Form 8865 Schedule K 1 Partner's Share of Income, Deductions, Credits, Etc

What is the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc

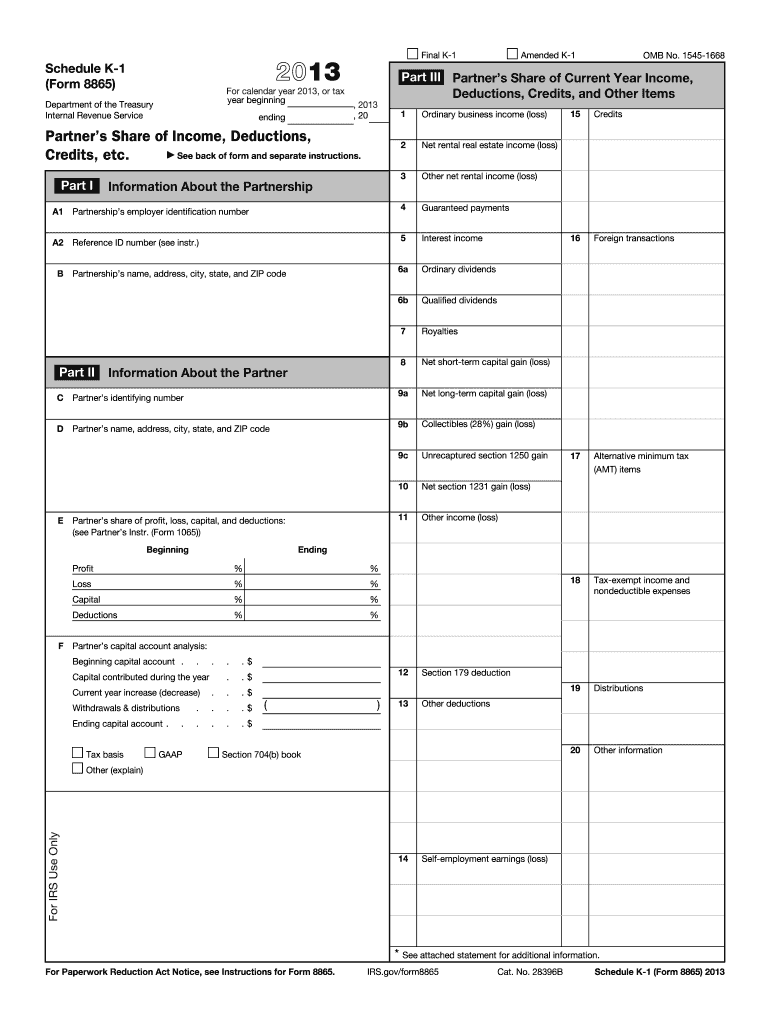

The Form 8865 Schedule K-1 is a critical document for partners in a partnership or multi-member LLC. It details each partner's share of the entity's income, deductions, credits, and other tax-related items. This form is essential for reporting income accurately on individual tax returns. Each partner receives a copy of the Schedule K-1, which they must include when filing their personal tax returns. The information provided helps the IRS track income distribution among partners and ensures compliance with tax obligations.

Steps to Complete the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc

Completing the Form 8865 Schedule K-1 involves several important steps. First, gather all relevant financial information from the partnership, including income statements, expense reports, and any applicable deductions. Next, accurately fill in the partner's identifying information, including name, address, and taxpayer identification number. Then, report the partner's share of income, deductions, and credits as provided by the partnership. It is vital to ensure that all figures are correct to avoid discrepancies with the IRS. Finally, review the completed form for accuracy before distributing it to the partners.

How to Obtain the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc

The Form 8865 Schedule K-1 can be obtained through the IRS website or directly from the partnership. Partnerships are responsible for preparing and distributing the Schedule K-1 to each partner. If you are a partner and have not received your copy, it is advisable to contact the partnership directly. Additionally, partners can access the form from tax preparation software that supports IRS forms, ensuring they have the most current version for their filings.

IRS Guidelines for the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc

The IRS provides specific guidelines for completing and filing the Form 8865 Schedule K-1. These guidelines outline the necessary information to include, the deadlines for submission, and the penalties for non-compliance. It is essential for partners to familiarize themselves with these guidelines to ensure accurate reporting. The IRS also emphasizes the importance of maintaining proper records to support the information reported on the Schedule K-1, which can be crucial in case of an audit.

Filing Deadlines / Important Dates for the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc

Filing deadlines for the Form 8865 Schedule K-1 are closely tied to the partnership's tax return due date. Typically, partnerships must file their tax returns by the fifteenth day of the third month following the end of their tax year. Partners should receive their Schedule K-1s in time to incorporate the information into their personal tax returns, which are generally due on April fifteenth. It is crucial for partners to be aware of these deadlines to avoid penalties and ensure timely compliance with tax obligations.

Penalties for Non-Compliance with the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc

Failure to comply with the requirements for the Form 8865 Schedule K-1 can result in significant penalties. The IRS may impose fines for late filing or inaccuracies in the reported information. Additionally, partners who do not report their income as indicated on the Schedule K-1 may face further penalties, including interest on unpaid taxes. It is essential for partners to ensure that they receive and accurately report their Schedule K-1 information to avoid these potential consequences.

Quick guide on how to complete 2013 form 8865 schedule k 1 partners share of income deductions credits etc

Complete Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc effortlessly on any apparatus

Digital document management has become popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest method to alter and eSign Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc with ease

- Obtain Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 8865 schedule k 1 partners share of income deductions credits etc

How to generate an electronic signature for your 2013 Form 8865 Schedule K 1 Partners Share Of Income Deductions Credits Etc online

How to create an eSignature for the 2013 Form 8865 Schedule K 1 Partners Share Of Income Deductions Credits Etc in Google Chrome

How to make an electronic signature for signing the 2013 Form 8865 Schedule K 1 Partners Share Of Income Deductions Credits Etc in Gmail

How to create an electronic signature for the 2013 Form 8865 Schedule K 1 Partners Share Of Income Deductions Credits Etc straight from your smart phone

How to create an eSignature for the 2013 Form 8865 Schedule K 1 Partners Share Of Income Deductions Credits Etc on iOS devices

How to create an eSignature for the 2013 Form 8865 Schedule K 1 Partners Share Of Income Deductions Credits Etc on Android

People also ask

-

What is the 8865 form and why do I need it?

The 8865 form is used by U.S. taxpayers to report income, gains, losses, deductions, and credits from foreign partnerships. If you are a partner in a foreign partnership, filing the 8865 form is crucial for compliance with IRS regulations and avoiding penalties.

-

How does airSlate SignNow help with the 8865 form?

airSlate SignNow simplifies the process of completing and signing your 8865 form electronically. With our intuitive platform, you can manage all your eSigning tasks seamlessly, ensuring that your documents are completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the 8865 form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost depends on the features you choose, but we ensure that our solution remains cost-effective, especially for managing documents like the 8865 form.

-

What features does airSlate SignNow offer for managing the 8865 form?

Our platform provides several features specifically designed to assist with the 8865 form, including document templates, secure eSigning, and tracking capabilities. These features help streamline the completion and filing process, ensuring you stay organized and compliant.

-

Can I integrate airSlate SignNow with my accounting software for the 8865 form?

Absolutely! airSlate SignNow offers integrations with various accounting software solutions. This allows you to seamlessly manage your 8865 form within your existing workflows, making the filing process more efficient and less time-consuming.

-

What are the benefits of using airSlate SignNow for the 8865 form?

Using airSlate SignNow for your 8865 form ensures a faster and clearer documentation process. Our platform offers secure storage, easy access to templates, and the ability to collaborate with partners effortlessly, enhancing overall efficiency.

-

How secure is my data when using airSlate SignNow for the 8865 form?

Your data security is our top priority at airSlate SignNow. We employ advanced encryption protocols and compliance measures to protect your sensitive information while you manage your 8865 form online.

Get more for Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc

Find out other Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document