Maryland Personal Form

What is the Maryland Personal Form

The Maryland Personal Form is a crucial document used for various personal and legal purposes within the state of Maryland. This form is often required for matters such as estate planning, tax filings, and other personal legal transactions. Understanding the specific use and requirements of the Maryland Personal Form is essential for ensuring compliance with state regulations and for effective document management.

How to use the Maryland Personal Form

Using the Maryland Personal Form involves several steps to ensure that it is completed correctly. First, gather all necessary information that will be required on the form, including personal details and any relevant financial information. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled out, it may need to be signed and dated before submission, depending on its intended use. Utilizing digital tools can simplify this process, allowing for easy eSigning and secure submission.

Steps to complete the Maryland Personal Form

Completing the Maryland Personal Form requires attention to detail. Follow these steps for a smooth process:

- Gather necessary documents and information, such as identification and relevant financial records.

- Access the Maryland Personal Form, either online or in a physical format.

- Fill out the form completely, ensuring that all required fields are addressed.

- Review the form for accuracy and completeness.

- Sign the form where required, either electronically or with a handwritten signature.

- Submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal use of the Maryland Personal Form

The Maryland Personal Form is legally binding when completed and submitted in accordance with state laws. To ensure its legal validity, it is important to follow specific guidelines, such as obtaining necessary signatures and adhering to any regulatory requirements. Utilizing a trusted eSignature solution can enhance the legal standing of the form, providing a digital certificate that verifies the identity of the signer and the integrity of the document.

Key elements of the Maryland Personal Form

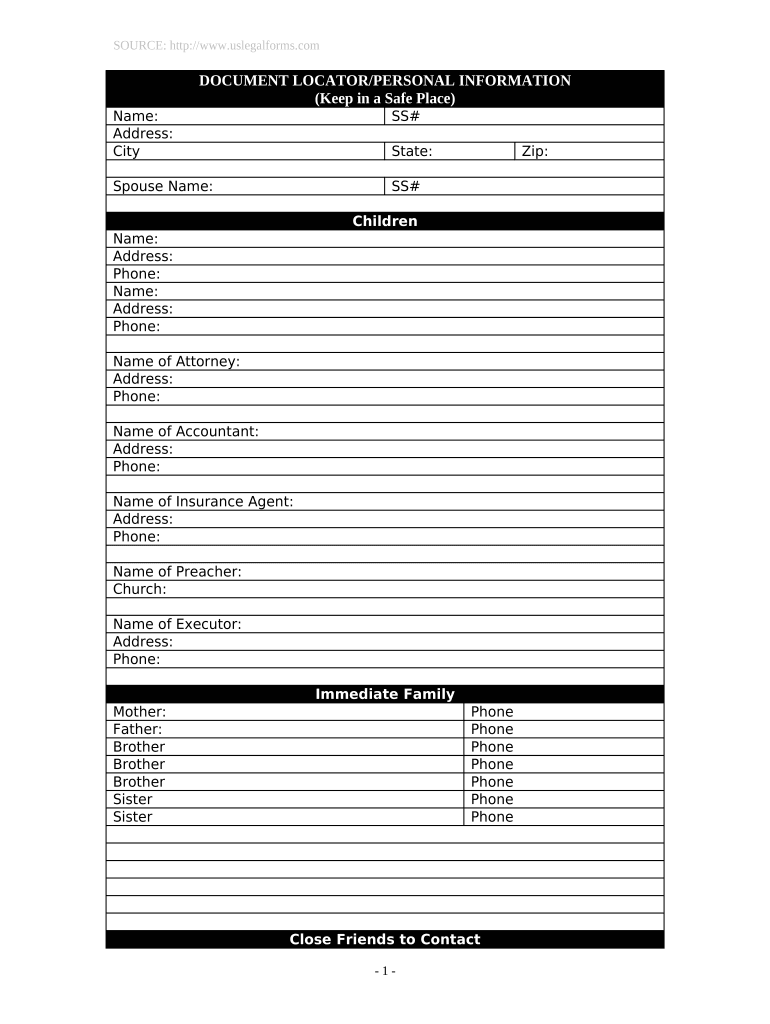

Understanding the key elements of the Maryland Personal Form is essential for effective completion. Important components typically include:

- Personal Information: This includes the name, address, and contact information of the individual submitting the form.

- Purpose of the Form: Clearly stating the reason for submitting the form helps clarify its intended use.

- Signatures: Required signatures from the individual and any witnesses, if applicable, are crucial for legal validation.

- Date of Submission: The date on which the form is completed and submitted is often a critical element for legal timelines.

State-specific rules for the Maryland Personal Form

Maryland has specific rules governing the use of the Personal Form, which can vary based on the form's purpose. It is essential to be aware of these regulations to ensure compliance. For instance, certain forms may require notarization or specific witness signatures to be considered valid. Familiarizing oneself with the Maryland state laws related to the Personal Form can help avoid potential legal issues and ensure proper handling of the document.

Quick guide on how to complete maryland personal form

Complete Maryland Personal Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can access the necessary forms and securely keep them online. airSlate SignNow provides you with all the tools necessary to create, amend, and electronically sign your documents swiftly without delays. Handle Maryland Personal Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The most efficient method to modify and electronically sign Maryland Personal Form with ease

- Find Maryland Personal Form and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Maryland Personal Form to guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Maryland personal form and how can I use it with airSlate SignNow?

A Maryland personal form is a document that is specifically designed for personal use within the state of Maryland. With airSlate SignNow, you can easily upload your Maryland personal form, fill it out, and electronically sign it, simplifying the process and ensuring compliance with state regulations.

-

How much does it cost to use airSlate SignNow for Maryland personal forms?

airSlate SignNow offers flexible pricing plans that cater to various needs, including those who require Maryland personal forms. You can choose a plan that fits your budget, and our transparent pricing means you won't encounter any hidden fees while using our services.

-

What features does airSlate SignNow offer for Maryland personal forms?

airSlate SignNow provides numerous features that enhance the usability of Maryland personal forms, such as templates, customizable fields, and secure cloud storage. Our intuitive interface allows users to navigate easily and streamline their document workflows with ease.

-

Are there any integrations available for using Maryland personal forms?

Yes, airSlate SignNow integrates seamlessly with a variety of applications that can enhance your experience with Maryland personal forms. This includes popular tools like Google Drive, Salesforce, and Microsoft Office, allowing you to create a cohesive workflow across your business processes.

-

What are the benefits of using airSlate SignNow for Maryland personal forms?

Using airSlate SignNow for Maryland personal forms offers numerous benefits, including increased efficiency, reduced paper usage, and improved document security. With our platform, you can sign and manage your forms electronically, saving time and ensuring that your documents are safe and organized.

-

Is airSlate SignNow compliant with Maryland laws for personal forms?

Absolutely! airSlate SignNow is designed to comply with all relevant Maryland laws regarding electronic signatures and personal forms. This ensures that your documents retain legal validity when processed through our platform.

-

Can I track the status of my Maryland personal forms in airSlate SignNow?

Yes, one of the key features of airSlate SignNow is the ability to track the status of all your Maryland personal forms. You will receive notifications about document views, completions, and any actions taken by signers, giving you complete visibility throughout the signing process.

Get more for Maryland Personal Form

Find out other Maryland Personal Form

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement