Living Trust for Husband and Wife with Minor and or Adult Children New Hampshire Form

What is the Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire

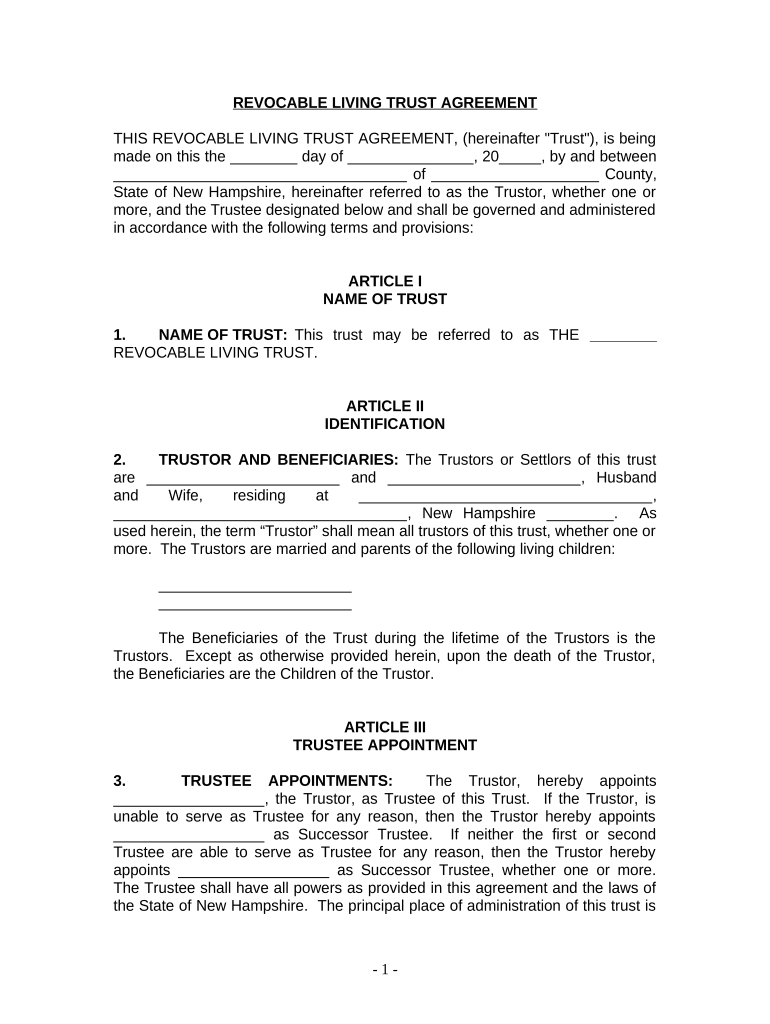

A living trust for husband and wife with minor and or adult children in New Hampshire is a legal arrangement that allows couples to manage and distribute their assets during their lifetime and after death. This type of trust is particularly beneficial for ensuring that minor children are provided for in the event of both parents' passing. It allows for the seamless transfer of assets without the need for probate, which can be a lengthy and costly process. Additionally, it provides flexibility in managing assets, as the couple can modify the trust as their circumstances change.

Steps to Complete the Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire

Completing a living trust involves several key steps:

- Identify the assets to be included in the trust, such as real estate, bank accounts, and investments.

- Choose a trustee, which can be one or both spouses, or a third party, to manage the trust.

- Draft the trust document, which outlines the terms of the trust, including how assets will be managed and distributed.

- Sign the trust document in accordance with New Hampshire law, ensuring that it is witnessed or notarized as required.

- Transfer ownership of the chosen assets into the trust, which may involve changing titles and account names.

Legal Use of the Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire

The legal use of a living trust in New Hampshire allows couples to dictate how their assets will be managed and distributed upon their death. This legal instrument can help avoid the probate process, which can delay asset distribution and incur additional costs. It also provides a mechanism for appointing guardians for minor children, ensuring their care and financial support. Furthermore, a living trust can be designed to address specific family needs, such as providing for children with special needs or managing assets for adult children who may not be financially responsible.

State-Specific Rules for the Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire

New Hampshire has specific regulations governing living trusts. The trust must be created in writing and signed by the grantors. It is essential to ensure that the trust document complies with state laws regarding witnesses and notarization. Additionally, New Hampshire does not impose a state inheritance tax, making living trusts an attractive option for couples looking to manage their estate planning efficiently. Couples should also be aware of any federal tax implications that may arise from the establishment of a living trust.

Key Elements of the Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire

Key elements of a living trust include:

- Grantors: The individuals who create the trust, typically the husband and wife.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or entities that will receive benefits from the trust, which may include minor and adult children.

- Trust Property: The assets placed into the trust, which can include real estate, bank accounts, and personal property.

- Distribution Terms: Clear instructions on how and when the assets will be distributed to beneficiaries.

How to Obtain the Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire

To obtain a living trust in New Hampshire, couples can either draft the trust document themselves or seek assistance from an attorney specializing in estate planning. Many legal services offer templates and guidance for creating a living trust. It is advisable to consult with a legal professional to ensure compliance with state laws and to address any specific family circumstances. Once the trust document is prepared, it must be signed and notarized to be legally valid.

Quick guide on how to complete living trust for husband and wife with minor and or adult children new hampshire

Complete Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and safely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire effortlessly

- Locate Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive data with tools specially offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors necessitating the printing of new document versions. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire and ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with Minor and/or Adult Children in New Hampshire?

A Living Trust for Husband and Wife with Minor and/or Adult Children in New Hampshire is a legal arrangement that allows couples to manage their assets during their lifetime and ensure a smooth transition to their children after death. This type of trust helps in minimizing probate costs and maintaining privacy regarding estate distribution.

-

How does a Living Trust benefit families with minor children in New Hampshire?

A Living Trust for Husband and Wife with Minor and/or Adult Children in New Hampshire provides several benefits, including the ability to appoint a guardian for minor children and specify how assets should be managed until they signNow a responsible age. This ensures that your minor children are protected and their inheritance is handled wisely.

-

Can I create a Living Trust for Husband and Wife with Minor and/or Adult Children online?

Yes, you can create a Living Trust for Husband and Wife with Minor and/or Adult Children in New Hampshire online using legal services or software that specialize in estate planning. These platforms often provide guides and templates to help you set up the trust correctly.

-

What are the costs associated with setting up a Living Trust for Husband and Wife with Minor and/or Adult Children in New Hampshire?

The costs of establishing a Living Trust for Husband and Wife with Minor and/or Adult Children in New Hampshire can vary widely, depending on whether you use an attorney or an online service. Online solutions tend to be more cost-effective, often ranging from a few hundred to a couple of thousand dollars.

-

How is a Living Trust different from a will in New Hampshire?

A Living Trust for Husband and Wife with Minor and/or Adult Children in New Hampshire differs from a will primarily in how assets are managed and distributed. A trust is effective immediately upon creation, avoids probate, and ensures privacy, whereas a will only takes effect after death and must go through probate.

-

What assets can be placed in a Living Trust for Husband and Wife with Minor and/or Adult Children in New Hampshire?

You can place various assets in a Living Trust for Husband and Wife with Minor and/or Adult Children in New Hampshire, including real estate, bank accounts, investments, and personal property. It's crucial to fund the trust properly to ensure that these assets are managed according to your wishes.

-

Are there any tax implications with a Living Trust in New Hampshire?

Generally, a Living Trust for Husband and Wife with Minor and/or Adult Children in New Hampshire does not have direct tax implications during the lifetime of the trust creators. However, it's essential to consult with a tax professional to understand any potential tax consequences, especially regarding estate taxes after death.

Get more for Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire

- Of 306 186357 form

- Eritrean embassy tax form 77393790

- Westpac notification of death funds distribution indemnity form

- Bookkeeping client check list form

- Elite performers in coquitlam program epic secondary school information

- Jeld wen warranty claim form

- Application for canine good neighbour evaluator form

- H90 indicating required form controls using label or legend

Find out other Living Trust For Husband And Wife With Minor And Or Adult Children New Hampshire

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast