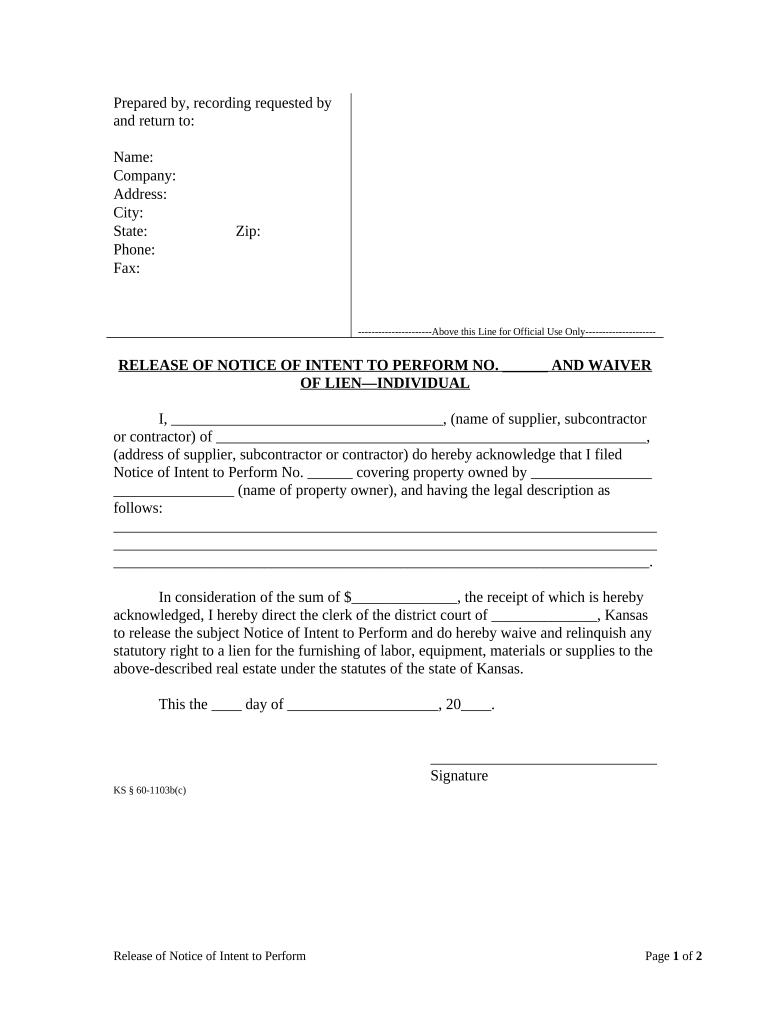

Kansas Waiver Form

What is the Kansas Notice Lien?

The Kansas notice lien is a legal document used to inform interested parties about a claim against a property due to unpaid debts. This lien serves as a public record, indicating that a creditor has a legal right to the property until the debt is settled. It is commonly utilized in various situations, such as unpaid taxes, loans, or services rendered. Understanding this form is crucial for both creditors seeking to protect their interests and property owners who need to address outstanding obligations.

Key Elements of the Kansas Notice Lien

Several essential components must be included in a Kansas notice lien to ensure its validity and effectiveness. These elements typically include:

- Debtor Information: Full name and address of the individual or entity responsible for the debt.

- Creditor Information: Name and address of the creditor filing the lien.

- Description of the Debt: A clear statement detailing the nature of the debt and the amount owed.

- Property Description: A legal description of the property subject to the lien.

- Date of Filing: The date when the lien is filed with the appropriate authority.

Including these elements ensures that the notice lien is properly recorded and enforceable under Kansas law.

Steps to Complete the Kansas Notice Lien

Filing a Kansas notice lien involves a series of steps to ensure compliance with legal requirements. Here’s a straightforward guide:

- Gather necessary information about the debtor and the debt.

- Prepare the notice lien document, ensuring all key elements are included.

- File the completed form with the appropriate county office, usually the county clerk or register of deeds.

- Pay any required filing fees associated with the submission.

- Obtain a copy of the filed lien for your records.

Following these steps will help ensure that the lien is properly recorded and legally binding.

Legal Use of the Kansas Notice Lien

The legal use of a Kansas notice lien is governed by state laws that dictate how and when a lien can be filed. It is essential for creditors to adhere to these regulations to maintain the enforceability of the lien. A properly filed notice lien can protect a creditor's rights, allowing them to pursue collection actions if the debt remains unpaid. However, improper filing or failure to follow legal procedures can lead to the lien being dismissed or challenged in court.

Form Submission Methods

Submitting a Kansas notice lien can be done through various methods, depending on the preferences of the filer and the requirements of the county office. Common submission methods include:

- In-Person: Filing the notice lien directly at the county clerk or register of deeds office.

- By Mail: Sending the completed form along with any required fees to the appropriate office.

- Online: Some counties may offer electronic filing options, allowing for a more streamlined process.

Choosing the right submission method can help ensure a timely and efficient filing process.

Examples of Using the Kansas Notice Lien

There are various scenarios in which a Kansas notice lien may be utilized. Common examples include:

- A contractor filing a lien for unpaid work on a property.

- A lender placing a lien on a property due to delinquent mortgage payments.

- A tax authority filing a lien for unpaid property taxes.

These examples illustrate the diverse applications of the notice lien in protecting creditor interests and ensuring compliance with financial obligations.

Quick guide on how to complete kansas waiver form

Prepare Kansas Waiver Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without interruptions. Manage Kansas Waiver Form on any platform utilizing airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Kansas Waiver Form easily

- Locate Kansas Waiver Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Update and electronically sign Kansas Waiver Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Kansas notice lien, and why is it important?

A Kansas notice lien is a legal notification that establishes a claim against a property due to unpaid debts. It is essential because it protects the creditor's rights and helps them recover owed amounts. Understanding how to manage a Kansas notice lien efficiently can prevent further legal complications.

-

How can airSlate SignNow assist with managing Kansas notice liens?

airSlate SignNow provides an efficient way to create, send, and eSign documents related to Kansas notice liens. Its user-friendly interface simplifies the process of documenting and managing liens. By using our solution, businesses can ensure compliance and facilitate timely actions.

-

What are the costs associated with using airSlate SignNow for Kansas notice lien documentation?

The pricing for airSlate SignNow is competitive and designed to cater to businesses of all sizes. Plans are based on the features required and include options for unlimited document signing. This cost-effective approach makes it easier to manage Kansas notice liens without breaking your budget.

-

Is airSlate SignNow easy to integrate with existing systems for managing Kansas notice liens?

Yes, airSlate SignNow offers seamless integration with various popular applications and platforms, enhancing your workflow. Integrating with your current systems allows for a more streamlined management of Kansas notice liens. Our API facilitates easy connections to ensure all your documentation processes work together efficiently.

-

What features does airSlate SignNow offer that benefit Kansas notice lien handling?

airSlate SignNow comes with features like customizable templates, audit trails, and automated reminders, which are particularly useful for handling Kansas notice liens. These tools help streamline the process and ensure all parties are informed and engaged. Additionally, eSigning capabilities ensure quick and secure documentation.

-

Can airSlate SignNow help with compliance issues related to Kansas notice liens?

Absolutely! airSlate SignNow supports compliance with state regulations associated with Kansas notice liens through its secure and legally-binding eSigning process. Our platform keeps your documents organized and accessible, making it easier to demonstrate compliance if needed.

-

How does airSlate SignNow enhance collaboration for teams managing Kansas notice liens?

airSlate SignNow enhances collaboration by allowing multiple users to work on documents simultaneously and providing real-time updates. This fosters effective communication within teams handling Kansas notice liens. Users can easily share documents and track changes, ensuring everyone is on the same page.

Get more for Kansas Waiver Form

Find out other Kansas Waiver Form

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself