Form 8453 FE U S Estate or Trust Declaration for an IRS E File Return 2022

What is the Form 8453 FE U S Estate Or Trust Declaration For An IRS E-file Return

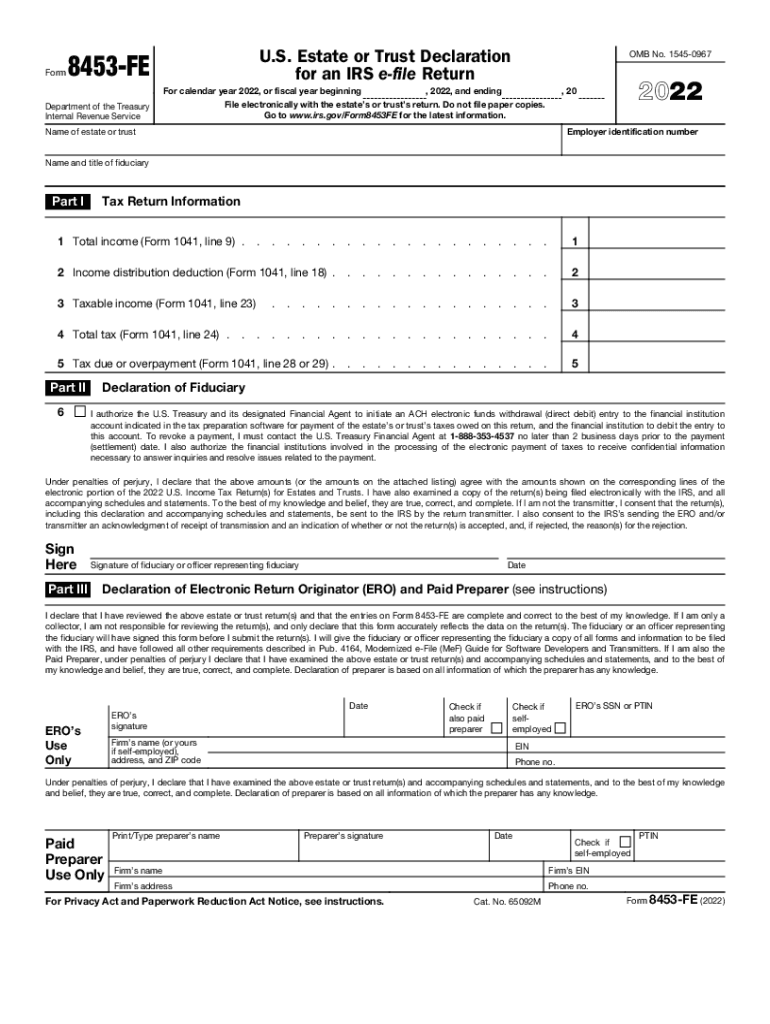

The Form 8453 FE is a crucial document for estates and trusts that are filing their tax returns electronically with the Internal Revenue Service (IRS). This form serves as a declaration, confirming the authenticity of the electronic submission. It is specifically designed for estates and trusts that need to report income, deductions, and other tax-related information. By utilizing this form, taxpayers can ensure compliance with IRS regulations while simplifying the e-filing process.

Steps to Complete the Form 8453 FE U S Estate Or Trust Declaration For An IRS E-file Return

Completing the Form 8453 FE involves several steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents related to the estate or trust. This includes income statements, deduction records, and any other pertinent information. Next, fill out the form, ensuring that all required fields are completed accurately. It is essential to include the taxpayer identification number and the name of the estate or trust. After filling out the form, review it carefully for any errors before submitting it electronically along with the tax return.

Legal Use of the Form 8453 FE U S Estate Or Trust Declaration For An IRS E-file Return

The legal use of the Form 8453 FE is governed by IRS regulations that stipulate its necessity for e-filing tax returns for estates and trusts. This form acts as a declaration of the authenticity of the electronic submission, providing legal backing for the information reported. It is important to understand that failing to submit this form may result in the IRS rejecting the e-filed return, which could lead to penalties or delays in processing. Therefore, proper completion and submission of the Form 8453 FE are essential for legal compliance.

Key Elements of the Form 8453 FE U S Estate Or Trust Declaration For An IRS E-file Return

Several key elements must be included in the Form 8453 FE to ensure its validity. These include:

- Taxpayer Identification Number: This is crucial for identifying the estate or trust.

- Name of the Estate or Trust: Clearly state the legal name as it appears in official documents.

- Signature: An authorized individual must sign the form to validate the submission.

- Date: The date of signing must be included to establish the timeline of submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8453 FE are aligned with the overall tax filing schedule for estates and trusts. Typically, the deadline for filing the federal income tax return for an estate or trust is April fifteenth of the year following the tax year. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is crucial to submit the Form 8453 FE along with the e-filed return by this deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 8453 FE is primarily submitted electronically as part of the e-filing process. When filing a tax return for an estate or trust, the form is included in the electronic submission to the IRS. However, if e-filing is not an option, the form can also be printed and mailed to the IRS along with the paper tax return. In-person submission is generally not applicable for this form, as it is designed for electronic filing.

Quick guide on how to complete 2022 form 8453 fe us estate or trust declaration for an irs e file return

Effortlessly prepare Form 8453 FE U S Estate Or Trust Declaration For An IRS E file Return on any device

The management of online documents has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents rapidly and without complications. Handle Form 8453 FE U S Estate Or Trust Declaration For An IRS E file Return on any device utilizing the airSlate SignNow applications for Android or iOS and streamline any document-related procedures today.

The simplest way to modify and electronically sign Form 8453 FE U S Estate Or Trust Declaration For An IRS E file Return without hassle

- Obtain Form 8453 FE U S Estate Or Trust Declaration For An IRS E file Return and select Get Form to begin.

- Make use of the tools provided to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 8453 FE U S Estate Or Trust Declaration For An IRS E file Return to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 8453 fe us estate or trust declaration for an irs e file return

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 8453 fe us estate or trust declaration for an irs e file return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow 8453 and how can it benefit my business?

airSlate SignNow 8453 is a powerful tool that enables businesses to send and eSign documents efficiently. By utilizing this solution, companies can streamline their document management processes, saving time and reducing operational costs. With its user-friendly interface, airSlate SignNow 8453 makes it easy for teams to collaborate and ensure that important documents are signed quickly and securely.

-

How much does airSlate SignNow 8453 cost?

The pricing for airSlate SignNow 8453 is competitive and designed to provide value for businesses of all sizes. Users can choose from various subscription plans that cater to different needs, with options for monthly or annual billing. This flexibility allows businesses to select a plan that best fits their budget and workflow requirements.

-

What features are included in airSlate SignNow 8453?

airSlate SignNow 8453 comes with a range of features designed to enhance document management. Key functionalities include electronic signature capabilities, customizable templates, real-time collaboration tools, and secure cloud storage. These features work together to improve efficiency and ensure legal compliance in document handling.

-

Can I integrate airSlate SignNow 8453 with other tools?

Yes, airSlate SignNow 8453 supports integrations with a variety of popular business applications. This allows users to seamlessly connect their existing workflows, whether it's with CRM systems, project management tools, or other software. By integrating with airSlate SignNow 8453, businesses can enhance productivity and maintain organizational efficiency.

-

Is airSlate SignNow 8453 secure for sensitive documents?

Absolutely, airSlate SignNow 8453 prioritizes the security of your documents. The platform uses advanced encryption technologies and ensures compliance with industry standards. With features such as audit trails and secure access controls, businesses can confidently manage sensitive information, knowing it's safe with airSlate SignNow 8453.

-

How easy is it to start using airSlate SignNow 8453?

Getting started with airSlate SignNow 8453 is incredibly easy. The platform offers a straightforward signup process, allowing users to create an account and begin sending documents in minutes. Additionally, airSlate SignNow 8453 provides helpful resources and customer support to assist users during their onboarding process.

-

What types of businesses can benefit from airSlate SignNow 8453?

airSlate SignNow 8453 is beneficial for a wide range of businesses, from small startups to large enterprises. Any organization that deals with contracts, agreements, or forms can leverage this solution to improve their document workflow. The versatility and scalability of airSlate SignNow 8453 make it suitable for various industries and sectors.

Get more for Form 8453 FE U S Estate Or Trust Declaration For An IRS E file Return

Find out other Form 8453 FE U S Estate Or Trust Declaration For An IRS E file Return

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself