Financial Account Transfer to Living Trust Michigan Form

What is the Financial Account Transfer To Living Trust Michigan

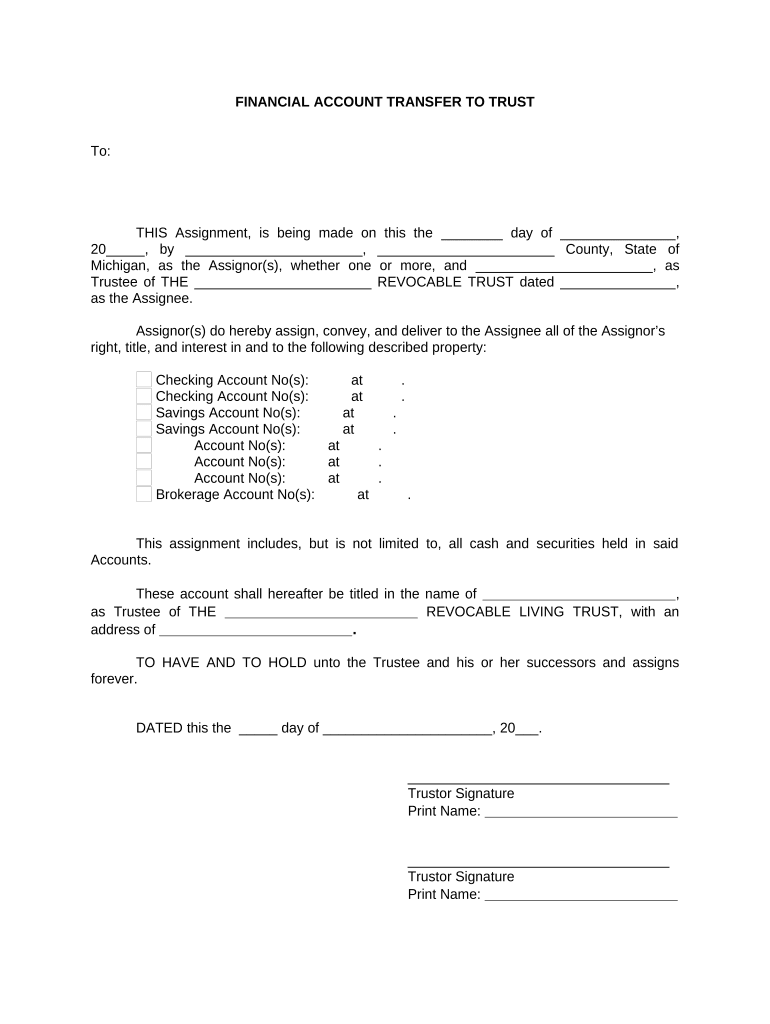

The Financial Account Transfer To Living Trust Michigan form is a legal document designed to facilitate the transfer of financial accounts into a living trust. This process helps ensure that assets are managed according to the trust's terms during the grantor's lifetime and after their passing. Establishing a living trust can provide benefits such as avoiding probate, maintaining privacy, and potentially reducing estate taxes. This form is essential for individuals in Michigan who wish to streamline the management of their financial assets and ensure a smooth transition of ownership.

Steps to complete the Financial Account Transfer To Living Trust Michigan

Completing the Financial Account Transfer To Living Trust Michigan form involves several key steps. First, gather all necessary information regarding the financial accounts you wish to transfer, including account numbers and the names of financial institutions. Next, fill out the form accurately, ensuring that all details align with the information held by the financial institutions. After completing the form, sign it according to the requirements specified by Michigan law. Finally, submit the form to the relevant financial institutions to initiate the transfer process. It is advisable to keep copies of all documents for your records.

Legal use of the Financial Account Transfer To Living Trust Michigan

The legal use of the Financial Account Transfer To Living Trust Michigan form is governed by state laws that outline the requirements for creating and managing living trusts. In Michigan, this form must be completed with precise information to be considered valid. It is crucial to comply with all legal stipulations, including proper signatures and notarization if required. By adhering to these legal standards, individuals can ensure that the transfer of assets into the living trust is recognized by financial institutions and upheld in court if necessary.

State-specific rules for the Financial Account Transfer To Living Trust Michigan

Michigan has specific rules regarding the Financial Account Transfer To Living Trust form that individuals must follow. These rules include the necessity of having the trust document properly drafted and executed, as well as ensuring that the financial account titles match the name of the trust. Additionally, Michigan law may require that certain types of accounts, such as retirement accounts, follow additional regulations when being transferred into a trust. Understanding these state-specific rules is essential for a smooth and legal transfer process.

Required Documents

To complete the Financial Account Transfer To Living Trust Michigan form, several documents are typically required. These may include:

- A copy of the living trust document, which outlines the terms and conditions of the trust.

- Identification documents, such as a driver's license or state ID, to verify the identity of the grantor.

- Account statements for the financial accounts being transferred, which provide necessary account details.

- Any additional forms required by the financial institutions, which may vary by institution.

Having these documents ready can streamline the transfer process and help avoid delays.

Examples of using the Financial Account Transfer To Living Trust Michigan

There are various scenarios in which individuals may use the Financial Account Transfer To Living Trust Michigan form. For instance, a married couple may decide to transfer their joint bank accounts into a living trust to ensure that their assets are managed according to their wishes after one spouse passes away. Similarly, an individual may transfer investment accounts into a trust to provide for their children without going through probate. Each example illustrates how this form can be utilized to facilitate the management and distribution of assets in alignment with personal goals and family needs.

Quick guide on how to complete financial account transfer to living trust michigan

Complete Financial Account Transfer To Living Trust Michigan effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Financial Account Transfer To Living Trust Michigan on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Financial Account Transfer To Living Trust Michigan with ease

- Locate Financial Account Transfer To Living Trust Michigan and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, and errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Financial Account Transfer To Living Trust Michigan and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for a Financial Account Transfer To Living Trust in Michigan?

To initiate a Financial Account Transfer To Living Trust in Michigan, you first need to review your trust documents and consult with an attorney if necessary. Once the trust is established, you can complete the necessary forms from your financial institution. This typically involves providing the trust's information and signing relevant documents to ensure a smooth transfer.

-

What types of accounts can I transfer to a living trust in Michigan?

In Michigan, you can transfer various types of financial accounts to a living trust, including bank accounts, investment accounts, and retirement accounts. It's important to check with each financial institution regarding their specific requirements for a Financial Account Transfer To Living Trust Michigan. Generally, both personal and joint accounts can be included.

-

Are there any tax implications for transferring my financial accounts to a living trust in Michigan?

Transferring financial accounts to a living trust in Michigan generally does not trigger tax liabilities, as it is not considered a sale. However, it's crucial to discuss potential tax implications with a financial advisor or tax professional. They can provide tailored advice regarding your unique financial situation and how it relates to your Financial Account Transfer To Living Trust Michigan.

-

How much does it cost to transfer financial accounts to a living trust in Michigan?

The cost for a Financial Account Transfer To Living Trust in Michigan can vary based on several factors, including legal fees and potential costs from financial institutions. Consulting with an estate planning attorney can help you get a comprehensive understanding of the costs involved. Many institutions also have specific fees for processing the transfer.

-

What benefits does a living trust offer for managing my financial accounts in Michigan?

A living trust provides several benefits for managing your financial accounts in Michigan, including avoiding probate court, ensuring privacy, and providing for a seamless transfer of assets. Additionally, it allows you to specify how and when you want your assets to be distributed. The Financial Account Transfer To Living Trust Michigan simplifies the management of your estate.

-

Can I make changes to my living trust after transferring financial accounts in Michigan?

Yes, you can make changes to your living trust after executing a Financial Account Transfer To Living Trust in Michigan, as long as the trust is revocable. This includes adding or removing financial accounts or altering beneficiaries. It’s advisable to consult an attorney to ensure any changes comply with state laws.

-

Do I need an attorney to complete a Financial Account Transfer To Living Trust in Michigan?

While it is not legally required to hire an attorney for a Financial Account Transfer To Living Trust in Michigan, consulting one can provide signNow advantages. An attorney can help ensure that all legal documents are accurate and that the transfer process complies with state laws, which can prevent future disputes.

Get more for Financial Account Transfer To Living Trust Michigan

- Scholarship exemption declaration form

- Care facility to emergency department transfer form

- Fidelity co executor affidavit and indemnification form

- Maryland gift deed one individual to two individuals as joint tenants form

- Lg220a exempt permit financial reporting form

- Po box 14326 reading pa 19612 form

- Influenza vaccination consent form for insurance claims

- Certificate of attendance erasmus template form

Find out other Financial Account Transfer To Living Trust Michigan

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors