Minnesota Living Trust Form

What is the Minnesota Living Trust

A Minnesota living trust is a legal arrangement that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust can help avoid probate, providing a more streamlined and private process for transferring assets to beneficiaries. By placing assets into a living trust, the grantor retains control over them while alive and can make adjustments as needed. Upon the grantor's passing, the assets are distributed according to the terms outlined in the trust document, which can simplify the estate settlement process for heirs.

How to use the Minnesota Living Trust

Using a Minnesota living trust involves several key steps. First, individuals must create the trust document, which outlines the terms and conditions of the trust, including the designation of a trustee and beneficiaries. Next, assets must be transferred into the trust, a process known as "funding" the trust. This can include real estate, bank accounts, investments, and personal property. It is essential to keep the trust updated as circumstances change, such as acquiring new assets or changes in beneficiaries. Regular reviews ensure that the trust continues to meet the grantor's wishes and complies with state laws.

Steps to complete the Minnesota Living Trust

Completing a Minnesota living trust involves several important steps:

- Determine your assets: Identify all assets you wish to include in the trust.

- Draft the trust document: Create a legal document that outlines the terms of the trust, including the trustee and beneficiaries.

- Fund the trust: Transfer ownership of assets into the trust, ensuring they are legally recognized as part of it.

- Review and update: Regularly review the trust to accommodate changes in your life circumstances or wishes.

Legal use of the Minnesota Living Trust

The legal use of a Minnesota living trust is governed by state laws that dictate how trusts are created, managed, and executed. To be valid, the trust must be properly executed, which typically involves signing the document in front of witnesses and possibly notarization. The trust must also comply with Minnesota's specific regulations regarding asset transfers and beneficiary designations. It is advisable to consult with a legal professional to ensure that the trust meets all legal requirements and serves its intended purpose effectively.

State-specific rules for the Minnesota Living Trust

In Minnesota, specific rules govern the creation and management of living trusts. These include requirements for the trust document to be in writing and signed by the grantor. Additionally, Minnesota law allows for revocable living trusts, meaning the grantor can alter or dissolve the trust during their lifetime. It is important to be aware of state-specific tax implications and reporting requirements associated with living trusts. Consulting with a legal expert familiar with Minnesota trust law can help navigate these regulations effectively.

Required Documents

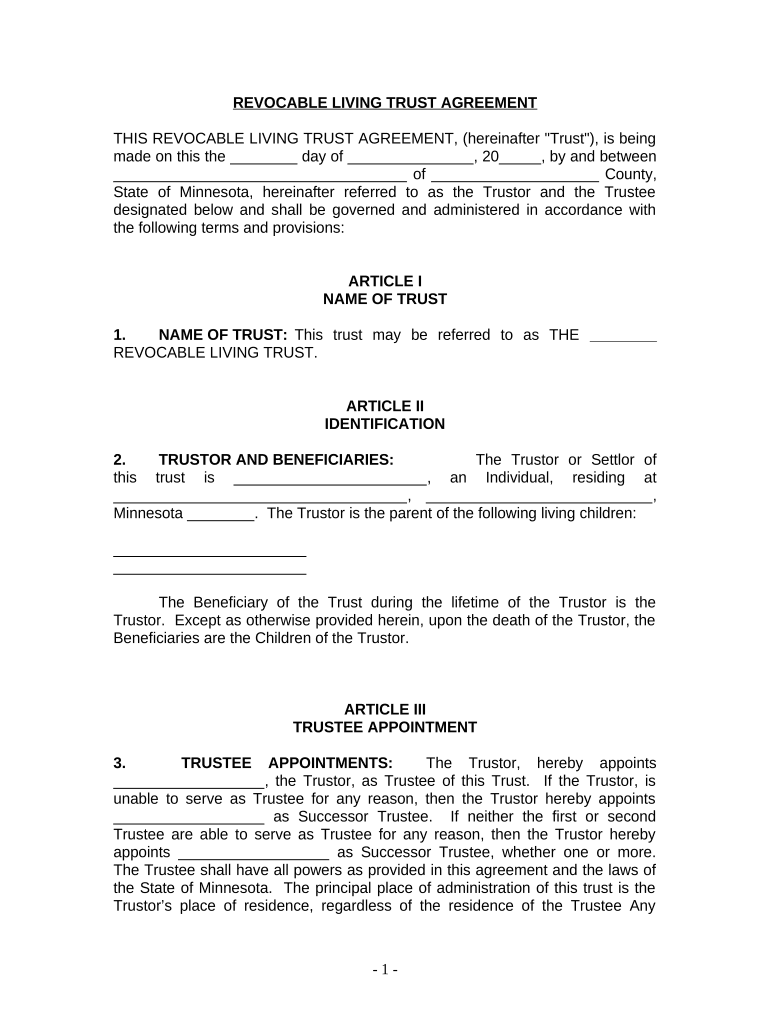

To establish a Minnesota living trust, several key documents are typically required:

- Trust Agreement: The primary document outlining the terms of the trust.

- Asset Transfer Documents: Deeds, titles, or account statements to transfer assets into the trust.

- Identification: Personal identification for the grantor and trustee, such as a driver's license or passport.

Eligibility Criteria

To create a Minnesota living trust, the grantor must be at least eighteen years old and of sound mind, meaning they understand the implications of creating a trust. There are no residency requirements for establishing a trust in Minnesota; however, the assets included in the trust must be located within the state or be governed by Minnesota law. Individuals should also consider their financial situation and estate planning goals to determine if a living trust is the right choice for them.

Quick guide on how to complete minnesota living trust

Complete Minnesota Living Trust effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Minnesota Living Trust on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Minnesota Living Trust without hassle

- Obtain Minnesota Living Trust and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Minnesota Living Trust and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Minnesota living trust and how does it work?

A Minnesota living trust is a legal document that allows you to place your assets into a trust during your lifetime and manage them according to your wishes. This arrangement helps avoid probate and can simplify the distribution of your estate after your passing. It ensures that your assets are protected and managed according to your preferences, making it a crucial tool for estate planning.

-

What are the benefits of setting up a Minnesota living trust?

Setting up a Minnesota living trust offers several benefits, including avoiding probate, minimizing estate taxes, and providing privacy regarding your assets. Additionally, it allows for greater control over how your assets are distributed after your death. With a living trust, you can also make changes or revoke it at any time, offering flexibility in your estate planning.

-

How much does a Minnesota living trust cost?

The cost of establishing a Minnesota living trust can vary depending on factors such as attorney fees and complexity of your estate. Typically, the range can go from a few hundred to a few thousand dollars. It’s wise to compare costs and services offered by various professionals to ensure you’re getting the best value for your estate planning.

-

Can I modify my Minnesota living trust after it’s created?

Yes, one of the key advantages of a Minnesota living trust is the ability to modify it at any time while you are alive. You can add or remove assets, adjust beneficiaries, or even revoke the trust entirely if needed. This flexibility is essential to adapt your estate plans as your financial situation and family dynamics change.

-

What types of assets can be placed in a Minnesota living trust?

You can place a variety of assets into a Minnesota living trust, including real estate, bank accounts, investments, and personal property. However, it’s important to ensure that each asset is properly transferred to the trust to take advantage of its benefits. Consulting with an estate planning professional can help ensure a smooth transfer process for all your assets.

-

How does a Minnesota living trust differ from a will?

While both a Minnesota living trust and a will are essential estate planning tools, they serve different purposes. A living trust avoids probate and allows for immediate management of your assets, while a will takes effect only after your death and must go through probate. Additionally, a living trust offers privacy, whereas a will becomes public record.

-

Are there any tax advantages to having a Minnesota living trust?

A Minnesota living trust itself does not provide direct tax advantages, but it can help in estate tax planning and potentially reduce estate tax liability. Properly structured, it also allows your heirs to benefit from tax exemptions. Consulting with a tax advisor can help clarify how a living trust can impact your overall tax strategy.

Get more for Minnesota Living Trust

- Fiata forwarding instructions form

- Cash drawer balance sheet form

- Security guard program security guard instructor application form

- Annexure format for agreement

- Salon client profile cards app form

- Comments on draft appendix comments on draft appendix georgewbush whitehouse archives form

- Kentucky income tax forms requisition

- Part iv upward review performance assessment mohave county

Find out other Minnesota Living Trust

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement