Estates and TrustsInternal Revenue Service IRS Tax FormsDeceased TaxpayersFiling the Estate Income Tax Return Deceased Taxpayers 2021

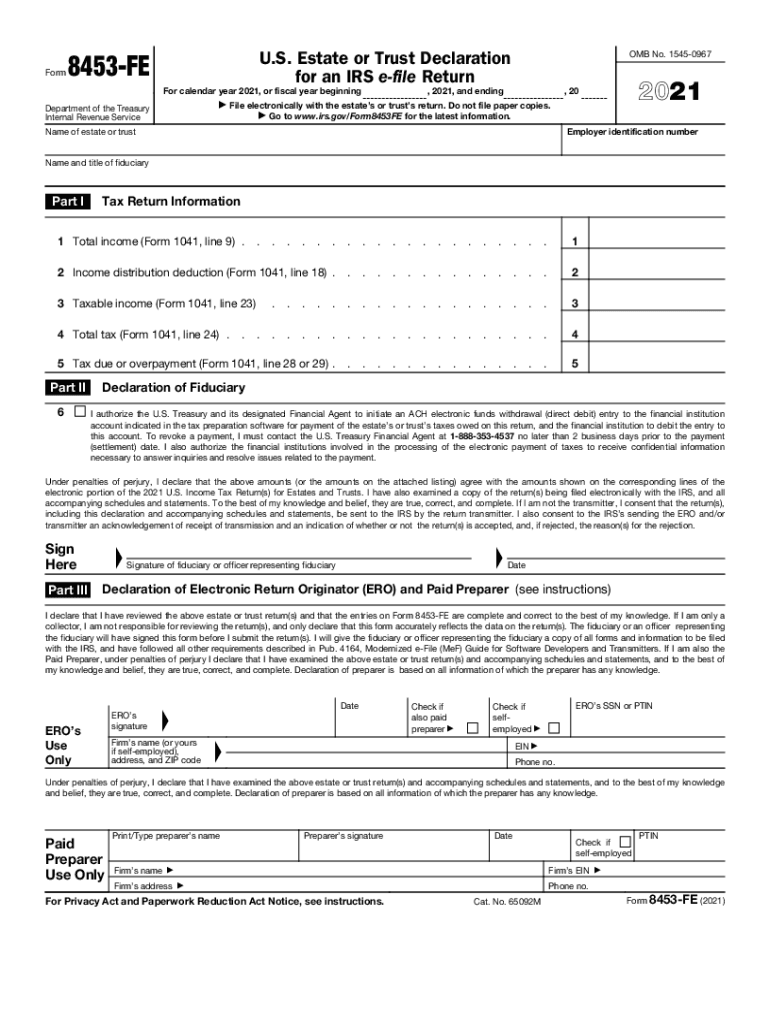

Understanding Form 8453

The form 8453, also known as the IRS Form 8453 F, is a crucial document used for electronically filing tax returns. This form serves as a declaration that the taxpayer has authorized the electronic submission of their return, ensuring compliance with IRS regulations. It is particularly relevant for individuals and businesses that opt for e-filing, as it provides a means to maintain the integrity and authenticity of the submitted information.

Steps to Complete Form 8453

Filling out the form 8453 involves several key steps to ensure accuracy and compliance. Here’s a streamlined process:

- Gather necessary information, including your Social Security number, tax year, and details of any attached forms.

- Complete the form by entering your personal information and confirming your identity.

- Review the form for accuracy, ensuring all required fields are filled out correctly.

- Sign the form electronically, which may require a secure eSignature solution to validate your identity.

- Submit the form alongside your electronic tax return through your chosen e-filing platform.

Legal Use of Form 8453

The legal validity of form 8453 hinges on its proper execution and adherence to IRS guidelines. The form must be signed by the taxpayer or an authorized representative to be considered legally binding. Utilizing a reliable eSignature platform ensures compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which recognizes electronic signatures as valid and enforceable.

Filing Deadlines for Form 8453

Timely submission of form 8453 is essential to avoid penalties. The form must be filed by the same deadline as your tax return. Typically, this means submitting it by April 15 for individual taxpayers. However, if you file for an extension, ensure that the form is submitted within the extended timeframe to maintain compliance.

Required Documents for Form 8453

When preparing to submit form 8453, certain documents are necessary to support your tax return. These may include:

- Your completed tax return (e.g., Form 1040 or Form 1065).

- Any attached schedules or forms that are part of your return.

- Documentation supporting deductions or credits claimed.

Form Submission Methods

Form 8453 can be submitted electronically as part of your e-filed tax return. It is important to ensure that you are using a compliant e-filing platform that integrates the form submission process. Alternatively, if you are unable to e-file, the form can be printed and mailed to the appropriate IRS address, though this method is less common in the digital age.

Quick guide on how to complete estates and trustsinternal revenue service irs tax formsdeceased taxpayersfiling the estate income tax return deceased

Complete Estates And TrustsInternal Revenue Service IRS Tax FormsDeceased TaxpayersFiling The Estate Income Tax Return Deceased Taxpayers seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents rapidly without delays. Manage Estates And TrustsInternal Revenue Service IRS Tax FormsDeceased TaxpayersFiling The Estate Income Tax Return Deceased Taxpayers on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The ultimate method to modify and eSign Estates And TrustsInternal Revenue Service IRS Tax FormsDeceased TaxpayersFiling The Estate Income Tax Return Deceased Taxpayers effortlessly

- Find Estates And TrustsInternal Revenue Service IRS Tax FormsDeceased TaxpayersFiling The Estate Income Tax Return Deceased Taxpayers and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as an ordinary ink signature.

- Review the information and then select the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunts, and mistakes requiring new printed copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Estates And TrustsInternal Revenue Service IRS Tax FormsDeceased TaxpayersFiling The Estate Income Tax Return Deceased Taxpayers and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct estates and trustsinternal revenue service irs tax formsdeceased taxpayersfiling the estate income tax return deceased

Create this form in 5 minutes!

How to create an eSignature for the estates and trustsinternal revenue service irs tax formsdeceased taxpayersfiling the estate income tax return deceased

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an e-signature straight from your mobile device

The way to make an e-signature for a PDF file on iOS

The way to make an e-signature for a PDF document on Android devices

People also ask

-

What is Form 8453 and how is it used in e-signing with airSlate SignNow?

Form 8453 is a crucial document for taxpayers who need to authenticate electronic tax filings. With airSlate SignNow, you can easily e-sign Form 8453, ensuring that your electronic submissions are secure and compliant with IRS regulations.

-

How does airSlate SignNow simplify the signing of Form 8453?

airSlate SignNow streamlines the signing process for Form 8453 by allowing users to send, receive, and sign documents digitally in just a few clicks. This convenience saves time and ensures that the form is completed correctly without unnecessary delays.

-

Are there any costs associated with using airSlate SignNow for Form 8453?

Yes, airSlate SignNow offers various pricing plans that include features specifically designed for e-signing documents like Form 8453. You can choose a plan that suits your business needs while enjoying a cost-effective solution for document management.

-

Can I integrate airSlate SignNow with other software to manage Form 8453?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive and Dropbox, allowing you to manage Form 8453 alongside your other critical workflows. These integrations enhance your productivity by keeping all your files in one place.

-

What are the key benefits of using airSlate SignNow for managing Form 8453?

Using airSlate SignNow for Form 8453 offers several benefits, including increased efficiency, enhanced security, and the ability to track document status in real-time. It ensures that you have an organized approach to handling necessary tax documents.

-

Is the process of signing Form 8453 with airSlate SignNow legally binding?

Yes, signing Form 8453 with airSlate SignNow is legally binding and complies with e-signature regulations. This guarantees the integrity of your electronic signatures and ensures that your tax forms are valid in the eyes of the law.

-

How can I ensure my Form 8453 is completed correctly with airSlate SignNow?

airSlate SignNow provides templates and guided workflows to help ensure that your Form 8453 is filled out correctly. Users can benefit from helpful prompts and validations that reduce the risk of errors in their submissions.

Get more for Estates And TrustsInternal Revenue Service IRS Tax FormsDeceased TaxpayersFiling The Estate Income Tax Return Deceased Taxpayers

- Corporate records maintenance package for existing corporations district of columbia form

- District of columbia limited liability company llc formation package district of columbia

- Limited liability company llc operating agreement district of columbia form

- Dc llc form

- Dc succession form

- Dc claim form

- District of columbia deed form

- Warranty deed from husband and wife to a trust district of columbia form

Find out other Estates And TrustsInternal Revenue Service IRS Tax FormsDeceased TaxpayersFiling The Estate Income Tax Return Deceased Taxpayers

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe