Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property Louisiana Form

What is the Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana

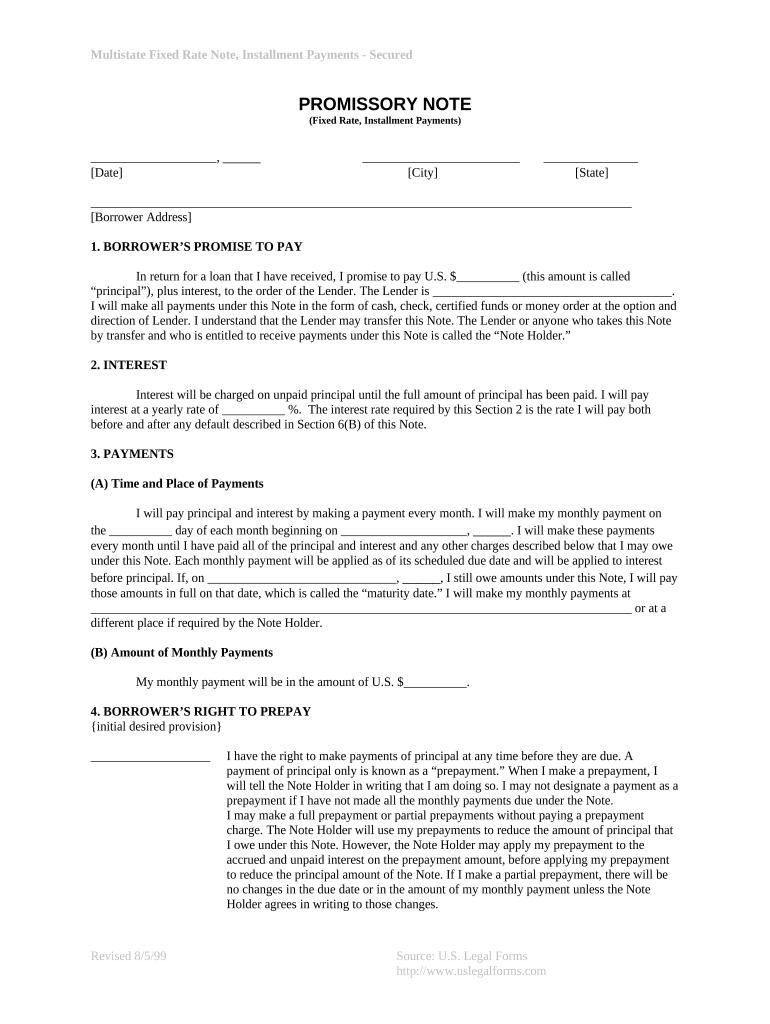

The Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document that outlines the terms of a loan agreement between a borrower and a lender. This note specifies that the borrower agrees to repay the loan in fixed installments over a predetermined period. The uniqueness of this promissory note lies in its security; it is backed by personal property, meaning that if the borrower defaults on the loan, the lender has the right to claim the specified property as collateral. This type of note is commonly used in various lending scenarios, providing both parties with a clear understanding of their obligations.

How to use the Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana

Using the Louisiana Installments Fixed Rate Promissory Note involves several steps to ensure that both the borrower and lender are protected. First, both parties should review the terms of the note carefully, including the interest rate, payment schedule, and consequences of default. Once both parties agree to the terms, they must fill out the document accurately, ensuring all required information is included. After completing the form, both parties should sign it, ideally in the presence of a witness or notary to enhance its legal standing. Finally, each party should keep a copy of the signed document for their records.

Key elements of the Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana

Several key elements are essential to the Louisiana Installments Fixed Rate Promissory Note. These include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the principal.

- Payment Schedule: Details on how often payments are due, typically monthly or quarterly.

- Collateral Description: A clear description of the personal property securing the loan.

- Default Terms: Conditions under which the lender can claim the collateral if the borrower fails to make payments.

- Signatures: Signatures of both the borrower and lender, along with dates.

Steps to complete the Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana

Completing the Louisiana Installments Fixed Rate Promissory Note requires careful attention to detail. Follow these steps:

- Gather Information: Collect all necessary details about the loan, including the principal amount, interest rate, and payment terms.

- Fill Out the Form: Accurately enter the required information into the promissory note template.

- Review the Document: Both parties should review the filled-out note to ensure accuracy and agreement on the terms.

- Sign the Document: Both the borrower and lender should sign the note, ideally in front of a witness or notary.

- Distribute Copies: Provide each party with a signed copy of the note for their records.

Legal use of the Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana

The Louisiana Installments Fixed Rate Promissory Note is legally binding when executed correctly. It must comply with state laws governing promissory notes and secured transactions. This includes ensuring that the note contains all necessary elements, such as the identification of parties, loan terms, and a clear description of the collateral. By adhering to these legal requirements, both parties can enforce the terms of the note in a court of law if necessary.

Quick guide on how to complete louisiana installments fixed rate promissory note secured by personal property louisiana

Effortlessly Prepare Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana on Any Device

The management of documents online has increasingly gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and Electronically Sign Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana with Ease

- Find Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Modify and eSign Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana?

A Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana is a legal document that outlines a borrower's obligation to repay a fixed amount of money over a specified period. This type of note is secured by personal property, providing additional assurance to the lender that they can claim the asset if the borrower defaults. It’s a reliable financial tool for structured installment payments.

-

What are the benefits of using a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana?

The primary benefits of a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana include clear repayment terms and enhanced security for lenders. By having the note secured by personal property, borrowers often receive better terms and lower interest rates. This arrangement fosters trust between parties and facilitates smoother transactions.

-

How does airSlate SignNow facilitate the creation of a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana?

AirSlate SignNow provides an intuitive platform that allows users to quickly draft a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana. With user-friendly templates and automation tools, businesses can generate these documents in minutes, ensuring compliance with Louisiana laws. This efficiency saves time and reduces errors.

-

Are there customization options available for a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana?

Yes, airSlate SignNow offers extensive customization options for your Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana. Users can modify terms, interest rates, and repayment schedules to fit their specific needs. This flexibility ensures that the note adequately reflects the agreement between the borrower and lender.

-

How can airSlate SignNow assist with eSigning a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana?

AirSlate SignNow simplifies the eSigning process for a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana by allowing all parties to sign electronically from anywhere. This functionality not only speeds up the transaction but also ensures that all signatures are legally binding. It's a vital feature for businesses looking to streamline their document management.

-

What pricing options are available for creating a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana?

AirSlate SignNow offers competitive pricing plans that cater to various business needs for creating a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana. Subscription plans come with different features, including document templates and eSignature capabilities. Users can choose a plan that aligns with their budget and requirements.

-

Is a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana legally binding?

Yes, a Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana is legally binding, provided it meets the necessary legal requirements set forth by Louisiana law. When executed properly, with the requisite consent and consideration, the note is enforceable in a court of law. Always consider consulting a legal professional for specific concerns.

Get more for Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana

Find out other Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property Louisiana

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile