Paychex Dependent Care Reimbursement Form 2012-2026

What is the Paychex Dependent Care Reimbursement Form

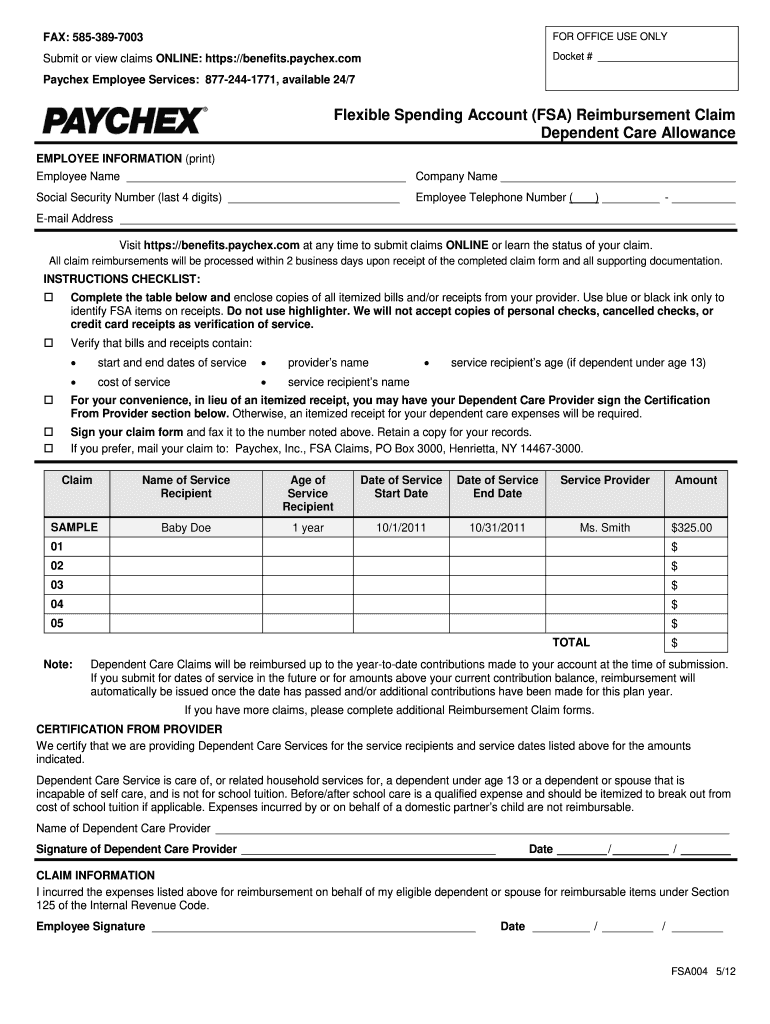

The Paychex Dependent Care Reimbursement Form is a document used by employees to request reimbursement for eligible dependent care expenses. This form is particularly useful for parents or guardians who incur costs for child care or care for dependents while they work or look for work. By submitting this form, employees can receive financial relief for expenses that qualify under the dependent care assistance program.

How to use the Paychex Dependent Care Reimbursement Form

Using the Paychex Dependent Care Reimbursement Form involves several steps. First, gather all relevant information regarding the dependent care expenses you wish to claim. This includes receipts and documentation that verify the services provided. Next, complete the form by accurately filling out all required fields, including your personal information and details about the care provider. After completing the form, submit it through the designated method, whether online, by mail, or in person, to ensure timely processing of your reimbursement request.

Steps to complete the Paychex Dependent Care Reimbursement Form

Completing the Paychex Dependent Care Reimbursement Form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including receipts and provider information.

- Fill out your personal details, including your name, address, and employee identification number.

- List the names and ages of the dependents for whom care was provided.

- Detail the type of care received and the corresponding costs.

- Sign and date the form to certify that the information is accurate.

Legal use of the Paychex Dependent Care Reimbursement Form

The Paychex Dependent Care Reimbursement Form is designed for legal use under the Internal Revenue Code, specifically regarding dependent care benefits. Employees must ensure that the expenses claimed meet the IRS guidelines for qualifying dependent care costs. This includes care for children under the age of thirteen or for dependents who are physically or mentally incapable of self-care. Proper documentation and adherence to the legal requirements are essential to avoid penalties or denial of claims.

Eligibility Criteria

To be eligible to use the Paychex Dependent Care Reimbursement Form, employees must meet specific criteria. Generally, this includes being an active employee of a company that offers a dependent care assistance program. Additionally, the care must be provided for a qualifying dependent, such as a child under thirteen or an adult dependent who requires care. Employees should also ensure that their income falls within the limits set by the IRS for claiming dependent care benefits.

Required Documents

When submitting the Paychex Dependent Care Reimbursement Form, certain documents are required to support your claim. These typically include:

- Receipts or invoices from the care provider detailing the services rendered.

- The provider's tax identification number or Social Security number.

- Proof of employment, if requested by the employer's benefits department.

Quick guide on how to complete monthly dependent care claim form page one intranet

The simplest method to obtain and sign Paychex Dependent Care Reimbursement Form

On a corporate scale, ineffective procedures concerning document approval can consume a signNow amount of working time. Signing documents like Paychex Dependent Care Reimbursement Form is an inherent aspect of operations across all sectors, which is why the efficiency of each agreement’s lifecycle greatly impacts the overall productivity of the company. With airSlate SignNow, signing your Paychex Dependent Care Reimbursement Form is as simple and swift as possible. This platform provides you with the latest version of nearly any document. Even better, you can sign it immediately without needing to install third-party applications on your computer or printing any physical copies.

Steps to obtain and sign your Paychex Dependent Care Reimbursement Form

- Browse our library by category or utilize the search bar to locate the document you require.

- Check the document preview by clicking Learn more to confirm it is the correct one.

- Click Get form to start editing right away.

- Fill out your document and incorporate any necessary information using the toolbar.

- When finished, click the Sign feature to sign your Paychex Dependent Care Reimbursement Form.

- Select the signing method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documents efficiently. You can find, fill out, edit, and even send your Paychex Dependent Care Reimbursement Form all within a single tab effortlessly. Enhance your workflows with one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Is it legal for a doctor to charge fifty dollars to fill out the one page ca20 form workers comp requires?

Almost certainly. This is not covered under the costs of medical care. If it takes him only 10 minutes to do so that physician is being underpaid. If it is 5 minutes it might be close. Doctor’s time is expensive because of high overhead. The front desk person, the nurse, the building, the utilities, the malpractice insurance. Most physicians have overhead of over $200 an hour.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

I can't figure out if I should claim 1 dependent or 2 dependents on my W-4 tax form. When and how do you make changes to your W-4 tax form after having children?

OK, first off I’m going to say *IGNORE* the instructions on the updated W-4 form. It’s not worth anything. And yes, I’ve seen and followed the directions, which are wildly inaccurate and misleading.Here’s how exemptions and the W-4 work.As of last year, per the Tax Cuts and Job Act, you can NO LONGER, claim yourself as a dependent/exemption. You can, if you are married, no longer claim your spouse as a dependent/exemption.IF you have minor children (Age 19 and under) you *MAY* claim one exemption per child. IF you have a child, enrolled ‘full time in school’ who is age 24 or under, and that schooling is College, Trade School, Vo-Tech, etc and NOT primary education (IE High School education, GED classes, etc) you may claim an exemption for them.So simple example. Jack and Jane Darling are married. They have one child born June 1st.From January to June, Jack and Jane can *ONLY* claim ZERO EXEMPTIONS on their W-4. From June 1st, when the child is born, on wards, they can each claim ONE Exemption on their W-4.Hopefully that helps and simplifies it down. And yes, I’m a tax preparer as well. I spent all of last year warning various clients and I’m doing the same this year, along with explaining how many you can *legally* claim on your W-4.

-

If one is employed to a company, why does one have to fill in a Tax form when taxation is taken out of one's pay cheque automatically every month?

