Living Trust Property Record Massachusetts Form

What is the Living Trust Property Record Massachusetts

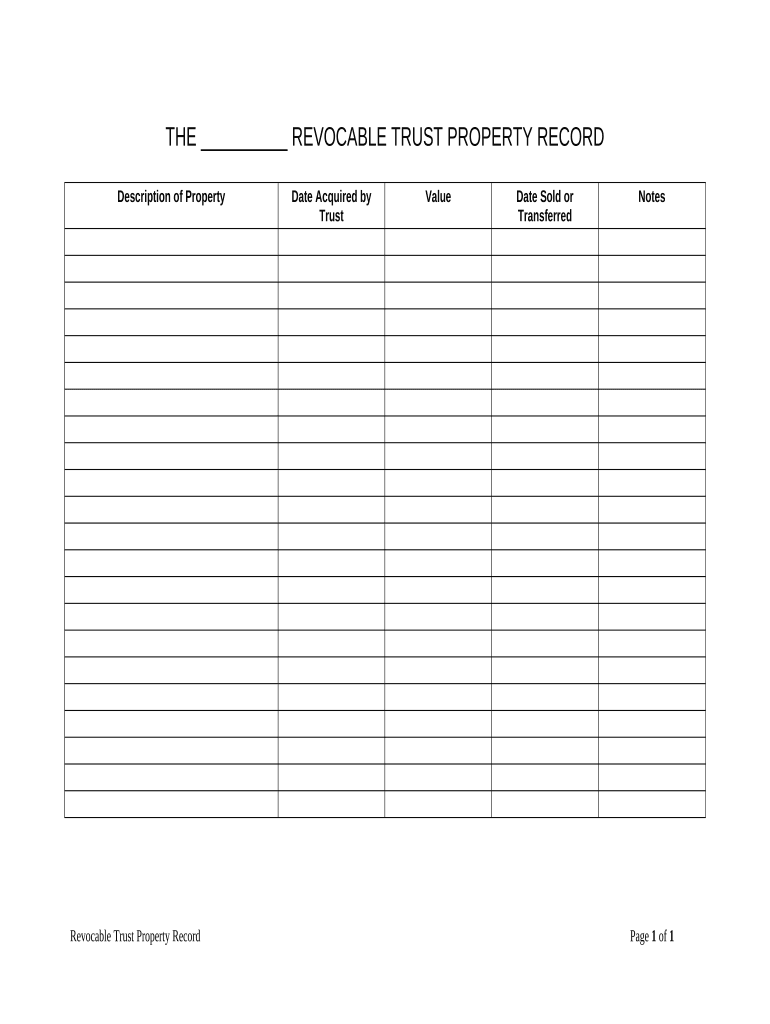

The Living Trust Property Record in Massachusetts serves as a legal document that outlines the assets held within a living trust. This record is essential for estate planning, allowing individuals to manage their properties during their lifetime and ensure a smooth transition of assets upon death. It provides clarity on asset ownership and can help avoid probate, making it a valuable tool for many families.

How to use the Living Trust Property Record Massachusetts

Utilizing the Living Trust Property Record in Massachusetts involves several steps. First, individuals must gather all relevant information about the assets included in the trust. This includes property descriptions, titles, and any associated financial documents. Once compiled, the information should be accurately documented in the property record form. This record can then be used to verify ownership and facilitate the transfer of assets according to the trust's terms.

Steps to complete the Living Trust Property Record Massachusetts

Completing the Living Trust Property Record requires careful attention to detail. Begin by filling out the form with the necessary personal information, including the name of the trust and the trustee. Next, list all assets included in the trust, providing detailed descriptions and any pertinent identification numbers, such as parcel numbers for real estate. After reviewing the information for accuracy, sign the document in accordance with Massachusetts law, ensuring all required signatures are present.

Legal use of the Living Trust Property Record Massachusetts

The Living Trust Property Record is legally recognized in Massachusetts, provided it meets specific requirements. To ensure its validity, the document must be signed by the trustee and, if necessary, notarized. This legal standing allows the record to serve as proof of ownership and facilitate the distribution of assets as outlined in the trust. Adhering to state laws is crucial to maintain the document's enforceability.

State-specific rules for the Living Trust Property Record Massachusetts

Massachusetts has particular regulations governing the use of Living Trust Property Records. These rules include requirements for notarization and specific formatting of the document. Additionally, state laws dictate how assets must be listed and the information that must be included to ensure compliance. Familiarizing oneself with these regulations is essential for anyone looking to create or maintain a living trust in Massachusetts.

Required Documents

When preparing the Living Trust Property Record in Massachusetts, several documents are necessary. Individuals should gather titles for real estate, bank statements, and any other financial documents related to the assets in the trust. Identification documents for the trustee and any co-trustees may also be required. Ensuring all necessary paperwork is in order can streamline the process and help avoid legal complications.

Quick guide on how to complete living trust property record massachusetts

Complete Living Trust Property Record Massachusetts effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely keep it online. airSlate SignNow offers all the tools you need to create, modify, and eSign your documents quickly without hindrances. Manage Living Trust Property Record Massachusetts on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and eSign Living Trust Property Record Massachusetts seamlessly

- Find Living Trust Property Record Massachusetts and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Living Trust Property Record Massachusetts and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in Massachusetts?

A Living Trust Property Record in Massachusetts is a legal document that outlines the ownership and distribution of real estate assets held in a living trust. This record ensures that property is transferred according to the trust's terms without going through probate, providing a seamless process for beneficiaries.

-

How can I access my Living Trust Property Record in Massachusetts?

You can access your Living Trust Property Record in Massachusetts through the appropriate state or county office that manages property records or through your attorney. Many services, including airSlate SignNow, provide templates and assistance for creating and managing these records efficiently.

-

Is there a fee to create a Living Trust Property Record in Massachusetts?

Yes, there may be fees associated with creating a Living Trust Property Record in Massachusetts, such as filing fees or legal fees for professional assistance. However, airSlate SignNow offers a cost-effective solution to streamline the eSigning process without additional hidden costs.

-

What are the benefits of using airSlate SignNow for Living Trust Property Records?

Using airSlate SignNow for your Living Trust Property Records ensures a secure and efficient eSigning process, helps you manage your documents easily, and provides a paperless solution that saves time and resources. Its user-friendly interface makes it accessible for everyone, regardless of tech-savviness.

-

Can I integrate airSlate SignNow with other tools for managing Living Trust Property Records?

Absolutely! airSlate SignNow offers integrations with various software tools that can enhance the management of your Living Trust Property Records. This connectivity allows you to streamline workflows and access essential information across platforms seamlessly.

-

How does airSlate SignNow ensure the security of my Living Trust Property Record in Massachusetts?

airSlate SignNow prioritizes the security of your documents, including your Living Trust Property Record in Massachusetts, by using encryption, secure cloud storage, and access controls. These measures ensure that your sensitive information remains protected throughout the eSigning process.

-

What features does airSlate SignNow offer for Living Trust Property Records?

airSlate SignNow offers several features for managing Living Trust Property Records, including customizable templates, mobile access, and automated reminders for signing. These features facilitate a smooth and efficient document signing experience, ideal for handling important legal records.

Get more for Living Trust Property Record Massachusetts

Find out other Living Trust Property Record Massachusetts

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter