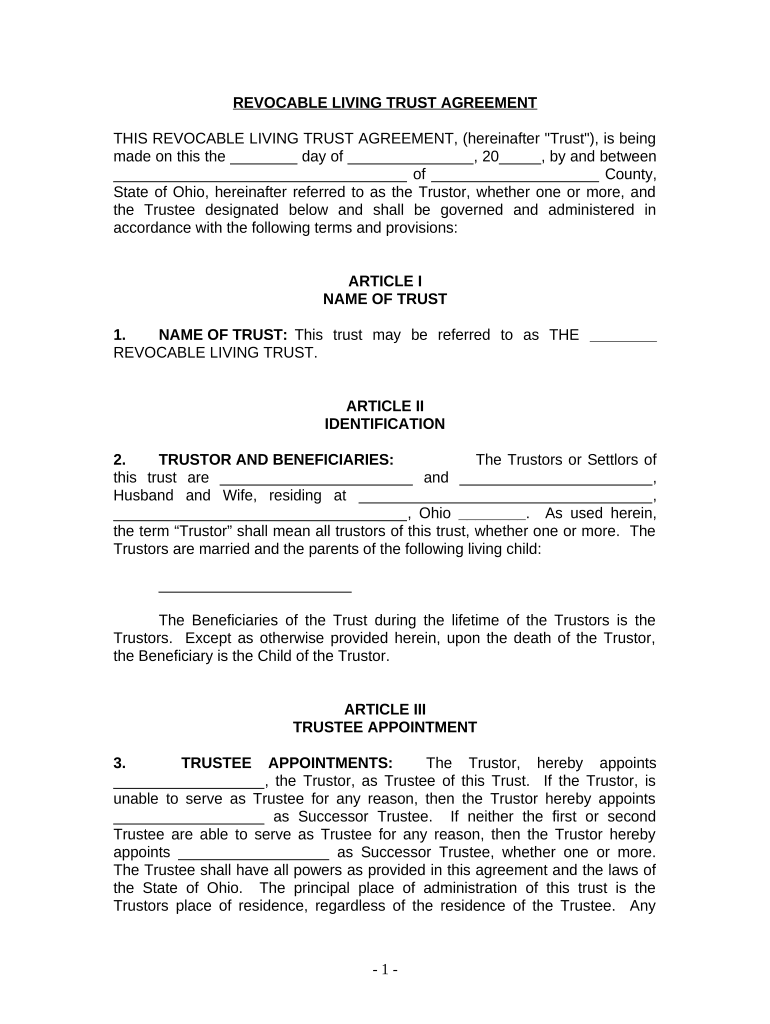

Living Trust for Husband and Wife with One Child Ohio Form

What is the Living Trust For Husband And Wife With One Child Ohio

A living trust for husband and wife with one child in Ohio is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed upon their passing. This type of trust can help avoid probate, ensuring a smoother transition of assets to the surviving spouse and child. It typically includes provisions for both spouses, allowing them to act as co-trustees, and can be modified or revoked as needed. Establishing this trust provides clarity and security regarding family assets and their management.

How to Use the Living Trust For Husband And Wife With One Child Ohio

Using a living trust for husband and wife with one child in Ohio involves several steps. First, both spouses must decide on the assets to be included in the trust. This may include real estate, bank accounts, investments, and personal property. Next, they need to draft the trust document, which outlines the terms of the trust and the roles of the trustees. Once the document is prepared, it should be signed and notarized to ensure its legal validity. Finally, transferring the assets into the trust is crucial, as this step ensures that the trust operates effectively and that the assets are managed according to the trust's terms.

Steps to Complete the Living Trust For Husband And Wife With One Child Ohio

Completing a living trust for husband and wife with one child in Ohio involves a series of organized steps:

- Identify and list all assets to be included in the trust.

- Draft the trust document, detailing the terms and conditions.

- Sign the document in the presence of a notary public.

- Transfer ownership of the identified assets into the trust.

- Review and update the trust periodically to reflect any changes in circumstances.

Key Elements of the Living Trust For Husband And Wife With One Child Ohio

Key elements of a living trust for husband and wife with one child in Ohio typically include:

- Trustees: Usually, both spouses serve as co-trustees, managing the trust during their lifetime.

- Beneficiaries: The couple's child is often named as the primary beneficiary, receiving assets upon the death of both parents.

- Revocation Clause: This allows the trust to be modified or revoked if circumstances change.

- Distribution Instructions: Clear guidelines on how and when assets will be distributed to the beneficiaries.

State-Specific Rules for the Living Trust For Husband And Wife With One Child Ohio

Ohio has specific rules governing living trusts. For instance, the trust must be established in writing and signed by the grantors. Additionally, Ohio law requires that the trust document clearly outline the terms of the trust, including the powers granted to the trustees. It is also essential to ensure that the trust complies with state laws regarding asset transfer and management. Consulting with a legal professional familiar with Ohio estate planning laws can help ensure compliance and proper execution of the trust.

Legal Use of the Living Trust For Husband And Wife With One Child Ohio

The legal use of a living trust for husband and wife with one child in Ohio provides several advantages. It allows for the seamless transfer of assets without going through probate, which can be time-consuming and costly. The trust remains effective during the lifetime of the grantors, ensuring that asset management is straightforward. Additionally, the trust can provide instructions for the care of minor children, should both parents pass away. Legal recognition of the trust ensures that its terms are enforceable in court, offering peace of mind to the grantors and beneficiaries.

Quick guide on how to complete living trust for husband and wife with one child ohio

Effortlessly Prepare Living Trust For Husband And Wife With One Child Ohio on Any Device

Digital document management has become increasingly popular among enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents promptly without delays. Manage Living Trust For Husband And Wife With One Child Ohio on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

The Easiest Way to Modify and eSign Living Trust For Husband And Wife With One Child Ohio Stress-Free

- Obtain Living Trust For Husband And Wife With One Child Ohio and select Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that require reprinting entire copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Modify and eSign Living Trust For Husband And Wife With One Child Ohio and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child Ohio?

A Living Trust For Husband And Wife With One Child Ohio is a legal arrangement that allows couples to manage their assets during their lifetime and specify how their property is distributed upon death. This trust helps avoid probate, provides privacy, and can offer flexibility in asset management. It’s an ideal solution for couples wishing to ensure their child is taken care of after they're gone.

-

What are the benefits of setting up a Living Trust For Husband And Wife With One Child Ohio?

Creating a Living Trust For Husband And Wife With One Child Ohio provides signNow advantages, including minimizing estate taxes, ensuring smooth asset transfer upon death, and avoiding the lengthy probate process. Additionally, it allows for continued management of assets if one spouse becomes incapacitated. This trust ultimately provides peace of mind for families.

-

How much does it cost to establish a Living Trust For Husband And Wife With One Child Ohio?

The cost of setting up a Living Trust For Husband And Wife With One Child Ohio varies depending on several factors, including legal fees and the complexity of your estate. Generally, you can expect to pay anywhere from a few hundred to a couple of thousand dollars. Investing in this trust can save money in the long run by avoiding probate costs.

-

Can I change my Living Trust For Husband And Wife With One Child Ohio after it’s created?

Yes, one of the key features of a Living Trust For Husband And Wife With One Child Ohio is that it can be altered or revoked at any time while both spouses are alive. If your situation changes, such as a divorce or the birth of another child, you can update the trust accordingly. This flexibility makes a Living Trust a practical choice for many couples.

-

What assets can be included in a Living Trust For Husband And Wife With One Child Ohio?

A Living Trust For Husband And Wife With One Child Ohio can include various assets, such as real estate, bank accounts, investments, and personal property. It’s essential to fund your trust properly to ensure that all desired assets are managed under the trust framework. This ensures a seamless transition of your assets to your child.

-

Do I need an attorney to create a Living Trust For Husband And Wife With One Child Ohio?

While it is possible to create a Living Trust For Husband And Wife With One Child Ohio without an attorney, it's highly advisable to consult one to navigate the complexities of trust law. An attorney can ensure the trust complies with Ohio laws and meets your specific needs. This professional guidance can save you time and potential legal issues in the future.

-

How does a Living Trust For Husband And Wife With One Child Ohio differ from a will?

A Living Trust For Husband And Wife With One Child Ohio differs from a will in that it is effective during your lifetime and avoids probate upon death, providing a quicker transfer of assets. A will, on the other hand, only takes effect after death and must go through probate, which can be time-consuming and public. Trusts offer greater privacy and control over asset distribution.

Get more for Living Trust For Husband And Wife With One Child Ohio

Find out other Living Trust For Husband And Wife With One Child Ohio

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast