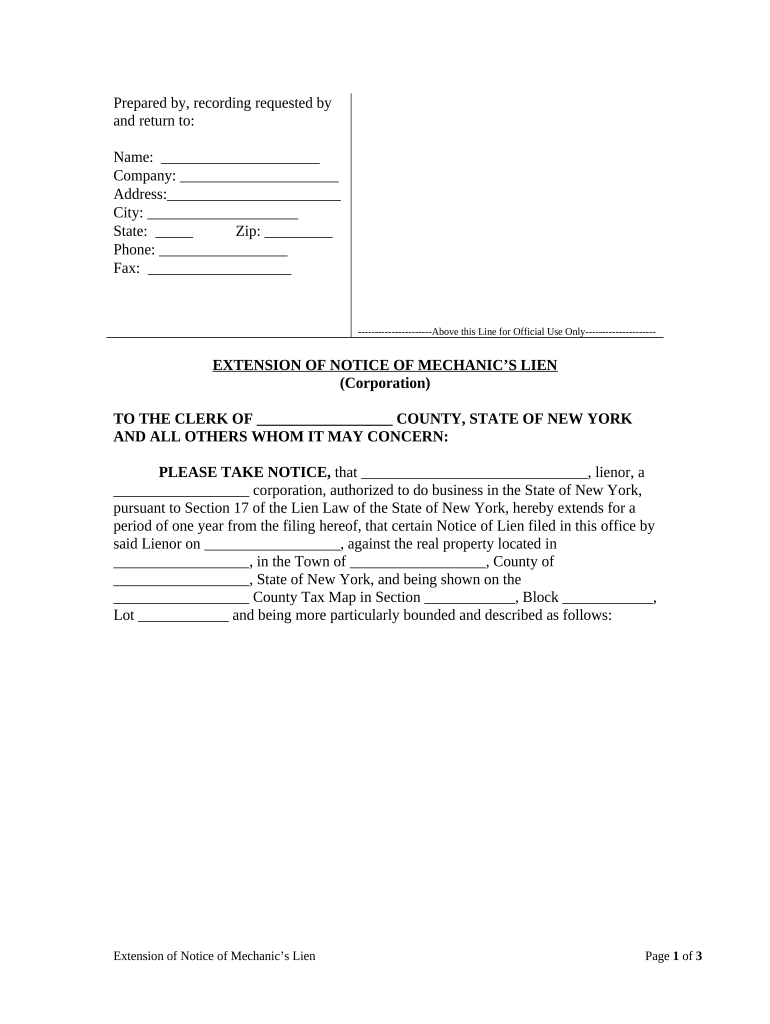

New York Extension Form

Understanding the New York Extension

The New York extension allows taxpayers to extend the time for filing their tax returns. This extension is particularly useful for individuals and businesses needing additional time to prepare their documents accurately. It is essential to note that while the extension provides more time to file, it does not extend the time to pay any taxes owed. Taxpayers must still estimate and pay their tax liability by the original due date to avoid penalties and interest.

Steps to Complete the New York Extension

Completing the New York extension involves several straightforward steps:

- Obtain the correct form, typically the IT-370 for individuals or the CT-5 for corporations.

- Fill out the required information, including your name, address, and Social Security number or Employer Identification Number (EIN).

- Estimate your tax liability and indicate any payments already made.

- Submit the completed form to the New York State Department of Taxation and Finance by the original due date of your return.

Legal Use of the New York Extension

The New York extension is legally recognized and provides taxpayers with a legitimate means to defer their filing deadlines. To ensure compliance, it is crucial to follow the specific guidelines set forth by the New York State Department of Taxation and Finance. This includes filing the extension request on time and adhering to any payment requirements to avoid penalties.

Required Documents for the New York Extension

When applying for the New York extension, certain documents are necessary to support your request:

- Your completed extension form (IT-370 or CT-5).

- Any documentation related to estimated tax payments made.

- Supporting financial statements if applicable, to substantiate your tax liability estimate.

Filing Deadlines for the New York Extension

It is important to be aware of the filing deadlines associated with the New York extension. The extension request must be submitted by the original due date of your tax return. For most individual taxpayers, this is typically April fifteenth. Corporations may have different deadlines based on their fiscal year. Failure to file by these deadlines may result in penalties.

Examples of Using the New York Extension

The New York extension can be beneficial in various scenarios:

- A self-employed individual may require additional time to gather income and expense documentation.

- A corporation may need to finalize its financial statements before filing its tax return.

- Taxpayers facing unexpected life events, such as illness or family emergencies, may find the extension useful for managing their tax obligations without stress.

Quick guide on how to complete new york extension

Complete New York Extension seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage New York Extension on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign New York Extension effortlessly

- Locate New York Extension and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Identify important parts of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method for submitting your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign New York Extension and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New York lien form?

A New York lien form is a legal document used to establish a claim against a property in New York. This document ensures that creditors receive payment by placing a lien on the property until the debt is settled. Understanding how to properly complete and file a New York lien form is crucial for protecting your interests.

-

How can airSlate SignNow help with New York lien forms?

AirSlate SignNow simplifies the process of creating and eSigning New York lien forms. With our platform, you can easily draft, customize, and send lien forms securely online. This streamlines your workflow, saves time, and reduces the stress associated with lien documentation.

-

What features does airSlate SignNow offer for handling New York lien forms?

AirSlate SignNow offers numerous features for managing New York lien forms, including custom templates, secure eSigning, and automated workflows. Our platform ensures that all your documents are compliant with New York state regulations, making it easier than ever to handle liens efficiently.

-

Is there a cost associated with using airSlate SignNow for New York lien forms?

Yes, while airSlate SignNow offers various pricing plans, the costs are designed to be cost-effective and cater to businesses of all sizes. You can choose a plan that allows unlimited access to tools necessary for managing New York lien forms without breaking the bank.

-

Can I integrate airSlate SignNow with other applications to manage New York lien forms?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, such as CRM systems and document management tools. This helps you manage your New York lien forms more effectively while maintaining a cohesive workflow across your business operations.

-

What are the benefits of using airSlate SignNow for New York lien forms?

Using airSlate SignNow for New York lien forms offers several benefits, such as increased efficiency, reduced paperwork, and enhanced security. Our intuitive platform provides tracking and confirmation of document delivery, ensuring that your lien forms are handled with precision and care.

-

How secure is airSlate SignNow when handling New York lien forms?

AirSlate SignNow prioritizes the security of your documents. We utilize cutting-edge encryption and robust security measures to protect all your New York lien forms throughout the signing process. You can rest assured that your sensitive information is safe with us.

Get more for New York Extension

- Www ociservices comwp contentuploadsgreat western final expense insurance oci services form

- Tracer request form

- Credit application 516733477 form

- Allstate wellness claim form 37530580

- Form 30 445255627

- Mental health provider template excellus bcbs form

- Penn mutual forms

- Occipital nerve blocks for acute treatment of pediatric migraine form

Find out other New York Extension

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement