airSlate SignNow offers flexible pricing options that cater to different business needs, ensuring that you get a cost-effective solution for your document signing requirements.

-

What features are included in the 25 Hartford nonresident package?

The 25 Hartford nonresident package includes features such as document templates, real-time tracking, and secure cloud storage. These features are designed to enhance your document management experience and ensure that your signing process is both efficient and secure.

-

How can the 25 Hartford nonresident service benefit my business?

Utilizing the 25 Hartford nonresident service can signNowly reduce turnaround times for document signing, allowing your business to operate more efficiently. Additionally, it enhances collaboration among team members and clients, regardless of their location.

-

Is the 25 Hartford nonresident service easy to integrate with other tools?

Yes, the 25 Hartford nonresident service is designed to seamlessly integrate with various business tools and applications. This ensures that you can incorporate eSigning into your existing workflows without any hassle, enhancing overall productivity.

-

What security measures are in place for the 25 Hartford nonresident service?

The 25 Hartford nonresident service prioritizes security with features like encryption and secure access controls. airSlate SignNow ensures that your documents are protected throughout the signing process, giving you peace of mind when handling sensitive information.

-

Can I customize documents using the 25 Hartford nonresident service?

Absolutely! The 25 Hartford nonresident service allows you to customize documents with your branding and specific fields. This flexibility ensures that your documents meet your business's unique requirements while maintaining a professional appearance.

Get more for Connecticut Department Of Revenue ServicesHartford CT

Find out other Connecticut Department Of Revenue ServicesHartford CT

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document