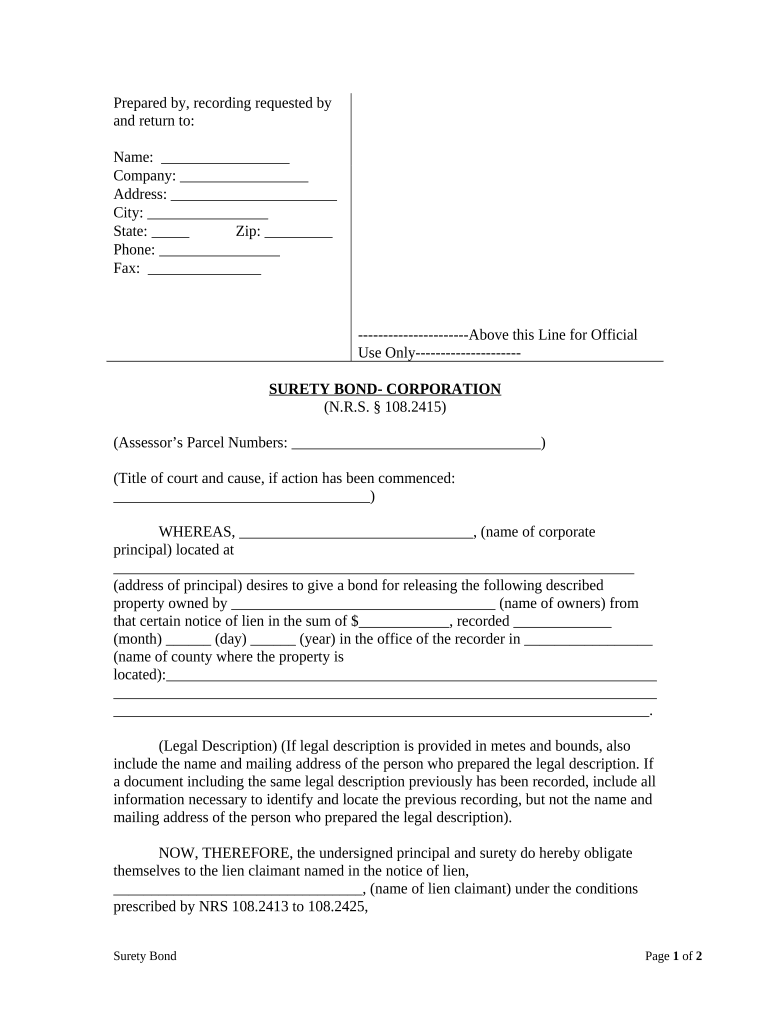

Nevada Surety Bond Form

What is the Nevada Surety Bond

A Nevada surety bond is a legally binding agreement that involves three parties: the principal, the obligee, and the surety. The principal is the individual or business that needs the bond, the obligee is the entity requiring the bond for protection, and the surety is the company that issues the bond and guarantees the principal's obligations. This bond serves as a financial guarantee that the principal will fulfill their contractual obligations, comply with regulations, or pay damages in the event of a breach. In Nevada, surety bonds are commonly required in various industries, including construction, licensing, and court-related matters.

How to obtain the Nevada Surety Bond

Obtaining a Nevada surety bond involves several steps. First, determine the specific type of bond required for your situation, as different industries may have unique requirements. Next, gather necessary documentation, which may include personal and business financial information, credit history, and details about the project or obligation. After preparing the required documents, approach a licensed surety bond provider to request a quote. The provider will evaluate your application, assess your creditworthiness, and determine the bond premium. Once approved, you will need to sign the bond agreement and pay the premium to receive your bond.

Steps to complete the Nevada Surety Bond

Completing a Nevada surety bond requires careful attention to detail. Begin by accurately filling out the bond application form, ensuring all information is correct and complete. Next, review the bond terms and conditions to understand your obligations and rights. Once the application is submitted, the surety company will conduct a review, which may involve a credit check and financial assessment. After approval, sign the bond and retain a copy for your records. It's essential to submit the bond to the appropriate obligee as required, ensuring compliance with all relevant regulations.

Legal use of the Nevada Surety Bond

The legal use of a Nevada surety bond is governed by state laws and regulations. These bonds must comply with the Nevada Revised Statutes, which outline the requirements and enforcement mechanisms for various types of surety bonds. When executed correctly, a surety bond is enforceable in court, providing protection to the obligee against potential default by the principal. It is crucial for all parties involved to understand their rights and responsibilities under the bond agreement to ensure legal compliance and protection.

Key elements of the Nevada Surety Bond

Key elements of a Nevada surety bond include the bond amount, the parties involved, and the specific obligations outlined within the bond agreement. The bond amount is the maximum financial liability the surety will cover in case of a claim. The obligations typically specify the conditions under which the bond will be enforced, including compliance with laws and regulations. Additionally, the bond may include provisions for penalties in case of non-compliance, ensuring that all parties are aware of the consequences of failing to meet their obligations.

State-specific rules for the Nevada Surety Bond

Nevada has specific rules and regulations governing surety bonds, which vary by industry and purpose. These rules dictate the requirements for bond amounts, the types of bonds available, and the processes for filing and enforcing claims. For instance, certain professions, such as contractors and real estate agents, may have unique bonding requirements to protect consumers and ensure compliance with state laws. It is essential for individuals and businesses seeking a Nevada surety bond to familiarize themselves with these state-specific regulations to ensure proper compliance.

Quick guide on how to complete nevada surety bond

Complete Nevada Surety Bond with ease on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Nevada Surety Bond on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Nevada Surety Bond effortlessly

- Obtain Nevada Surety Bond and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Nevada Surety Bond and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Nevada surety bond?

A Nevada surety bond is a legally binding agreement that involves three parties: the principal, the obligee, and the surety. This bond guarantees that the principal will comply with certain laws or regulations established by the obligee, which is often a state or local government entity. Obtaining a Nevada surety bond is essential for various businesses to operate legally within the state.

-

How much does a Nevada surety bond cost?

The cost of a Nevada surety bond varies based on several factors, including the type of bond, the bond amount, and the applicant's credit history. Generally, premiums range from 1% to 15% of the total bond amount. To get accurate pricing for a Nevada surety bond, it's best to request a quote from a licensed surety provider.

-

What are the main benefits of obtaining a Nevada surety bond?

Obtaining a Nevada surety bond provides numerous benefits, including compliance with legal requirements and enhanced credibility with clients. It protects consumers and ensures that businesses adhere to ethical and professional standards. Additionally, having a surety bond can help you secure more contracts and opportunities in the Nevada market.

-

How long does it take to obtain a Nevada surety bond?

The process of obtaining a Nevada surety bond can be relatively quick, often completed within a few days. Factors that influence the timeline include the complexity of the application and the amount of supporting information required. In some cases, businesses may receive their bonds the same day if their applications are straightforward.

-

Are there different types of Nevada surety bonds?

Yes, there are various types of Nevada surety bonds, including contractor bonds, license bonds, and court bonds. Each type serves a specific purpose and is often required for different industries or professions. Understanding the specific type of Nevada surety bond you need is crucial to ensure compliance with state regulations.

-

What happens if I need to file a claim against a Nevada surety bond?

If you need to file a claim against a Nevada surety bond, the claimant must contact the surety company that issued the bond. The surety will then investigate the claim and determine whether it is valid. If the claim is substantiated, the surety will cover the cost up to the bond amount, while the principal must repay the surety.

-

Can I get a Nevada surety bond with bad credit?

While having bad credit can impact your ability to secure a Nevada surety bond, it is still possible to obtain one. Many surety companies consider various factors beyond credit scores, such as your business experience and financial history. Working with a knowledgeable surety bond agent can help you find the best options available for your situation.

Get more for Nevada Surety Bond

- Clearwave vac track form

- Alief isd middle school science staar review form

- Form 4562 depreciation and amortization irs

- Out of area emission test form ecy wa

- Captax form

- White sands national park service u nps form

- Dds georgia govdui or risk reduction programdui or risk reduction programgeorgia department of driver form

- District court of maryland for located at affixed form

Find out other Nevada Surety Bond

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement