Quitclaim Deed from Husband and Wife to LLC Kansas Form

What is the Quitclaim Deed From Husband And Wife To LLC Kansas

A quitclaim deed from husband and wife to an LLC in Kansas is a legal document that transfers ownership of property from a married couple to a limited liability company (LLC). This type of deed is often used when couples wish to transfer their real estate assets into a business entity for liability protection or tax benefits. Unlike a warranty deed, a quitclaim deed does not guarantee that the title is free of claims or encumbrances, making it essential for both parties to understand the implications of this transfer.

Key Elements of the Quitclaim Deed From Husband And Wife To LLC Kansas

Several critical components must be included in a quitclaim deed for it to be valid in Kansas. These elements include:

- Names of Grantors and Grantees: The full legal names of both the husband and wife (grantors) and the LLC (grantee) must be clearly stated.

- Property Description: A detailed description of the property being transferred, including its legal description, must be provided.

- Consideration: The document should specify any consideration exchanged for the property, even if it is nominal.

- Signatures: Both spouses must sign the deed in the presence of a notary public to validate the transfer.

- Notarization: The deed must be notarized to ensure its legality and authenticity.

Steps to Complete the Quitclaim Deed From Husband And Wife To LLC Kansas

Completing a quitclaim deed involves several steps to ensure that the transfer is executed correctly:

- Gather necessary information, including the property description and the names of all parties involved.

- Draft the quitclaim deed, ensuring all key elements are included.

- Have both spouses sign the deed in front of a notary public.

- File the completed quitclaim deed with the appropriate county office to make the transfer official.

- Keep a copy of the filed deed for your records.

Legal Use of the Quitclaim Deed From Husband And Wife To LLC Kansas

The quitclaim deed serves a specific legal purpose in Kansas. It allows spouses to transfer their interest in a property to an LLC, which can provide benefits such as limited liability protection and potential tax advantages. However, it is crucial to understand that this type of deed does not guarantee clear title. Therefore, both parties should conduct due diligence to ensure there are no outstanding liens or claims against the property before proceeding with the transfer.

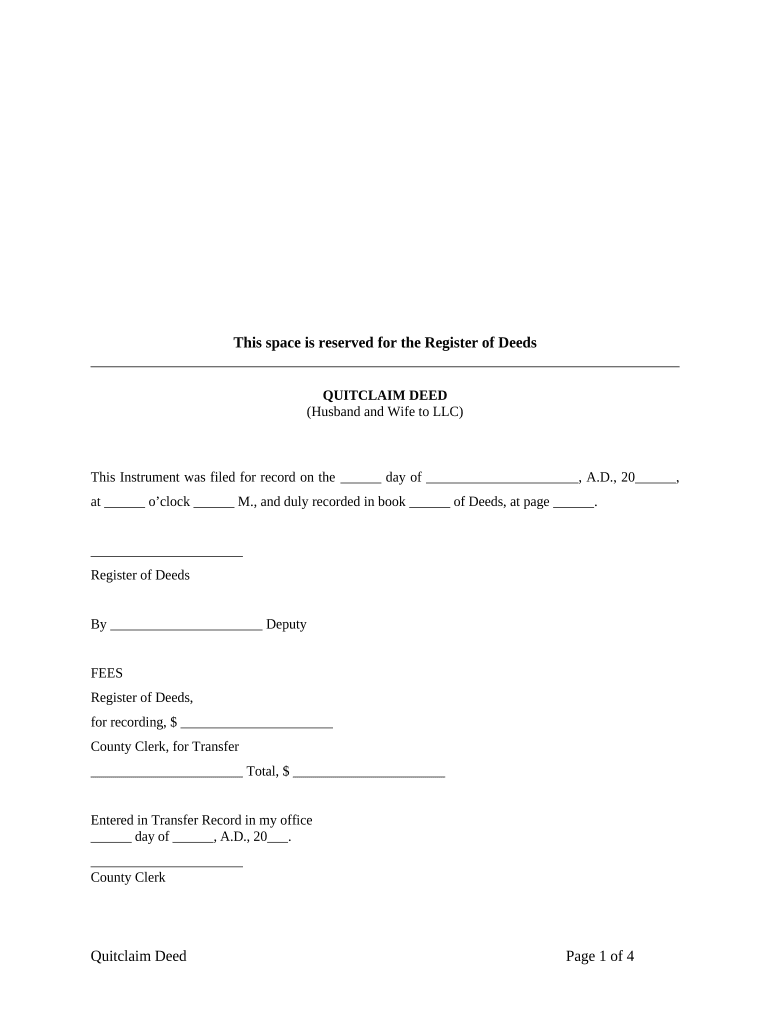

State-Specific Rules for the Quitclaim Deed From Husband And Wife To LLC Kansas

Kansas has specific regulations governing the execution and filing of quitclaim deeds. These rules include:

- The deed must be in writing and signed by the grantors.

- It must be notarized to be considered valid.

- Filing the deed with the county register of deeds is necessary for public record.

- There may be specific forms or formats required by the county, so checking local regulations is advisable.

Quick guide on how to complete quitclaim deed from husband and wife to llc kansas

Effortlessly Prepare Quitclaim Deed From Husband And Wife To LLC Kansas on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and electronically sign your documents without any hold-ups. Manage Quitclaim Deed From Husband And Wife To LLC Kansas on any device using the airSlate SignNow apps available for Android or iOS, and streamline any document-related processes today.

How to Modify and Electronically Sign Quitclaim Deed From Husband And Wife To LLC Kansas with Ease

- Obtain Quitclaim Deed From Husband And Wife To LLC Kansas and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or conceal sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or by downloading it to your computer.

Put an end to lost or misfiled documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you select. Modify and electronically sign Quitclaim Deed From Husband And Wife To LLC Kansas to ensure remarkable communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Husband And Wife To LLC Kansas?

A Quitclaim Deed From Husband And Wife To LLC Kansas is a legal document that allows spouses to transfer their property interests to a limited liability company (LLC). This type of deed is often used in real estate transactions to simplify ownership transfer without guaranteeing that the title is clear. Utilizing this deed can be an effective way to manage joint ownership efficiently.

-

How do I create a Quitclaim Deed From Husband And Wife To LLC Kansas?

You can create a Quitclaim Deed From Husband And Wife To LLC Kansas by using an online document preparation service like airSlate SignNow. Our platform provides templates and guidance to ensure that you include all necessary information, ensuring that the deed is legally binding and properly executed. It’s a straightforward process that increases accessibility for users.

-

What are the benefits of using a Quitclaim Deed From Husband And Wife To LLC Kansas?

Using a Quitclaim Deed From Husband And Wife To LLC Kansas provides several benefits, including simplifying property transfers and protecting assets from personal liability. This method allows for a quick transfer without formal title certification, which can save time and legal costs. It also aids in the effective management of joint property ownership.

-

Is there a fee associated with creating a Quitclaim Deed From Husband And Wife To LLC Kansas?

Yes, there may be fees related to creating a Quitclaim Deed From Husband And Wife To LLC Kansas, depending on the provider you choose. With airSlate SignNow, we offer cost-effective solutions to create legally binding documents, ensuring you receive high value for your investment. Pricing can vary based on the features you select, so please review our pricing details.

-

Can I eSign my Quitclaim Deed From Husband And Wife To LLC Kansas?

Absolutely! airSlate SignNow allows you to eSign your Quitclaim Deed From Husband And Wife To LLC Kansas securely and conveniently. This digital signature process ensures that your document is legally binding while also offering you the benefits of a quick and efficient signing experience. It eliminates the need for printing and scanning.

-

What features does airSlate SignNow offer for managing Quitclaim Deeds?

airSlate SignNow offers several features for managing Quitclaim Deeds, including customizable templates, secure eSigning options, and document tracking. Users can easily edit and store their Quitclaim Deed From Husband And Wife To LLC Kansas documents within our platform. The user-friendly interface also simplifies collaboration among involved parties.

-

How does using a Quitclaim Deed From Husband And Wife To LLC Kansas affect property taxes?

Transferring property via a Quitclaim Deed From Husband And Wife To LLC Kansas may have implications for property taxes, depending on the value of the property and local regulations. In many cases, this type of transfer could trigger a reassessment of the property value, potentially affecting your taxes. It’s advisable to consult with a tax professional to understand the specific implications related to your situation.

Get more for Quitclaim Deed From Husband And Wife To LLC Kansas

Find out other Quitclaim Deed From Husband And Wife To LLC Kansas

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online