Business Credit Application Maine Form

What is the Business Credit Application Maine

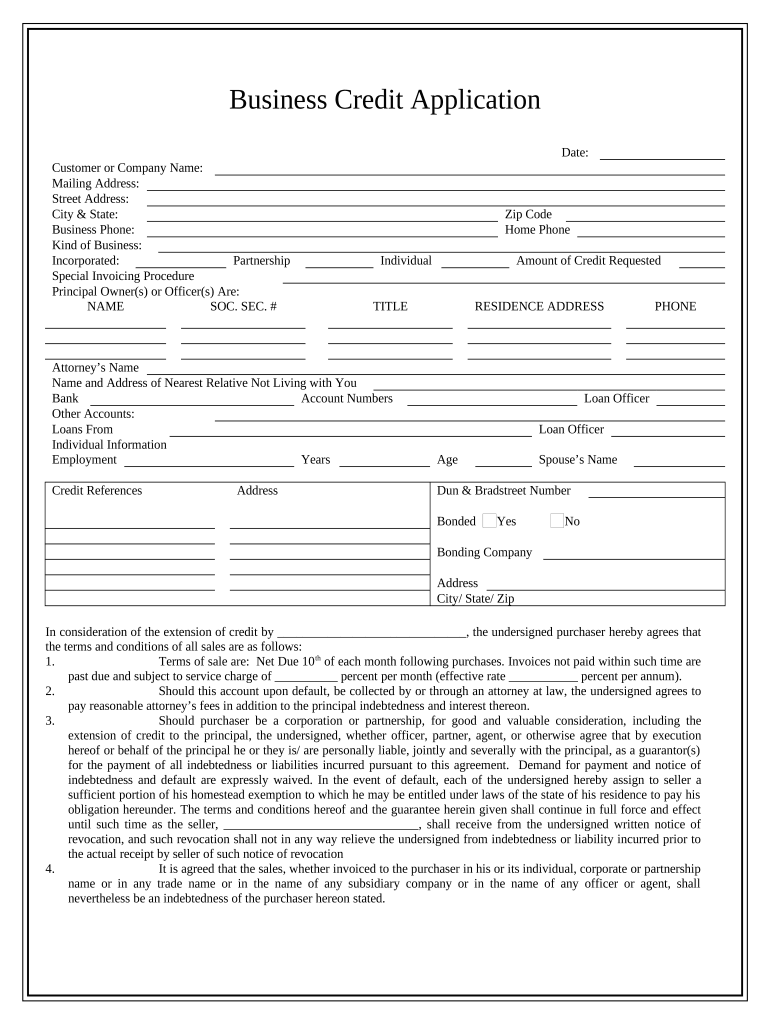

The Business Credit Application Maine is a formal document that businesses in Maine use to apply for credit from lenders or suppliers. This application typically requests essential information about the business, including its legal structure, financial history, and creditworthiness. It serves as a crucial tool for establishing trust between the business and potential creditors, allowing them to assess the risk involved in extending credit.

Key elements of the Business Credit Application Maine

When filling out the Business Credit Application Maine, several key elements are essential for a comprehensive submission. These elements typically include:

- Business Information: Name, address, and contact details of the business.

- Legal Structure: Type of business entity, such as LLC, corporation, or partnership.

- Financial Statements: Recent financial documents that showcase the business's financial health.

- Credit History: Information regarding past credit accounts and payment history.

- Owner Information: Personal details of business owners or key stakeholders, including social security numbers.

Steps to complete the Business Credit Application Maine

Completing the Business Credit Application Maine involves several important steps to ensure accuracy and compliance. Follow these steps for a successful application:

- Gather Documentation: Collect all necessary documents, including financial statements and identification.

- Fill Out the Application: Provide accurate and detailed information in each section of the application.

- Review for Errors: Double-check all entries for accuracy and completeness before submission.

- Submit the Application: Choose your preferred submission method, whether online, by mail, or in person.

Legal use of the Business Credit Application Maine

The legal validity of the Business Credit Application Maine hinges on compliance with relevant laws and regulations. To ensure that the application is legally binding, it must meet specific criteria, such as obtaining proper signatures and adhering to eSignature laws. Utilizing a reliable electronic signature platform can help maintain compliance with the ESIGN Act and UETA, ensuring that the application holds up in legal contexts.

How to use the Business Credit Application Maine

Using the Business Credit Application Maine effectively requires understanding its purpose and the information it seeks. Businesses should approach the application as a means to present their financial credibility to potential creditors. By accurately filling out the application and providing supporting documentation, businesses can enhance their chances of securing favorable credit terms.

Eligibility Criteria

Eligibility for completing the Business Credit Application Maine generally involves meeting specific criteria set by the lender or supplier. Common eligibility requirements may include:

- Established business entity registered in Maine.

- Demonstrated financial stability, often evidenced by financial statements.

- Good credit history with minimal defaults or late payments.

- Compliance with local and federal regulations.

Quick guide on how to complete business credit application maine

Effortlessly Complete Business Credit Application Maine on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Business Credit Application Maine on any device with airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

How to Modify and Electronically Sign Business Credit Application Maine with Ease

- Find Business Credit Application Maine and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive data with the tools specifically offered by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your document: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Business Credit Application Maine and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application in Maine?

A Business Credit Application in Maine is a formal document that businesses use to apply for credit from lenders or suppliers. This application typically includes details about the business, such as its financial status, operations, and credit history. By utilizing airSlate SignNow, businesses can efficiently manage their applications by electronically signing and sending documents securely.

-

How can airSlate SignNow help with Business Credit Applications in Maine?

airSlate SignNow streamlines the process of submitting your Business Credit Application in Maine by allowing users to eSign and send documents easily. This reduces the time spent on paperwork and helps you focus more on your business operations. Additionally, its user-friendly features ensure that the application process is both efficient and secure.

-

What are the pricing options for airSlate SignNow for Business Credit Applications?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling Business Credit Applications in Maine. Plans range from basic to advanced, allowing businesses to choose based on their usage and features required. You can explore these pricing options on our website to find the best fit for your organization.

-

Are there any integrations available with airSlate SignNow for Business Credit Applications?

Yes, airSlate SignNow offers seamless integrations with various CRM software, project management tools, and cloud storage services. This is particularly beneficial for businesses in Maine looking to enhance their workflow when processing Business Credit Applications. By integrating existing systems, you can streamline your processes and maintain a smooth operation.

-

What benefits does eSigning a Business Credit Application in Maine provide?

eSigning a Business Credit Application in Maine provides numerous benefits, including faster turnaround times and improved document security. With airSlate SignNow, your signed documents are stored securely, reducing the risk of loss or fraud. The convenience of eSigning means you can submit applications anytime and anywhere, expediting the funding process.

-

Is airSlate SignNow secure for handling Business Credit Applications?

Absolutely! airSlate SignNow prioritizes security, employing robust encryption and compliance measures to ensure that your Business Credit Application in Maine is protected. All documents are securely stored and access is restricted to authorized users. This commitment to security helps you manage sensitive information with confidence.

-

Can I use airSlate SignNow on mobile devices for my Business Credit Application?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage your Business Credit Application in Maine on the go. Whether you’re using a smartphone or tablet, you can easily eSign documents, send applications, and track their status. This flexibility is essential for busy professionals who require quick access to their documents.

Get more for Business Credit Application Maine

Find out other Business Credit Application Maine

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document