Form 8453 F Internal Revenue Service Irs 2012

What is the Form 8453 F Internal Revenue Service IRS

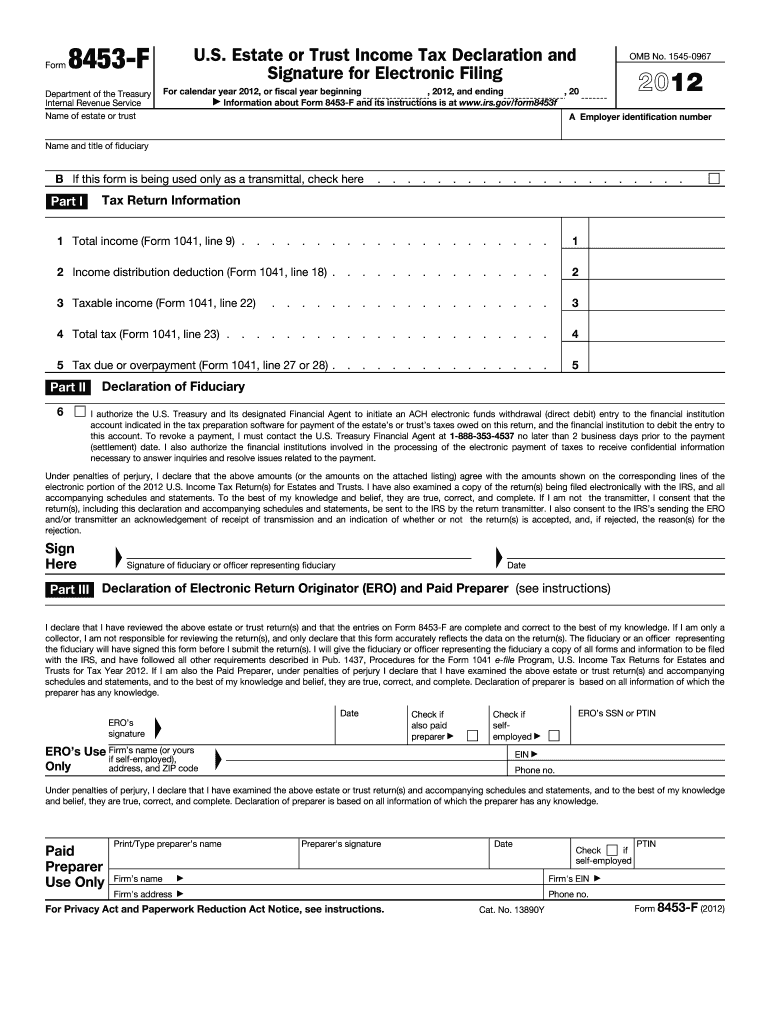

The Form 8453 F is a document used by taxpayers to authorize the Internal Revenue Service (IRS) to electronically file their tax returns. This form is specifically designed for those who are filing certain types of tax returns electronically, ensuring that the information submitted is accurate and complete. It serves as a declaration that the taxpayer has reviewed the return and confirms that all information is correct. The form also allows for the electronic submission of supporting documents, which can streamline the filing process.

How to use the Form 8453 F Internal Revenue Service IRS

Using the Form 8453 F involves several straightforward steps. First, ensure you have the correct version of the form, as outdated forms may not be accepted. Next, complete the required fields, which typically include your name, Social Security number, and details about your tax return. After filling out the form, review it for accuracy. Once confirmed, you can submit the form electronically alongside your tax return. This process helps facilitate a smoother filing experience and ensures that your documents are properly linked to your electronic submission.

Steps to complete the Form 8453 F Internal Revenue Service IRS

Completing the Form 8453 F requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS website.

- Fill in your personal information, including your name and Social Security number.

- Provide details regarding your tax return, such as the type of return being filed.

- Review all entries to ensure accuracy and completeness.

- Sign and date the form electronically, if submitting online.

- Submit the form along with your electronic tax return.

Key elements of the Form 8453 F Internal Revenue Service IRS

The Form 8453 F includes several key elements essential for its validity. These elements typically consist of:

- Your personal identification information, including name and Social Security number.

- Details of the tax return being filed, such as the type of income and deductions.

- A declaration statement confirming the accuracy of the information provided.

- Signature section for the taxpayer, which may include electronic signature options.

Form Submission Methods (Online / Mail / In-Person)

The Form 8453 F can be submitted through various methods, depending on the taxpayer's preferences and the IRS guidelines. For electronic submissions, the form is typically included as part of the e-filing process through approved tax software. Alternatively, if filing by mail, the completed form should be sent along with your tax return to the appropriate IRS address. In-person submissions are generally not common for this form, as electronic filing is encouraged for efficiency and speed.

IRS Guidelines

The IRS has established specific guidelines for the use of Form 8453 F. Taxpayers must ensure that they are using the most current version of the form and that all required fields are completed accurately. The IRS also outlines the importance of keeping copies of submitted forms and supporting documents for record-keeping purposes. Familiarizing yourself with these guidelines can help prevent delays or issues with your tax filing.

Quick guide on how to complete 2012 form 8453 f internal revenue service irs

Discover the simplest method to complete and endorse your Form 8453 F Internal Revenue Service Irs

Are you still spending time preparing your official paperwork on paper instead of online? airSlate SignNow offers a superior alternative to fill out and endorse your Form 8453 F Internal Revenue Service Irs and related forms for public services. Our intelligent electronic signature solution equips you with everything necessary to process documents swiftly and in compliance with official standards - powerful PDF editing, organizing, safeguarding, signing, and sharing features all available within a user-friendly interface.

Only a few steps are needed to fill out and endorse your Form 8453 F Internal Revenue Service Irs:

- Insert the editable template into the editor via the Get Form button.

- Determine the information you need to supply in your Form 8453 F Internal Revenue Service Irs.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Press Sign to generate a legally binding electronic signature using your preferred method.

- Add the Date adjacent to your signature and conclude your task with the Done button.

Store your completed Form 8453 F Internal Revenue Service Irs in the Documents directory within your profile, download it, or export it to your chosen cloud storage. Our platform also provides adaptable form sharing. There’s no need to print your templates when you can submit them to the appropriate public office - do it through email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 8453 f internal revenue service irs

FAQs

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

Internal Revenue Service (IRS): How many W-2s were issued in 2012? How many Forms 1099-MISC?

I don't have an answer as I was also unable to find this statistic anywhere. I can tell you that the Social Security Administration actually processes W2's and forwards the information to the IRS. 1099's however are processed by the IRS directly.The closest statistic I can find is that in 2010 there were 117,820,074 tax returns processed that showed salaries and wages (W2 income) on them. That does not allow for returns where the taxpayers have multiple W2's nor does it allow for people who received a W2 and did not file a tax return, so all I can say is the number of W2's is something larger than 117M.

-

Which Internal Revenue Service forms do I need to fill (salaried employee) for tax filing when my visa status changed from F1 OPT to H1B during 2015?

You can use the IRS page for residency test: Substantial Presence TestIf you live in a state that does not have income tax, you can use IRS tool: Free File: Do Your Federal Taxes for Free or any other free online software. TaxAct is one such.If not and if you are filing for the first time, it might be worth spending few dollars on a tax consultant. You can claim the fee in your return.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Internal Revenue Service (IRS): Why do so many companies wait until the last second to give employees their W2 forms?

WWEELLL consider that most small businesses do not prepare their own W-2s. Being a CPA and today is 1/18/17 I still have about 10 or so businesses that I’ve W-2s to prepare for them.Now as to the second part of the question you are aware that the IRS does not even accept a return for electronic filing until 1/23/17?Why such a hurry? Additionally, with the new security procedures in place you are probably looking at 4 -6 weeks to get your refund (even filing electronically) - AANNDD truthfully no one really knows because this is the first year for these new security measures.

-

Internal Revenue Service (IRS): How to expensify a payment for a foreign contractor?

Absolutely. That's the way we used to do it back in the old days before computers :)Seriously, the IRS does not require any specific method of record keeping; all that you are required to do in the event of an audit is to produce documentation that substantiates the deductions that you claim. A paper invoice with a signed paper receipt attached certainly meets the requirements. Refer to IRS Publication 583, http://www.irs.gov/publications/... for more information.

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

-

How much money does the US Internal Revenue Service (IRS) fail to collect in a typical fiscal year?

A LOT. We negotiate on our clients behalf to help them recoop some of it. Keystone National Tax

-

How do the penalties of IRS (Internal Revenue Service) compare to those of the FTB (Franchise Tax Board)?

Pretty much the same. Both charge a penalty of 5% of unpaid balance of tax to a maximum of 25%. Note, though, that this does not include interest which keeps is a gift that keeps on giving.If you’re more than 60 days late in filing, the FTB will also ding you with a penalty of 100% of the unpaid tax, capped at $135. Pretty much exactly the same as theIRS.

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 8453 f internal revenue service irs

How to make an eSignature for the 2012 Form 8453 F Internal Revenue Service Irs online

How to create an electronic signature for your 2012 Form 8453 F Internal Revenue Service Irs in Chrome

How to generate an electronic signature for putting it on the 2012 Form 8453 F Internal Revenue Service Irs in Gmail

How to create an electronic signature for the 2012 Form 8453 F Internal Revenue Service Irs from your smart phone

How to make an eSignature for the 2012 Form 8453 F Internal Revenue Service Irs on iOS

How to generate an eSignature for the 2012 Form 8453 F Internal Revenue Service Irs on Android

People also ask

-

What is Form 8453 F Internal Revenue Service IRS?

Form 8453 F Internal Revenue Service IRS is a tax form used to authenticate electronic tax returns submitted to the IRS. This form serves as a declaration that the taxpayer has reviewed the electronic submission and provides necessary signature information. It's essential for ensuring compliance and security in electronic tax filing.

-

How can airSlate SignNow help with Form 8453 F Internal Revenue Service IRS?

airSlate SignNow simplifies the process of completing and signing Form 8453 F Internal Revenue Service IRS digitally. With our user-friendly platform, you can effortlessly eSign and send the form without the need for printing. This ensures a faster processing time, which can help you meet IRS deadlines more efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs. Whether you're an individual or a large organization, you can choose from flexible subscriptions that allow unlimited access to features, including eSigning Form 8453 F Internal Revenue Service IRS. Start with a free trial to explore the platform at no cost.

-

Is it secure to eSign Form 8453 F Internal Revenue Service IRS with airSlate SignNow?

Yes, eSigning Form 8453 F Internal Revenue Service IRS with airSlate SignNow is secure. Our platform employs advanced encryption and compliance measures to safeguard your sensitive information. You can have peace of mind knowing that your signed documents are protected from unauthorized access.

-

Can I integrate airSlate SignNow with other applications for Form 8453 F Internal Revenue Service IRS?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including leading accounting and tax software, to help you manage Form 8453 F Internal Revenue Service IRS. This integration streamlines your workflow, allowing you to send, track, and eSign documents directly from the platforms you already use.

-

What are the key benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form 8453 F Internal Revenue Service IRS offers numerous benefits. It enhances efficiency, reducing the time spent on document management, and ensures accuracy with features like automatic data population. Additionally, it allows for real-time tracking of your documents, providing status updates at every step.

-

How do I get started with eSigning Form 8453 F Internal Revenue Service IRS?

Getting started with airSlate SignNow to eSign Form 8453 F Internal Revenue Service IRS is easy. Simply sign up for an account, upload your document, and follow the guided steps to add your eSignature. If you need assistance, our dedicated support team is available to help you navigate the process.

Get more for Form 8453 F Internal Revenue Service Irs

- Legal last will and testament form for a single person with minor children california

- Legal last will and testament form for single person with adult and minor children california

- Legal last will and testament form for single person with adult children california

- Legal last will and testament for married person with minor children from prior marriage california form

- Ca last will testament form

- Legal last will and testament form for married person with adult children from prior marriage california

- Legal last will and testament form for divorced person not remarried with adult children california

- Legal last will and testament form for domestic partner with adult children from prior marriage california

Find out other Form 8453 F Internal Revenue Service Irs

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer