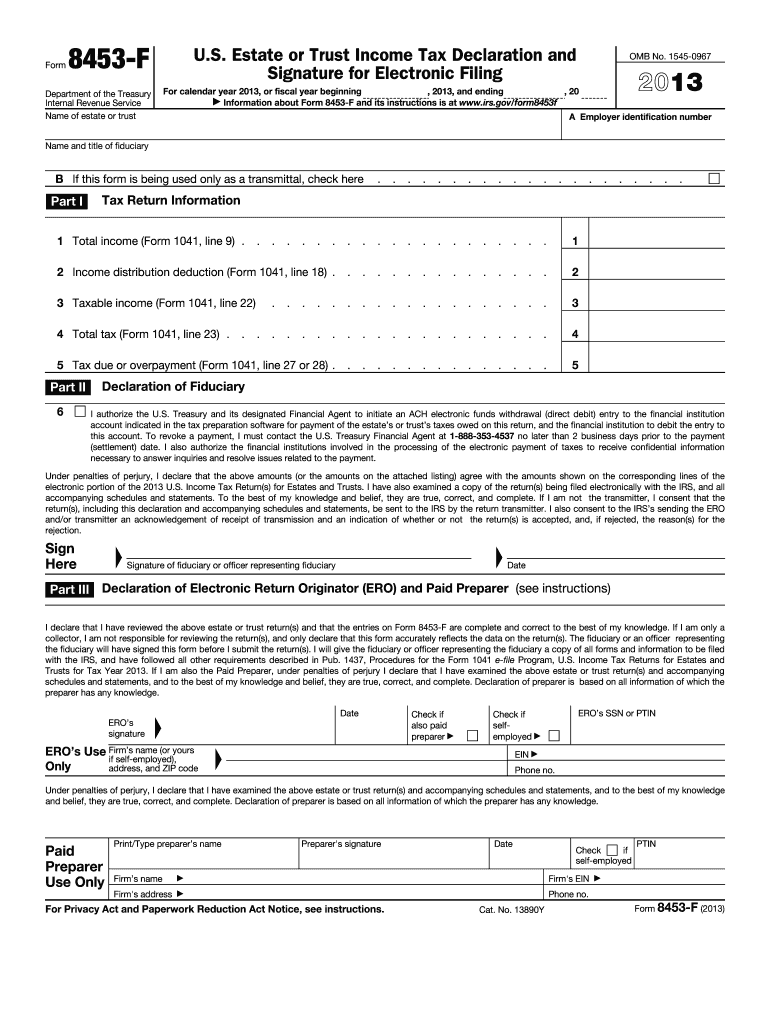

Form 8453 2013

What is the Form 8453

The Form 8453 is a document used by taxpayers in the United States to authorize the electronic filing of their tax returns. This form serves as a declaration that the taxpayer has reviewed the return and agrees to its submission. The IRS requires this form to ensure that all electronic submissions are legitimate and that the taxpayer is aware of their tax obligations. The Form 8453 can also be used for various purposes, including the submission of supporting documents for certain tax credits and deductions.

How to use the Form 8453

Using the Form 8453 involves several steps. First, ensure you have completed your tax return accurately. Next, fill out the Form 8453 with the necessary information, including your name, Social Security number, and the tax year. Once completed, you can submit this form along with your electronic tax return. It is important to retain a copy of the Form 8453 for your records, as it serves as proof of your authorization for electronic filing.

Steps to complete the Form 8453

Completing the Form 8453 requires careful attention to detail. Follow these steps:

- Gather all necessary information, including your tax return details.

- Fill in your name, Social Security number, and the tax year on the form.

- Review the form for accuracy, ensuring all required fields are completed.

- Sign and date the form to validate your authorization.

- Keep a copy for your records before submitting it with your electronic return.

Legal use of the Form 8453

The legal use of the Form 8453 is essential for ensuring compliance with IRS regulations. This form must be signed by the taxpayer to confirm that they have reviewed the return and agree to its submission. The IRS accepts the Form 8453 as a valid document for electronic filing, provided it is completed correctly and submitted in conjunction with the electronic return. Failure to use the form appropriately may result in delays or rejections of your tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8453 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. If you are filing for an extension, be aware that the Form 8453 must still be submitted by the extended deadline. It is crucial to stay informed about any changes in deadlines, as these can affect your tax obligations and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 8453 can be submitted electronically alongside your tax return when using approved e-filing software. If you are unable to file electronically, you may also print the form and submit it by mail. Ensure that you send it to the appropriate IRS address based on your state of residence. In-person submissions are generally not accepted for this form, as it is primarily designed for electronic filing. Always check for the latest guidelines on submission methods to ensure compliance.

Quick guide on how to complete 8453 form 2013 2018

Uncover the most efficient method to complete and sign your Form 8453

Are you still spending time preparing your official documents on paper copies instead of online? airSlate SignNow provides a superior approach to finalize and endorse your Form 8453 and similar forms for public services. Our advanced eSignature solution equips you with everything necessary to manage paperwork swiftly and in accordance with official standards - powerful PDF editing, organizing, securing, signing, and sharing tools all available within an intuitive interface.

There are only a few steps needed to complete and sign your Form 8453:

- Add the fillable template to the editor using the Get Form button.

- Review what information you need to enter in your Form 8453.

- Navigate between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the top toolbar.

- Highlight what is essential or Blackout fields that are no longer relevant.

- Tap on Sign to create a legally valid eSignature using any method you prefer.

- Add the Date next to your signature and conclude your task by clicking the Done button.

Store your completed Form 8453 in the Documents folder within your account, download it, or transfer it to your desired cloud storage. Our solution also provides flexible file sharing options. There’s no need to print your templates when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

Find and fill out the correct 8453 form 2013 2018

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

How do I fill out the NEET application form for 2018?

For the academic session of 2018-2019, NEET 2018 will be conducted on 6th May 2018.The application form for the same had been released on 8th February 2018.Steps to Fill NEET 2018 Application Form:Registration: Register yourself on the official website before filling the application form.Filling Up The Form: Fill up the application form by providing personal information (like name, father’s name, address, etc.), academic details.Uploading The Images: Upload the scanned images of their photograph, signature and right-hand index finger impression.Payment of The Application Fees: Pay the application fees for NEET 2018 in both online and offline mode. You can pay through credit/debit card/net banking or through e-challan.For details, visit this site: NEET 2018 Application Form Released - Apply Now!

Create this form in 5 minutes!

How to create an eSignature for the 8453 form 2013 2018

How to make an eSignature for the 8453 Form 2013 2018 online

How to generate an eSignature for your 8453 Form 2013 2018 in Chrome

How to generate an electronic signature for signing the 8453 Form 2013 2018 in Gmail

How to create an eSignature for the 8453 Form 2013 2018 right from your smart phone

How to create an eSignature for the 8453 Form 2013 2018 on iOS devices

How to make an electronic signature for the 8453 Form 2013 2018 on Android OS

People also ask

-

What is Form 8453 and how does it relate to eSignature solutions?

Form 8453 is a declaration document used by taxpayers to authorize the electronic submission of their tax returns. Utilizing airSlate SignNow, you can easily eSign and manage your Form 8453 electronically, streamlining your tax filing process and ensuring compliance with IRS regulations.

-

How can airSlate SignNow help in signing Form 8453?

With airSlate SignNow, signing Form 8453 becomes a breeze. Our intuitive platform allows users to upload, eSign, and send the Form 8453 securely, saving time and reducing the hassle of paper-based processes.

-

Is there a cost associated with using airSlate SignNow for Form 8453?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for individual users or teams. You can easily access the features you need to manage Form 8453 without breaking the bank.

-

What features does airSlate SignNow offer for handling Form 8453?

airSlate SignNow provides a range of features specifically designed to facilitate the signing of Form 8453, including customizable templates, advanced security measures, and real-time tracking of document status, ensuring a smooth and efficient signing experience.

-

Can I integrate airSlate SignNow with other software for managing Form 8453?

Absolutely! airSlate SignNow seamlessly integrates with various business applications like CRM systems and document management tools, allowing you to streamline the process of managing Form 8453 within your existing workflows.

-

What are the benefits of using airSlate SignNow for Form 8453?

Using airSlate SignNow for Form 8453 offers numerous benefits, including faster processing times, enhanced security for sensitive information, and the convenience of eSigning from anywhere. This not only simplifies your tax filing but also improves overall productivity.

-

Is airSlate SignNow compliant with IRS regulations for Form 8453?

Yes, airSlate SignNow meets all necessary compliance standards set by the IRS for electronic signatures, ensuring that your Form 8453 is filed correctly and securely. This commitment to compliance protects your data and provides peace of mind.

Get more for Form 8453

- Nebraska department of roads form

- Nevada declaration paternity form

- Bill of sale nevadapdffillercom form

- Form sr1

- Bikash bhaban from filap er jono jeje documents dite hobe tar list details form

- Ab128 form

- Form it 196 i instructions for form it 196 tax ny gov

- How to file new york form it 203 for a nonresident

Find out other Form 8453

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form