Business Credit Application Kentucky Form

What is the Business Credit Application Kentucky

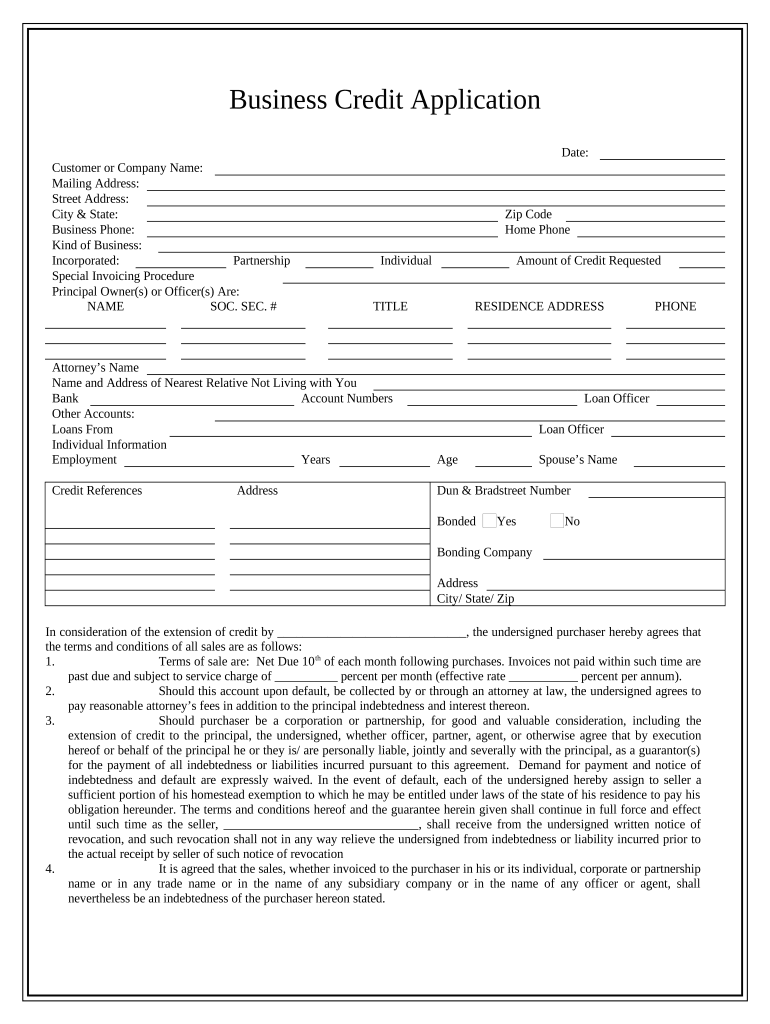

The Business Credit Application Kentucky is a formal document used by businesses in Kentucky to apply for credit from financial institutions or suppliers. This application collects essential information about the business, such as its legal structure, ownership details, financial statements, and credit history. Completing this form accurately is crucial for obtaining favorable credit terms and establishing a reliable business credit profile.

Key elements of the Business Credit Application Kentucky

Several key elements are essential to include in the Business Credit Application Kentucky. These elements typically encompass:

- Business Information: Name, address, and contact details of the business.

- Ownership Structure: Details about the owners or partners, including their names and ownership percentages.

- Financial Statements: Recent financial statements, including balance sheets and income statements, to demonstrate the business's financial health.

- Credit History: Information regarding the business's credit history, including any existing debts or outstanding loans.

- Purpose of Credit: A brief description of how the credit will be used, which helps lenders assess risk.

Steps to complete the Business Credit Application Kentucky

Completing the Business Credit Application Kentucky involves several important steps to ensure accuracy and completeness:

- Gather Required Information: Collect all necessary documents and information, including business details, financial statements, and credit history.

- Fill Out the Application: Carefully complete the application form, ensuring that all fields are filled out accurately.

- Review for Accuracy: Double-check all information provided to avoid errors that could delay the application process.

- Submit the Application: Send the completed application to the lender or supplier, following their specified submission methods.

- Follow Up: After submission, follow up with the lender to confirm receipt and inquire about the status of the application.

Legal use of the Business Credit Application Kentucky

The Business Credit Application Kentucky must adhere to legal standards to be considered valid. This means that the information provided must be truthful and accurate. Misrepresentation or providing false information can lead to legal consequences, including denial of credit or potential fraud charges. It is essential to understand the legal implications and ensure compliance with all applicable laws when completing this form.

Eligibility Criteria

Eligibility for the Business Credit Application Kentucky typically depends on several factors, including:

- Business Structure: The type of business entity, such as an LLC, corporation, or partnership.

- Creditworthiness: The business's credit history and financial stability as assessed by the lender.

- Time in Business: Many lenders require a minimum operational history, often at least two years.

- Revenue Levels: Some lenders may set minimum revenue thresholds to qualify for credit.

Application Process & Approval Time

The application process for the Business Credit Application Kentucky can vary by lender but generally follows a similar timeline:

- Submission: Once the application is submitted, the lender will begin the review process.

- Review Period: This can take anywhere from a few days to several weeks, depending on the lender's policies and the complexity of the application.

- Approval or Denial: After the review, the lender will notify the applicant of their decision, including any terms and conditions for approved credit.

Quick guide on how to complete business credit application kentucky

Complete Business Credit Application Kentucky effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Business Credit Application Kentucky on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Business Credit Application Kentucky without hassle

- Find Business Credit Application Kentucky and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the frustration of tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow handles all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Business Credit Application Kentucky and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application Kentucky?

A Business Credit Application Kentucky is a formal request made by a business to establish credit with a lender or supplier. This application typically includes business details, financial information, and credit history. Using airSlate SignNow, you can easily eSign these applications to expedite the credit approval process.

-

How does airSlate SignNow help streamline the Business Credit Application Kentucky process?

airSlate SignNow simplifies the Business Credit Application Kentucky process by allowing businesses to create, send, and electronically sign documents from anywhere. This reduces the time it takes to complete applications, as all parties can quickly review and sign without paperwork delays. It's an efficient and cost-effective solution for managing business documents.

-

What are the key features of the Business Credit Application Kentucky in airSlate SignNow?

Key features of the Business Credit Application Kentucky in airSlate SignNow include customizable templates, secure eSigning, real-time tracking, and integrations with popular CRMs. These features ensure that businesses can manage their credit applications efficiently and securely. Plus, the user-friendly interface makes it easy for anyone to navigate the process.

-

What are the benefits of using airSlate SignNow for a Business Credit Application Kentucky?

Using airSlate SignNow for a Business Credit Application Kentucky offers numerous benefits, including faster turnaround times, reduced paper usage, and enhanced document security. It helps businesses maintain a professional image while simplifying the application process. Additionally, electronic signatures are legally binding, ensuring that your applications are valid.

-

Is there a cost associated with using airSlate SignNow for Business Credit Application Kentucky?

Yes, there is a cost associated with using airSlate SignNow for Business Credit Application Kentucky. Pricing varies based on the subscription plan chosen, which may include features suited for businesses of all sizes. To find the best option, visit the airSlate SignNow website for a detailed pricing breakdown and consider a free trial to assess its effectiveness.

-

Can airSlate SignNow integrate with other business tools for Business Credit Application Kentucky?

Yes, airSlate SignNow offers integrations with various business tools, including CRMs, accounting software, and project management applications. These integrations enhance the functionality of your Business Credit Application Kentucky by allowing seamless data transfer and automated workflow processes. This ensures that all relevant information is readily available when needed.

-

How secure is the Business Credit Application Kentucky process with airSlate SignNow?

The Business Credit Application Kentucky process with airSlate SignNow is highly secure. The platform employs industry-standard encryption and complies with various regulations to protect sensitive business information. You can rest assured that your data is safe while you take advantage of efficient document management and eSigning.

Get more for Business Credit Application Kentucky

Find out other Business Credit Application Kentucky

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online