Notice of Default for Past Due Payments in Connection with Contract for Deed Michigan Form

What is the Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan

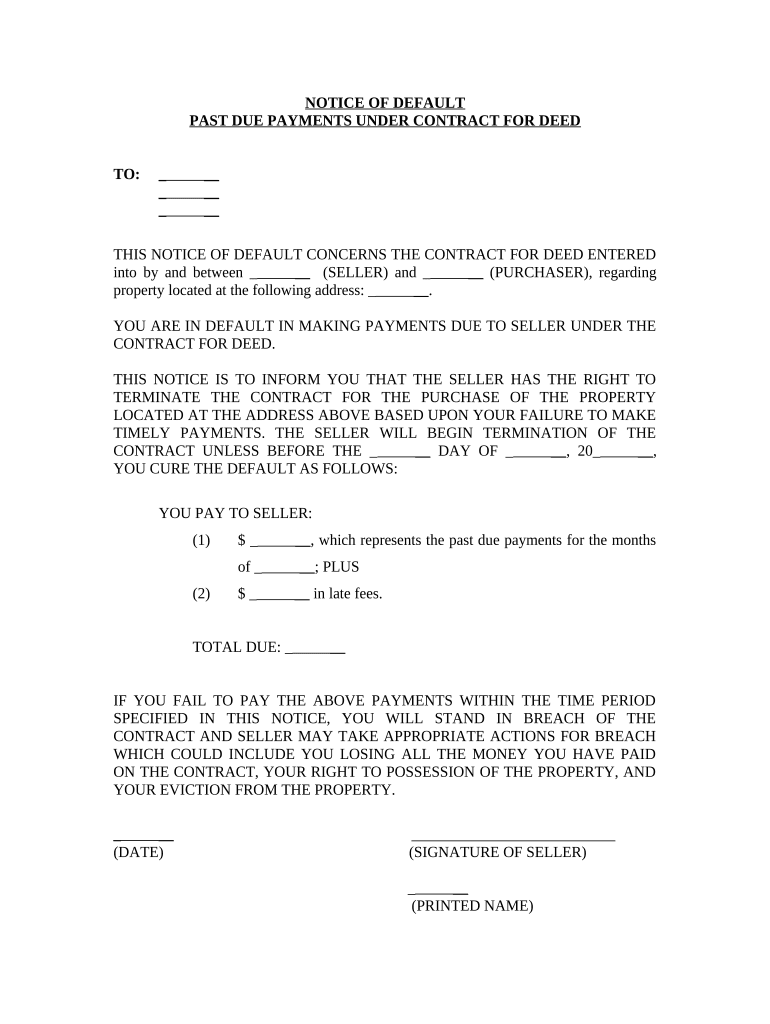

The Notice of Default for Past Due Payments in Connection with Contract for Deed in Michigan serves as a formal notification to a buyer who has failed to make timely payments under a contract for deed. This document outlines the specific amounts due and the consequences of continued non-payment. It is a critical step in the process of enforcing the terms of the contract, allowing the seller to take further action if necessary. Understanding this notice is essential for both buyers and sellers to navigate their rights and obligations effectively.

Steps to Complete the Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan

Completing the Notice of Default involves several important steps. First, gather all relevant information regarding the contract, including the names of the parties involved, the property address, and the payment history. Next, clearly state the amount past due and specify the payment deadlines that have been missed. It is crucial to include a statement indicating the potential consequences of continued non-payment, such as foreclosure or termination of the contract. Finally, ensure that the notice is signed and dated by the seller or their authorized representative to validate the document.

Legal Use of the Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan

The legal use of the Notice of Default is governed by Michigan law, which requires that the notice be sent in accordance with specific regulations. This document serves as a prerequisite for initiating legal proceedings against the buyer for breach of contract. It is important to ensure that the notice is delivered through a method that provides proof of receipt, such as certified mail. Failure to comply with these legal requirements may hinder the seller's ability to enforce the contract or seek remedies through the court system.

Key Elements of the Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan

Key elements of the Notice of Default include the following:

- Identification of Parties: Clearly state the names of the seller and buyer.

- Property Description: Provide the address and legal description of the property involved.

- Payment Details: Specify the amount past due and the dates of missed payments.

- Consequences: Outline the potential actions that may be taken if the default is not cured.

- Delivery Method: Indicate how the notice was delivered to ensure compliance with legal standards.

How to Obtain the Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan

The Notice of Default can typically be obtained through legal resources or templates available online. It is advisable to consult with a legal professional to ensure that the document meets all necessary legal requirements specific to Michigan. Additionally, many online platforms provide customizable templates that can be tailored to the specific details of the contract for deed. Ensuring accuracy and compliance is crucial to the effectiveness of the notice.

State-Specific Rules for the Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan

In Michigan, specific rules govern the issuance of a Notice of Default. These include requirements for the content of the notice, the method of delivery, and the timeframe allowed for the buyer to cure the default. Michigan law mandates that the notice must be clear and concise, providing the buyer with adequate information to understand their obligations. Additionally, sellers must adhere to any local ordinances that may impose further requirements on the notice process.

Quick guide on how to complete notice of default for past due payments in connection with contract for deed michigan

Complete Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan with ease on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily find the needed form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly and without holdups. Administer Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan effortlessly

- Find Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you'd like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, time-consuming form searches, or corrections that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan and guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan?

A Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan is a formal notification indicating that a borrower has failed to make scheduled payments on their contract for deed. This document serves as a critical step in the foreclosure process, allowing the lender to take further action if the default is not rectified.

-

How can airSlate SignNow help with managing Notices Of Default?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning Notices Of Default For Past Due Payments In Connection With Contract For Deed Michigan. With our user-friendly interface, you can quickly draft and distribute these important documents, making the process seamless for all parties involved.

-

What are the costs associated with using airSlate SignNow for Notices Of Default?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including handling Notices Of Default For Past Due Payments In Connection With Contract For Deed Michigan. You can choose from affordable monthly subscriptions, with no hidden fees, ensuring you get great value for your document management needs.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing for easy management of Notices Of Default For Past Due Payments In Connection With Contract For Deed Michigan across platforms. With integrations like Google Drive, Dropbox, and popular CRM systems, you can streamline your workflow and enhance efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow comes equipped with features specifically designed for document management, such as templates for Notices Of Default For Past Due Payments In Connection With Contract For Deed Michigan, customizable fields, and real-time tracking of document status. These features facilitate smoother communication and faster resolution of payment issues.

-

Can I track the status of my Notice Of Default documents with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your documents, including Notices Of Default For Past Due Payments In Connection With Contract For Deed Michigan. You'll be notified when the document is viewed, signed, or if any actions are pending, ensuring transparency and timely resolutions.

-

Is airSlate SignNow compliant with legal standards for Notices Of Default in Michigan?

Yes, airSlate SignNow is designed to comply with the legal standards required for Notices Of Default For Past Due Payments In Connection With Contract For Deed Michigan. Our platform ensures that all your eSignatures and documents meet industry and state regulations, giving you confidence in their legality.

Get more for Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan

Find out other Notice Of Default For Past Due Payments In Connection With Contract For Deed Michigan

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement