Ks Lien Form

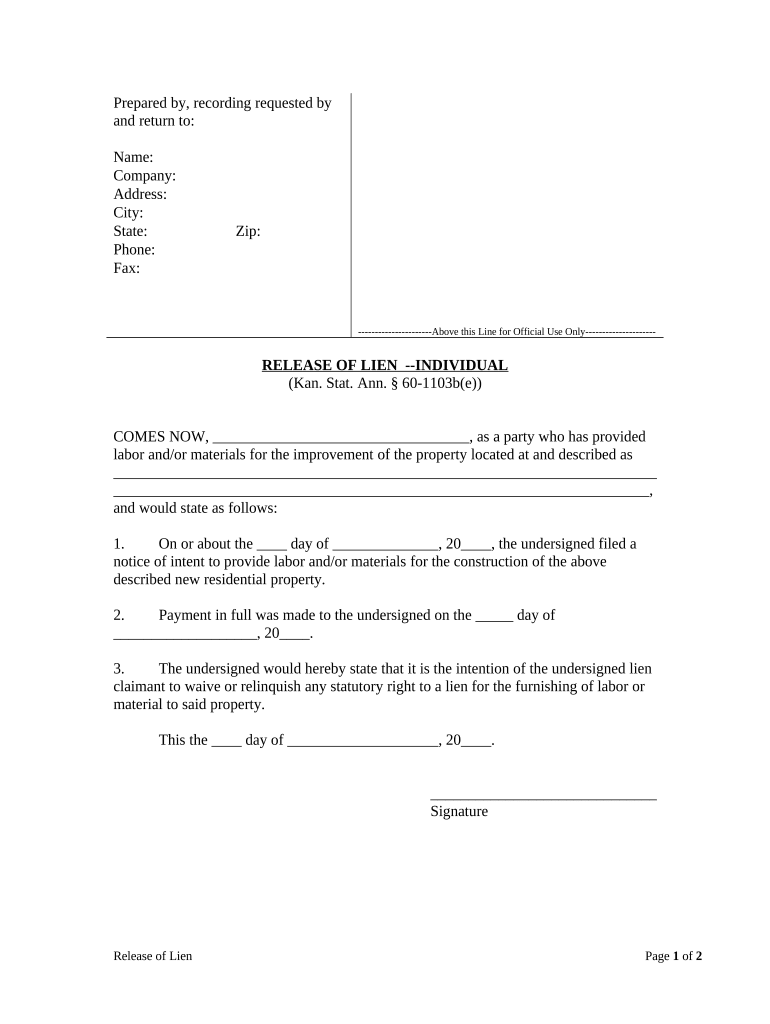

What is the KS Lien?

The KS lien is a legal claim against a property that ensures a lender or creditor is paid. This type of lien is often associated with real estate transactions, where it serves as a security interest in the property until the debt obligation is fulfilled. In Kansas, the lien can arise from various situations, such as unpaid property taxes, mortgages, or other financial obligations. Understanding the nature of the KS lien is crucial for both property owners and creditors, as it establishes the rights and responsibilities of all parties involved.

Steps to Complete the KS Lien

Completing the KS lien release form involves several important steps to ensure accuracy and compliance with legal requirements. Begin by gathering all necessary information, including the details of the property, the lienholder, and the debtor. Next, accurately fill out the KS lien form, ensuring that all fields are completed as required. It is essential to review the form for any errors before submission. Once the form is complete, it can be submitted electronically or via mail to the appropriate local authority, depending on state regulations.

Legal Use of the KS Lien

The legal use of the KS lien is governed by state laws that dictate how liens can be placed and released. In Kansas, a lien must be properly recorded to be enforceable. This means that the lienholder must file the lien with the appropriate county office, providing a public record of the claim. Additionally, the lien must comply with specific legal requirements, such as providing adequate notice to the property owner and allowing for any necessary dispute resolution. Understanding these legalities is essential for both lienholders and property owners to protect their rights.

Required Documents

When filing a KS lien, certain documents are required to support the claim. These typically include the completed KS lien form, proof of the debt owed, and any relevant agreements or contracts that establish the lienholder's right to claim the property. Additionally, identification documents may be required to verify the identities of the parties involved. Ensuring that all necessary documentation is prepared and submitted can help prevent delays in processing the lien.

Form Submission Methods

The KS lien form can be submitted through various methods, depending on local regulations. Common submission methods include online filing through designated state or county websites, mailing the completed form to the appropriate office, or delivering it in person. Each method has its own requirements and processing times, so it is important to choose the one that best fits your needs. Understanding these options can streamline the process and ensure that the lien is recorded promptly.

Eligibility Criteria

Eligibility to file a KS lien depends on specific criteria set by Kansas law. Generally, any individual or entity that has a legitimate financial claim against a property can file a lien. This includes lenders, contractors, and suppliers who have not been compensated for services rendered or goods provided. It is essential to ensure that the claim is valid and that all necessary conditions are met before proceeding with the lien filing to avoid potential legal complications.

Digital vs. Paper Version

When it comes to filing the KS lien, both digital and paper versions of the form are available. The digital version allows for quicker submission and processing, often providing immediate confirmation of receipt. In contrast, the paper version may take longer to process due to mailing times and manual handling. However, some individuals may prefer the traditional paper method for record-keeping purposes. Understanding the benefits of each option can help in making an informed decision about how to file the lien.

Quick guide on how to complete ks lien

Complete Ks Lien effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Manage Ks Lien on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Ks Lien with ease

- Locate Ks Lien and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Ks Lien and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a KS lien release?

A KS lien release is a legal document that formally removes a lien from a property in Kansas. After the lien is satisfied, this document is essential for ensuring that the property's title is clear for future transactions.

-

How can airSlate SignNow assist with KS lien releases?

airSlate SignNow helps streamline the process of creating, signing, and submitting KS lien releases. Our intuitive platform allows users to prepare documents quickly and obtain electronic signatures, ensuring timely and efficient processing.

-

What are the pricing plans for using airSlate SignNow for KS lien release?

airSlate SignNow offers several competitive pricing plans tailored to meet the needs of all businesses. Each plan includes features optimized for processing KS lien releases, ensuring affordability while maximizing efficiency.

-

Is airSlate SignNow secure for handling KS lien releases?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling KS lien releases. We utilize advanced encryption and security protocols to protect your sensitive documents and information.

-

Can airSlate SignNow integrate with other software for KS lien release processes?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for KS lien release management. Whether using CRM systems or document storage solutions, our integrations optimize your processes.

-

What benefits does airSlate SignNow offer for KS lien release documentation?

The benefits of using airSlate SignNow for KS lien release documentation include increased efficiency, reduced paperwork, and faster processing times. Our electronic signatures facilitate quicker approvals and help you maintain compliance effortlessly.

-

How user-friendly is airSlate SignNow for preparing a KS lien release?

airSlate SignNow is designed with user-friendliness in mind, making it easy to prepare a KS lien release, even for those with minimal technical expertise. Our guided process and intuitive interface ensure a smooth experience for all users.

Get more for Ks Lien

- Notarized site affidavit to accompany pupil form

- Okdhs forms online 29273995

- Agent owner letter welcome to solid source commission form

- T5 form cma

- Pension credit form pc1 download

- Ppib consent forms

- Ny 005 bargain and sale deed with covenant against grantors acts individual or corporation single sheet nybtu 8002 form

- Community service time sheet parker municipal court form

Find out other Ks Lien

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now