TAX EVASION IS ILLEGAL, TAX AVOIDANCE IS NOT!!!!!!IRS's game IRS's rules. Get a good Personal Tax Practitioner who is available year round that you trust, so when making financial decisions you can call and see how it will effect you tax wise and know the best way to implement it.Income tax reporting is voluntary. The IRS years ago felt that the American people as a whole were not being as forth coming as they should with income information. At this point IRS changed the rules by pitting the burden of proof on employers to report how much money they paid to each employee. This also helped IRS to balance businesses deductions against the populations income reporting. W-2's, 1099, a, b, c, misc, 1098 etc. is IRS's way of getting advanced information on the major things that happen to everyone in regards moneys earned and paid that effect personal & business taxes. Taxes withheld are only a percentage of your income and may not necessarily match the amount of taxes owed.Never for get that while the government is the government it is still a business that has to make money to operate. It forecast its earnings each year based on average working age and salaries of the population.Did you ever ask yourself why it is a IRS rule that taxes have to be filed within 3 years of the due date? IRS pays 6% simple interest on any refund held in their possession after the end of the filing season for that year. Years ago people who knew they had a refund just would not file for years, thus costing the IRS a lot of money when they did file. Now if you do not file within the 3 year time limit and you have a refund, guess who gets it? Yes, the IRS gets it. They confiscate your money for not doing something that they tell you is voluntary in the first place.The key thing to remember in reporting taxes is 1. Are your earnings below the reporting line? (yes) then 2. Were any taxes withheld federal or state? (Yes). Then file all w-2's to insure you get refunded all of the taxes that were withheld.If (No) to the same questions above no need to file IRS will have the same information and know you were below the filing requirement.

Create this form in 5 minutes!

How to create an eSignature for the monthly dependent care claim form page one intranet

How to generate an electronic signature for the Monthly Dependent Care Claim Form Page One Intranet in the online mode

How to make an eSignature for the Monthly Dependent Care Claim Form Page One Intranet in Chrome

How to create an electronic signature for putting it on the Monthly Dependent Care Claim Form Page One Intranet in Gmail

How to make an eSignature for the Monthly Dependent Care Claim Form Page One Intranet right from your mobile device

How to generate an electronic signature for the Monthly Dependent Care Claim Form Page One Intranet on iOS

How to make an eSignature for the Monthly Dependent Care Claim Form Page One Intranet on Android

People also ask

-

What is the monthly claim intranet and how does it work?

The monthly claim intranet is a centralized platform that simplifies the process of submitting and managing claims on a monthly basis. With airSlate SignNow, users can quickly generate, send, and eSign documents related to their claims, ensuring compliance and reducing errors. This user-friendly interface allows businesses to streamline their claims process efficiently.

-

How can the monthly claim intranet benefit my business?

Using the monthly claim intranet can signNowly enhance your business’s operational efficiency by automating document workflows and minimizing manual errors. airSlate SignNow ensures that all claim-related documents are processed swiftly, improving turnaround times. Ultimately, this leads to happier employees and satisfied clients, as claims can be resolved faster.

-

What features does the monthly claim intranet offer?

The monthly claim intranet offers a range of features including customizable document templates, eSignature capabilities, and automated reminders for claim submissions. Additionally, it supports real-time tracking of document status which allows businesses to stay updated on their claims. These features are designed to make the claim process as seamless and efficient as possible.

-

Is the monthly claim intranet easy to integrate with existing systems?

Yes, the monthly claim intranet is designed for easy integration with various business systems and tools you may already use. airSlate SignNow offers APIs and connectors that allow for smooth connectivity with your current software solutions. This flexibility helps ensure a quick and hassle-free implementation of your new claims process.

-

What is the pricing structure for the monthly claim intranet?

airSlate SignNow offers competitive pricing options for the monthly claim intranet, tailored to suit businesses of all sizes. The cost generally depends on the number of users and the features selected, providing flexibility for organizations to scale as needed. To find the best fit for your business, you can explore the different plans on our pricing page.

-

Can I customize documents in the monthly claim intranet?

Absolutely! The monthly claim intranet allows users to create and customize documents according to their specific needs. Features such as drag-and-drop document editing make it easy to adapt templates for individual claims, ensuring that all necessary information is captured efficiently. This customization elevates the overall user experience.

-

Is training required to use the monthly claim intranet?

While airSlate SignNow is designed to be intuitive and user-friendly, some basic training can help maximize its potential. We offer comprehensive resources, including tutorials and support, to help you and your team navigate the monthly claim intranet effectively. This approach ensures that everyone can utilize the platform efficiently right from the start.

Get more for Paychex Dependent Care Reimbursement Form

- Living trust florida form

- Living trust for individual who is single divorced or widow or widower with no children florida form

- Living trust for individual who is single divorced or widow or widower with children florida form

- Living trust for husband and wife with one child florida form

- Living trust for husband and wife with minor and or adult children florida form

- Amendment to living trust florida form

- Fl living trust form

- Financial account transfer to living trust florida form

Find out other Paychex Dependent Care Reimbursement Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document