DR 908 R 0125 Florida Department of Revenue Insu 2025-2026

What is the DR 908 R 0125 Florida Department Of Revenue Insu

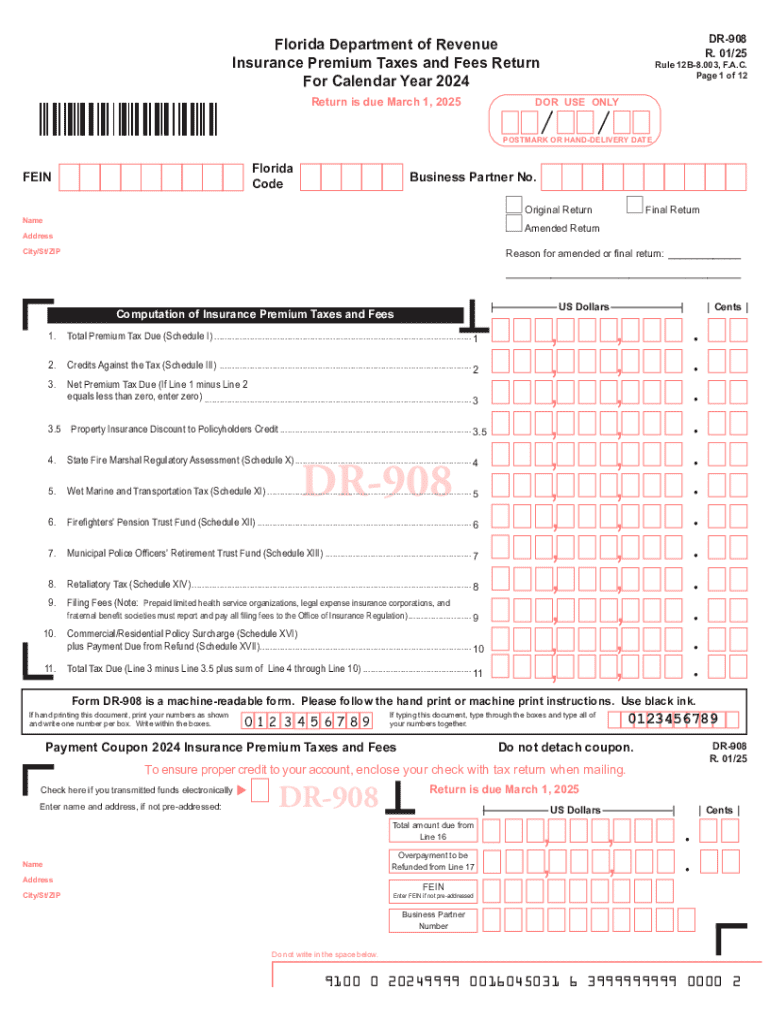

The DR 908 R 0125 is a form issued by the Florida Department of Revenue that pertains to insurance-related matters. Specifically, it is used for reporting and documenting insurance premiums for various types of insurance policies. This form is essential for ensuring compliance with state regulations regarding insurance taxation and reporting.

How to use the DR 908 R 0125 Florida Department Of Revenue Insu

To use the DR 908 R 0125 form effectively, individuals or businesses must first gather all necessary information regarding their insurance policies. This includes details about the types of insurance held, premium amounts, and any relevant policy numbers. Once the information is compiled, the form can be filled out accurately, ensuring all sections are completed to avoid delays or issues with processing.

Steps to complete the DR 908 R 0125 Florida Department Of Revenue Insu

Completing the DR 908 R 0125 involves several key steps:

- Gather all relevant insurance documentation, including policy details and premium amounts.

- Fill out the form, ensuring that all required fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form to the Florida Department of Revenue through the designated submission method, whether online, by mail, or in person.

Legal use of the DR 908 R 0125 Florida Department Of Revenue Insu

The legal use of the DR 908 R 0125 form is crucial for compliance with Florida state laws regarding insurance taxation. Failure to accurately complete and submit this form can result in penalties or fines. It serves as a formal declaration of insurance premiums, ensuring that all insurance providers adhere to state regulations and maintain transparency in their financial reporting.

Required Documents

When preparing to complete the DR 908 R 0125, it is important to have the following documents on hand:

- Insurance policy documents

- Previous year's insurance premium statements

- Any correspondence from the Florida Department of Revenue related to insurance reporting

Form Submission Methods

The DR 908 R 0125 can be submitted through various methods to accommodate different preferences:

- Online submission via the Florida Department of Revenue's official website

- Mailing the completed form to the appropriate address

- In-person delivery at designated Florida Department of Revenue offices

Create this form in 5 minutes or less

Find and fill out the correct dr 908 r 0125 florida department of revenue insu

Create this form in 5 minutes!

How to create an eSignature for the dr 908 r 0125 florida department of revenue insu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DR 908 R 0125 Florida Department Of Revenue Insu?

The DR 908 R 0125 Florida Department Of Revenue Insu is a specific form used for insurance purposes in Florida. It is essential for businesses to understand this form to ensure compliance with state regulations. Utilizing airSlate SignNow can simplify the process of completing and submitting this form electronically.

-

How can airSlate SignNow help with the DR 908 R 0125 Florida Department Of Revenue Insu?

airSlate SignNow provides an easy-to-use platform for businesses to fill out and eSign the DR 908 R 0125 Florida Department Of Revenue Insu. This streamlines the documentation process, ensuring that all necessary signatures are obtained quickly and efficiently. Additionally, it helps maintain compliance with state requirements.

-

What are the pricing options for using airSlate SignNow for the DR 908 R 0125 Florida Department Of Revenue Insu?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while providing access to features necessary for managing the DR 908 R 0125 Florida Department Of Revenue Insu. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing the DR 908 R 0125 Florida Department Of Revenue Insu?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing the DR 908 R 0125 Florida Department Of Revenue Insu. These features enhance efficiency and ensure that all documents are handled securely and in compliance with regulations.

-

Are there any benefits to using airSlate SignNow for the DR 908 R 0125 Florida Department Of Revenue Insu?

Yes, using airSlate SignNow for the DR 908 R 0125 Florida Department Of Revenue Insu offers numerous benefits, including time savings and reduced paperwork. The platform allows for quick document turnaround and ensures that all parties can sign from anywhere, making it a convenient solution for busy professionals.

-

Can airSlate SignNow integrate with other software for the DR 908 R 0125 Florida Department Of Revenue Insu?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when dealing with the DR 908 R 0125 Florida Department Of Revenue Insu. This integration capability allows you to connect with CRM systems, cloud storage, and other tools to streamline your document management process.

-

Is airSlate SignNow secure for handling the DR 908 R 0125 Florida Department Of Revenue Insu?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the DR 908 R 0125 Florida Department Of Revenue Insu. The platform employs advanced encryption and security protocols to protect your sensitive information throughout the signing process.

Get more for DR 908 R 0125 Florida Department Of Revenue Insu

- Federal form 1098 mortgage interest statement info copy

- Form 1120 excel template fill online printable

- Form 941 x rev july 2021 adjusted employers quarterly federal tax return or claim for refund

- Fillable online you cannot claim the ptc if your filing form

- 2021 form w 3 transmittal of wage and tax statements

- Ch 2 tax return schedule 1 form 1040pdf schedule 1

- 2021 form 1065 us return of partnership income

- Form 1040 schedule e

Find out other DR 908 R 0125 Florida Department Of Revenue Insu

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist