How Do I Get a Form 1099 from Opm Faxed

Understanding the Form

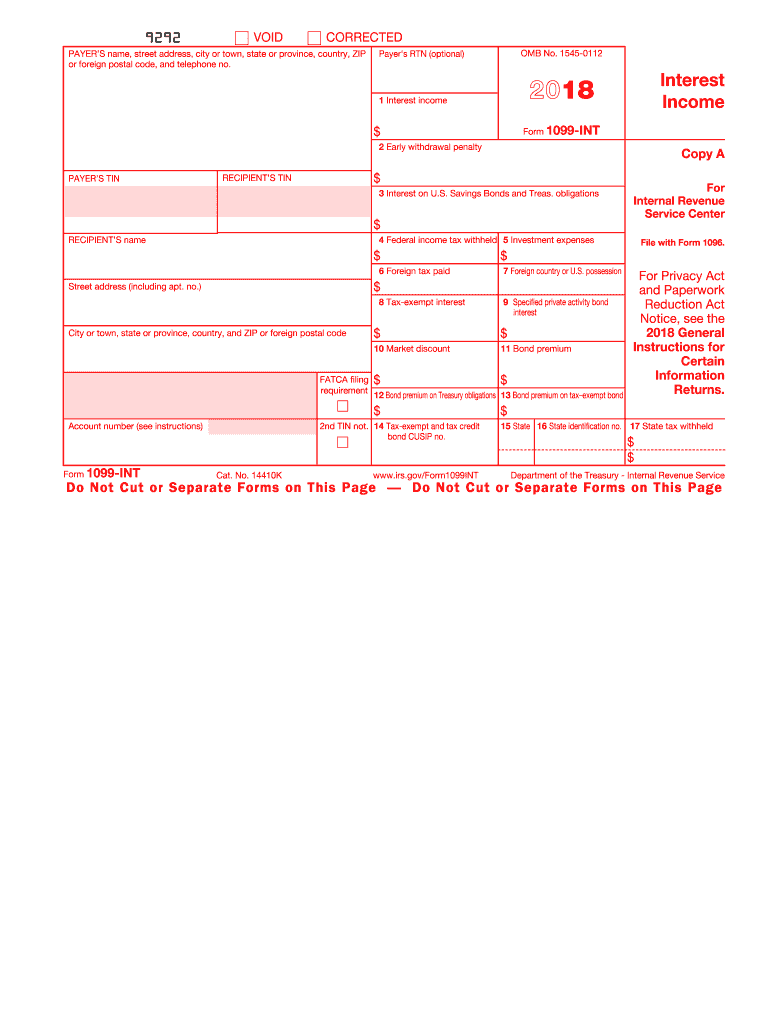

The form is a crucial document used for reporting various types of income other than wages, salaries, and tips. This form is primarily issued by businesses to report payments made to independent contractors, freelancers, and other non-employees. It is essential for ensuring accurate tax reporting and compliance with IRS regulations. The 1099 form series includes several variations, such as the 1099-MISC for miscellaneous income and the 1099-NEC specifically for non-employee compensation. Each variant serves a distinct purpose and must be filled out correctly to avoid penalties.

Key Elements of the Form

The form contains several important sections that must be completed accurately. Key elements include:

- Payer Information: This section includes the name, address, and taxpayer identification number (TIN) of the entity issuing the form.

- Recipient Information: Details about the recipient, including their name, address, and TIN, must be provided.

- Income Amounts: The form specifies the total amount paid to the recipient during the tax year, categorized by type of income.

- Tax Withholding: Any federal income tax withheld from payments must also be reported.

Steps to Complete the Form

Filling out the form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all necessary information about the payer and recipient, including names, addresses, and TINs.

- Determine the total amount paid to the recipient and categorize it appropriately.

- Fill in the payer and recipient sections accurately, ensuring all details match IRS records.

- Report any federal tax withholding, if applicable.

- Review the completed form for accuracy before submission.

IRS Guidelines for Filing the Form

The IRS provides specific guidelines for filing the form. It is essential to adhere to these guidelines to avoid potential issues:

- Forms must be filed by the deadline, typically January thirty-first for paper submissions.

- Ensure that all information is accurate and complete to prevent delays or penalties.

- Use the correct form variant based on the type of income being reported.

Form Submission Methods

The form can be submitted through various methods, depending on the preference of the payer:

- Online Filing: Many businesses choose to file electronically through the IRS e-file system, which is often faster and more efficient.

- Mail Submission: Paper forms can be mailed to the IRS, but ensure they are sent to the correct address based on the state of the payer.

- In-Person Filing: Some may opt to deliver forms in person at designated IRS offices, although this is less common.

Penalties for Non-Compliance

Failure to file the form correctly or on time can result in significant penalties. The IRS imposes fines based on the duration of the delay and the size of the business. Penalties can range from a few hundred dollars to several thousand, depending on the circumstances. It is crucial for businesses to maintain accurate records and submit forms punctually to avoid these consequences.

Quick guide on how to complete 1099 int fillable form 2017 2018

Easily Prepare How Do I Get A Form 1099 From Opm Faxed on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can find the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage How Do I Get A Form 1099 From Opm Faxed on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign How Do I Get A Form 1099 From Opm Faxed Effortlessly

- Obtain How Do I Get A Form 1099 From Opm Faxed and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign How Do I Get A Form 1099 From Opm Faxed and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

Create this form in 5 minutes!

How to create an eSignature for the 1099 int fillable form 2017 2018

How to create an electronic signature for the 1099 Int Fillable Form 2017 2018 online

How to create an eSignature for the 1099 Int Fillable Form 2017 2018 in Chrome

How to create an electronic signature for putting it on the 1099 Int Fillable Form 2017 2018 in Gmail

How to make an eSignature for the 1099 Int Fillable Form 2017 2018 from your mobile device

How to create an eSignature for the 1099 Int Fillable Form 2017 2018 on iOS devices

How to make an eSignature for the 1099 Int Fillable Form 2017 2018 on Android

People also ask

-

What is the 1099 2018 form and why is it important?

The 1099 2018 form is a tax document used in the United States for reporting various types of income. It is important for freelancers and independent contractors to accurately report their earnings to the IRS, ensuring compliance and avoiding potential penalties.

-

How can airSlate SignNow help me with the 1099 2018 form?

airSlate SignNow simplifies the process of sending and eSigning the 1099 2018 form. Our platform offers customizable templates and an intuitive interface, making it easy to collect necessary signatures and securely store documents.

-

Is airSlate SignNow cost-effective for managing the 1099 2018 form?

Yes, airSlate SignNow provides a cost-effective solution for managing the 1099 2018 form. With flexible pricing plans tailored for businesses of all sizes, you can efficiently handle your document needs without overspending.

-

What features does airSlate SignNow offer for the 1099 2018 form?

airSlate SignNow offers features such as customizable eSignature workflows, document templates for the 1099 2018 form, and secure document storage. These tools enhance your efficiency in managing tax-related forms easily and securely.

-

Can I integrate airSlate SignNow with other accounting software for the 1099 2018 form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, allowing you to effortlessly transfer and manage your 1099 2018 form and other documents within your existing workflows.

-

How secure is airSlate SignNow for sending the 1099 2018 form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to ensure that your 1099 2018 form and other sensitive documents are protected from unauthorized access.

-

What are the benefits of using airSlate SignNow for the 1099 2018 form?

Using airSlate SignNow for the 1099 2018 form streamlines your document signing process, saves time, and reduces the risk of errors. Our user-friendly platform improves efficiency, allowing you to focus more on your core business activities.

Get more for How Do I Get A Form 1099 From Opm Faxed

- Instructions form 2441 2017

- 990 k form 2018

- Form 502h 2012 maryland heritage structure rehabilitation tax credit for applications received by maryland historical trust on

- Irs 8804 2018 form

- 2012 new york form

- Instructions for schedule a form 990

- Il 1041 instructions illinois department of revenue 794692600 form

- 480 6c rev 07 23 form

Find out other How Do I Get A Form 1099 From Opm Faxed

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy