Letter to Lienholder to Notify of Trust Illinois Form

What is the Letter To Lienholder To Notify Of Trust Illinois

The Letter To Lienholder To Notify Of Trust in Illinois is a formal document used to inform a lienholder that a trust has been established. This letter serves to notify the lienholder of the change in ownership or management of the asset secured by the lien. It is essential for ensuring that the lienholder is aware of the trust's existence and its implications for the lien agreement. This notification can help prevent misunderstandings regarding the asset's status and the obligations of the trust and its beneficiaries.

How to Use the Letter To Lienholder To Notify Of Trust Illinois

Using the Letter To Lienholder To Notify Of Trust involves several key steps. First, gather the necessary information, including the trust's name, the names of the trustees, and details about the lienholder. Next, draft the letter, ensuring it includes all pertinent information and is formatted correctly. Once the letter is complete, it should be signed by the trustee and sent to the lienholder through a secure method, such as certified mail or an electronic signature platform. Keeping a copy of the letter for your records is also advisable.

Steps to Complete the Letter To Lienholder To Notify Of Trust Illinois

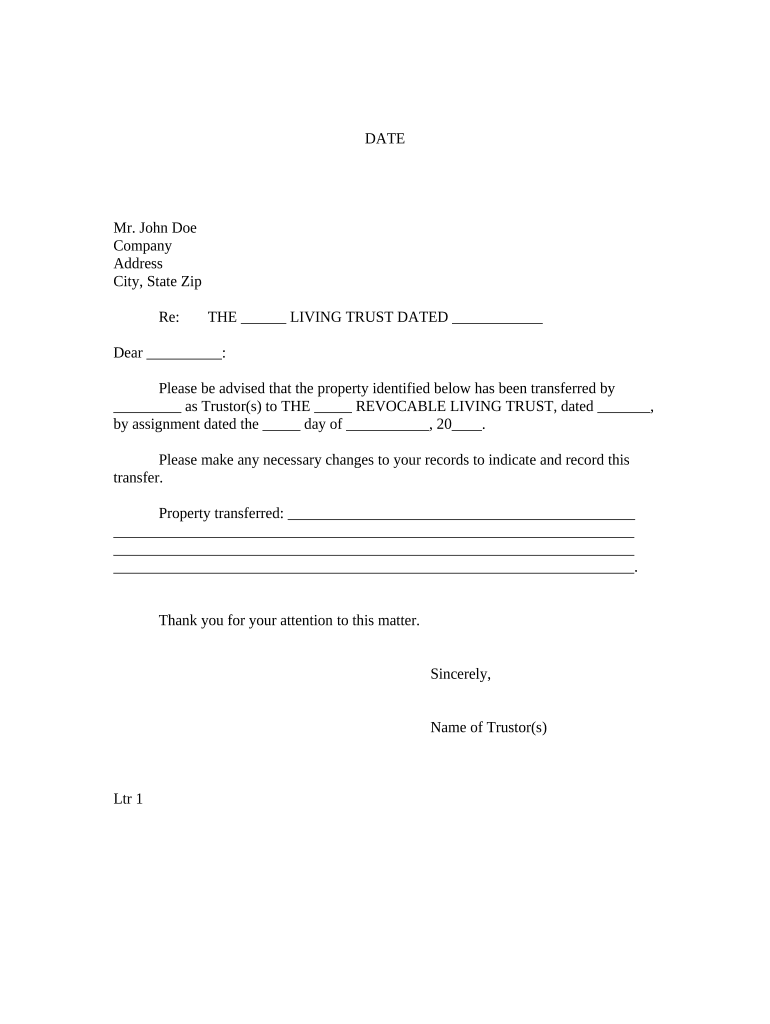

Completing the Letter To Lienholder To Notify Of Trust involves specific steps to ensure accuracy and compliance. Begin by clearly stating the date and the lienholder's contact information at the top of the letter. Next, include a salutation addressing the lienholder directly. In the body of the letter, provide a brief introduction of the trust, including its name and the date it was established. Clearly state the purpose of the letter, which is to notify the lienholder of the trust's existence. Finally, conclude with the trustee's signature and contact information. Ensure that the letter is concise and free from errors.

Key Elements of the Letter To Lienholder To Notify Of Trust Illinois

Several key elements must be included in the Letter To Lienholder To Notify Of Trust to ensure its effectiveness. These elements include:

- Trust Information: Name of the trust and date of establishment.

- Lienholder Details: Name and address of the lienholder.

- Trustee Information: Names and contact details of the trustees.

- Purpose Statement: A clear statement indicating that the letter serves to notify the lienholder about the trust.

- Signature: Signature of the trustee, along with the date.

Legal Use of the Letter To Lienholder To Notify Of Trust Illinois

The legal use of the Letter To Lienholder To Notify Of Trust is crucial for maintaining compliance with state laws regarding trusts and liens. By formally notifying the lienholder, the trustee ensures that the lienholder is aware of the trust's existence and can adjust their records accordingly. This letter is particularly important in cases where the trust holds property that is subject to a lien, as it clarifies the relationship between the trust and the lienholder. Proper execution of this letter can help prevent legal disputes and ensure that all parties are informed of their rights and responsibilities.

State-Specific Rules for the Letter To Lienholder To Notify Of Trust Illinois

In Illinois, specific rules govern the use of the Letter To Lienholder To Notify Of Trust. It is essential to adhere to state laws regarding the notification process, including any requirements for notarization or specific language that must be included in the letter. Additionally, trustees should be aware of any deadlines for notifying lienholders, particularly if the trust involves real estate or other significant assets. Familiarity with these state-specific rules can help ensure that the letter is legally sound and effectively communicates the necessary information to the lienholder.

Quick guide on how to complete letter to lienholder to notify of trust illinois

Effortlessly Prepare Letter To Lienholder To Notify Of Trust Illinois on Any Device

Managing documents online has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any delays. Manage Letter To Lienholder To Notify Of Trust Illinois on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

Effortless Editing and eSigning of Letter To Lienholder To Notify Of Trust Illinois

- Locate Letter To Lienholder To Notify Of Trust Illinois and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it directly to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you choose. Edit and eSign Letter To Lienholder To Notify Of Trust Illinois to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Letter To Lienholder To Notify Of Trust in Illinois?

A Letter To Lienholder To Notify Of Trust in Illinois is a formal document that informs lienholders about the establishment of a trust and the associated rights regarding the property involved. This letter is crucial for ensuring that lienholders recognize the trust's existence and adjust their records accordingly. It serves to protect the interests of both the trustee and beneficiaries.

-

How can airSlate SignNow help me send a Letter To Lienholder To Notify Of Trust in Illinois?

With airSlate SignNow, you can efficiently create, send, and electronically sign a Letter To Lienholder To Notify Of Trust in Illinois. Our platform makes it easy to customize your document and ensure that all necessary details are included. Additionally, you can track the document's status in real-time, ensuring a smooth communication process with lienholders.

-

What features does airSlate SignNow offer for drafting legal documents?

airSlate SignNow provides a variety of features to assist in drafting legal documents, including templates for Letters To Lienholder To Notify Of Trust in Illinois. Users can take advantage of customization options, collaborative tools, and a user-friendly interface. These features streamline the document creation process, making it accessible for individuals and businesses alike.

-

Is airSlate SignNow cost-effective for sending legal documents?

Yes, airSlate SignNow offers a cost-effective solution for sending legal documents, including Letters To Lienholder To Notify Of Trust in Illinois. Our competitive pricing plans cater to various needs, and the ability to eSign documents eliminates the need for printing and mailing, saving you time and money. Explore our pricing options to find the best fit for your budget.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow allows for seamless integration with many popular applications, enhancing your workflow when dealing with Letters To Lienholder To Notify Of Trust in Illinois. By connecting your existing tools, such as CRMs and document storage systems, you can streamline processes and improve efficiency for your legal document management.

-

What are the benefits of using airSlate SignNow for my legal documents?

Using airSlate SignNow for your legal documents, like a Letter To Lienholder To Notify Of Trust in Illinois, offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform ensures that your documents are securely stored and easily accessible, allowing you to manage sensitive information effectively. Moreover, the convenience of eSigning reduces turnaround times and facilitates swift communication.

-

How long does it take to send a Letter To Lienholder To Notify Of Trust in Illinois using airSlate SignNow?

Using airSlate SignNow, sending a Letter To Lienholder To Notify Of Trust in Illinois can be done in just a few minutes. Once you draft and customize the letter, you can eSign it and send it directly to the lienholder instantly. This quick and efficient process eliminates delays associated with traditional mailing, allowing for faster communication.

Get more for Letter To Lienholder To Notify Of Trust Illinois

Find out other Letter To Lienholder To Notify Of Trust Illinois

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now