Non Foreign Affidavit under IRC 1445 North Dakota Form

What is the Non Foreign Affidavit Under IRC 1445 North Dakota

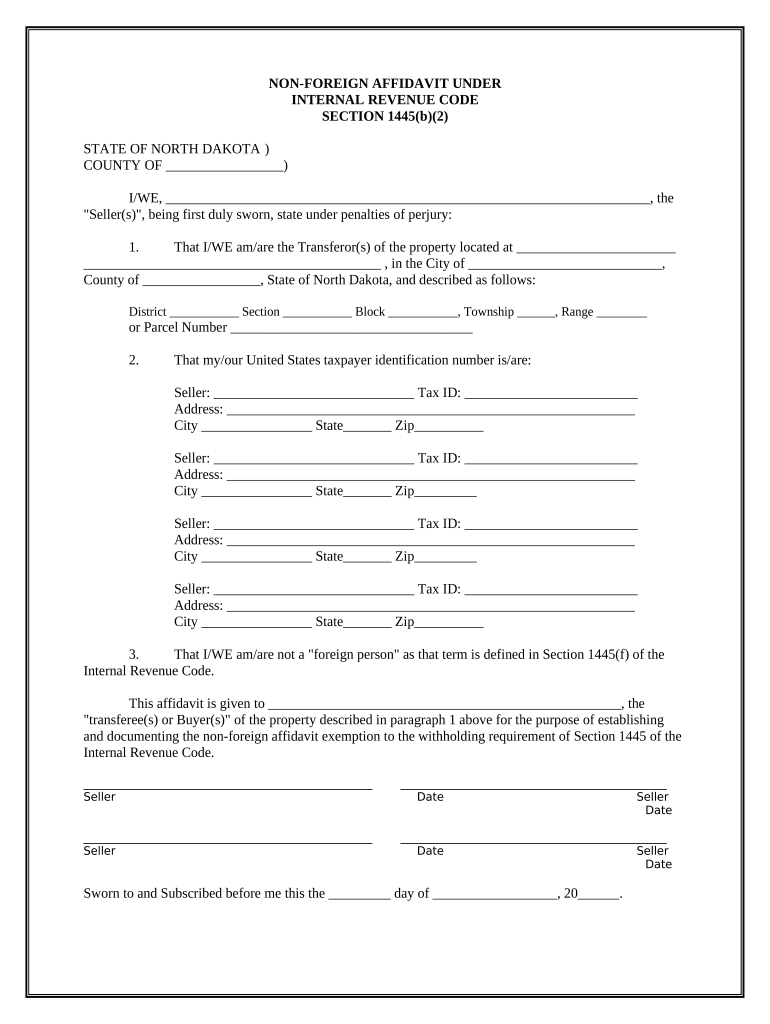

The Non Foreign Affidavit under IRC 1445 in North Dakota is a legal document used primarily in real estate transactions. It certifies that the seller of a property is not a foreign person, thereby exempting the buyer from withholding taxes that would typically apply to foreign sellers. This affidavit is essential for compliance with U.S. tax laws, particularly for transactions involving the sale of real property.

How to Use the Non Foreign Affidavit Under IRC 1445 North Dakota

To utilize the Non Foreign Affidavit, the seller must complete the form accurately and provide necessary information, including their name, address, and taxpayer identification number. Once completed, the affidavit should be submitted to the buyer, who will include it in the closing documents. This ensures that the transaction complies with IRS regulations and prevents unnecessary withholding of taxes.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 North Dakota

Completing the Non Foreign Affidavit involves several steps:

- Gather necessary information, including your taxpayer identification number and property details.

- Fill out the affidavit form, ensuring all sections are completed accurately.

- Sign and date the affidavit in the presence of a notary public, if required.

- Provide the completed affidavit to the buyer prior to the closing of the property sale.

Key Elements of the Non Foreign Affidavit Under IRC 1445 North Dakota

Important components of the Non Foreign Affidavit include:

- Seller's Information: Full name, address, and taxpayer identification number.

- Property Details: Description of the property being sold.

- Certification Statement: A declaration confirming the seller is not a foreign person.

- Signature: The seller must sign the affidavit to validate it.

Legal Use of the Non Foreign Affidavit Under IRC 1445 North Dakota

The legal use of the Non Foreign Affidavit is crucial for ensuring compliance with federal tax laws. By submitting this affidavit, sellers affirm their status as non-foreign individuals, thus protecting buyers from potential tax liabilities. Failure to provide this affidavit can lead to mandatory withholding of taxes from the sale proceeds, which can complicate transactions and create financial burdens for buyers.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Non Foreign Affidavit. Typically, the affidavit should be submitted during the closing process of the property sale. Buyers should ensure they receive the affidavit before the closing date to avoid withholding issues. Keeping track of these timelines can help facilitate a smooth transaction.

Quick guide on how to complete non foreign affidavit under irc 1445 north dakota

Complete Non Foreign Affidavit Under IRC 1445 North Dakota effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documentation, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools required to generate, alter, and eSign your documents quickly without delays. Manage Non Foreign Affidavit Under IRC 1445 North Dakota across any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The most effective method to alter and eSign Non Foreign Affidavit Under IRC 1445 North Dakota without hassle

- Find Non Foreign Affidavit Under IRC 1445 North Dakota and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Non Foreign Affidavit Under IRC 1445 North Dakota and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 North Dakota?

A Non Foreign Affidavit Under IRC 1445 North Dakota is a document used to signNow that a seller of property is not a foreign person for tax purposes. This affidavit helps buyers avoid withholding taxes on the sale of property when the seller is a U.S. resident. Understanding this document is crucial for smooth real estate transactions in North Dakota.

-

How do I obtain a Non Foreign Affidavit Under IRC 1445 North Dakota?

You can obtain a Non Foreign Affidavit Under IRC 1445 North Dakota through legal or real estate professionals who provide the necessary templates and guidance. Additionally, airSlate SignNow simplifies the process by offering customizable templates to help users easily create and eSign affidavits. With our solutions, you can ensure compliance and streamline document handling.

-

Are there any costs associated with using airSlate SignNow for a Non Foreign Affidavit Under IRC 1445 North Dakota?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to various business needs. Whether you are an individual or a business, our plans provide access to essential features for creating and managing Non Foreign Affidavits Under IRC 1445 North Dakota without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide to assist with Non Foreign Affidavit Under IRC 1445 North Dakota?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning capabilities to help you manage Non Foreign Affidavit Under IRC 1445 North Dakota efficiently. The platform is designed to simplify document preparation and ensure compliance with tax regulations. Moreover, you can track document statuses in real-time for enhanced visibility.

-

Can I integrate airSlate SignNow with other software for managing the Non Foreign Affidavit Under IRC 1445 North Dakota?

Yes, airSlate SignNow supports integrations with various business software, enabling you to manage the Non Foreign Affidavit Under IRC 1445 North Dakota seamlessly alongside your existing tools. By connecting with CRM, accounting software, and other applications, you can streamline your workflow and improve document management efficiency. This flexibility enhances your business processes.

-

What are the benefits of using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 North Dakota?

Using airSlate SignNow for handling Non Foreign Affidavit Under IRC 1445 North Dakota offers several benefits, including increased speed and efficiency in document processing. The user-friendly interface and robust features allow users to create, edit, and send documents quickly. Furthermore, the platform ensures secure storage and compliance with legal requirements.

-

Is airSlate SignNow suitable for individuals and businesses needing the Non Foreign Affidavit Under IRC 1445 North Dakota?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses dealing with Non Foreign Affidavit Under IRC 1445 North Dakota. Our platform provides essential tools for users of all sizes to manage their documents effectively, ensuring that everyone can benefit from our solutions, whether for personal or professional use.

Get more for Non Foreign Affidavit Under IRC 1445 North Dakota

- Ohio 4 h youth development club constitution article i name form

- Screener and opioid assessment for patients with pain soapp nhms form

- Inspection report charleston rental properties form

- Birth certificate form pdf 5521104

- Nsca guide state licensing form

- Tardy log pdf 450866145 form

- Form 592 resident and nonresident withholding statement

- Talent holding agreement template form

Find out other Non Foreign Affidavit Under IRC 1445 North Dakota

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word