How to File Form 8332 Electronically

What is the How To File Form 8332 Electronically

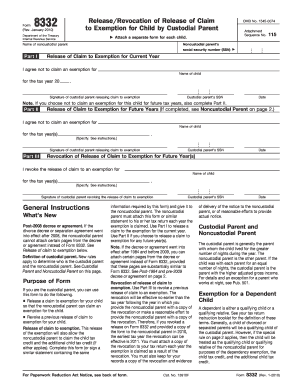

The Form 8332 is a crucial document used by custodial parents to release their claim to the child’s tax exemption to the non-custodial parent. Filing this form electronically streamlines the process, making it more efficient and secure. When you file Form 8332 electronically, you can ensure that the form is submitted directly to the IRS without the need for physical paperwork, which can often be lost or delayed. This electronic filing option is particularly beneficial during tax season when timely submission is essential.

Steps to complete the How To File Form 8332 Electronically

Completing Form 8332 electronically involves several straightforward steps:

- Access the form through a reliable e-signature platform that supports IRS forms.

- Fill in the required information, including the names of the custodial and non-custodial parents, and the child’s details.

- Review the information for accuracy to avoid any potential issues with the IRS.

- Sign the document electronically. This may involve using a digital signature or a secure method of verification.

- Submit the completed form electronically through the platform, ensuring you receive confirmation of submission.

Legal use of the How To File Form 8332 Electronically

Filing Form 8332 electronically is legally valid as long as it adheres to the regulations set forth by the IRS. The electronic version must include a proper digital signature, which is considered equivalent to a handwritten signature under the Electronic Signatures in Global and National Commerce Act (ESIGN). This ensures that the form is not only accepted but also holds the same legal weight as a paper submission.

IRS Guidelines

The IRS has specific guidelines regarding the use of Form 8332. It is essential to understand that this form must be filed for each tax year that the non-custodial parent claims the child as a dependent. The IRS recommends keeping a copy of the signed form for your records. Additionally, ensure that the form is submitted alongside the appropriate tax return to avoid any discrepancies.

Required Documents

To file Form 8332 electronically, you will need the following documents:

- The completed Form 8332 itself.

- Tax identification numbers for both parents and the child.

- Any prior agreements or court orders related to custody and tax exemptions.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

While electronic filing is the most efficient method, Form 8332 can also be submitted via mail or in person. If you choose to file by mail, ensure that you send it to the correct IRS address based on your location. In-person submissions may be made at local IRS offices, but electronic filing is generally recommended for its speed and security.

Quick guide on how to complete how to file form 8332 electronically

Effortlessly Complete How To File Form 8332 Electronically on Any Device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to locate the proper form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without holdups. Manage How To File Form 8332 Electronically on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-driven process today.

The easiest way to modify and electronically sign How To File Form 8332 Electronically with minimal effort

- Obtain How To File Form 8332 Electronically and then click Access Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using features that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Finish button to save your modifications.

- Select how you wish to send your form: via email, SMS, invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign How To File Form 8332 Electronically and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to file form 8332 electronically

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8332 and why is it important to file it electronically?

Form 8332 is a crucial document for divorced or separated parents to grant the non-custodial parent the right to claim their child as a dependent for tax purposes. Knowing how to file Form 8332 electronically can save time and reduce the likelihood of errors, ensuring that you're compliant with tax regulations.

-

How do I file Form 8332 electronically using airSlate SignNow?

To file Form 8332 electronically with airSlate SignNow, simply upload your completed form and use our eSignature features to sign it quickly. Our platform guides you through each step, making it easy to understand how to file Form 8332 electronically without any hassle.

-

Are there any costs associated with using airSlate SignNow to file Form 8332 electronically?

Yes, airSlate SignNow offers different pricing plans to cater to various business needs. Our pricing is designed to be cost-effective, especially for those who frequently need to eSign documents such as Form 8332. You can select a plan that fits your requirements best.

-

What features does airSlate SignNow provide for filing Form 8332 electronically?

airSlate SignNow offers a user-friendly interface for uploading, signing, and sharing Form 8332 electronically. Key features include template creation, mobile access, and secure signing options, allowing you to efficiently manage your documents and understand how to file Form 8332 electronically.

-

Can I track the status of my Form 8332 after filing it electronically?

Absolutely! With airSlate SignNow, users can easily track the status of their filed documents, including Form 8332. This feature provides peace of mind as you can confirm that your form has been submitted and received without any concerns.

-

What integrations does airSlate SignNow offer for filing Form 8332 electronically?

airSlate SignNow integrates seamlessly with popular platforms such as Google Drive, Dropbox, and CRM systems, enhancing your ability to handle document management. These integrations assist you in understanding how to file Form 8332 electronically while maximizing your productivity.

-

Is it safe to use airSlate SignNow for filing Form 8332 electronically?

Yes, airSlate SignNow prioritizes the security of your documents. Our platform employs advanced encryption techniques to protect your sensitive information, ensuring that when you learn how to file Form 8332 electronically, you can do so with confidence.

Get more for How To File Form 8332 Electronically

Find out other How To File Form 8332 Electronically

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free