Contractor Significant Incident Report CSIR 1 Form

What is the Contractor Significant Incident Report CSIR 1

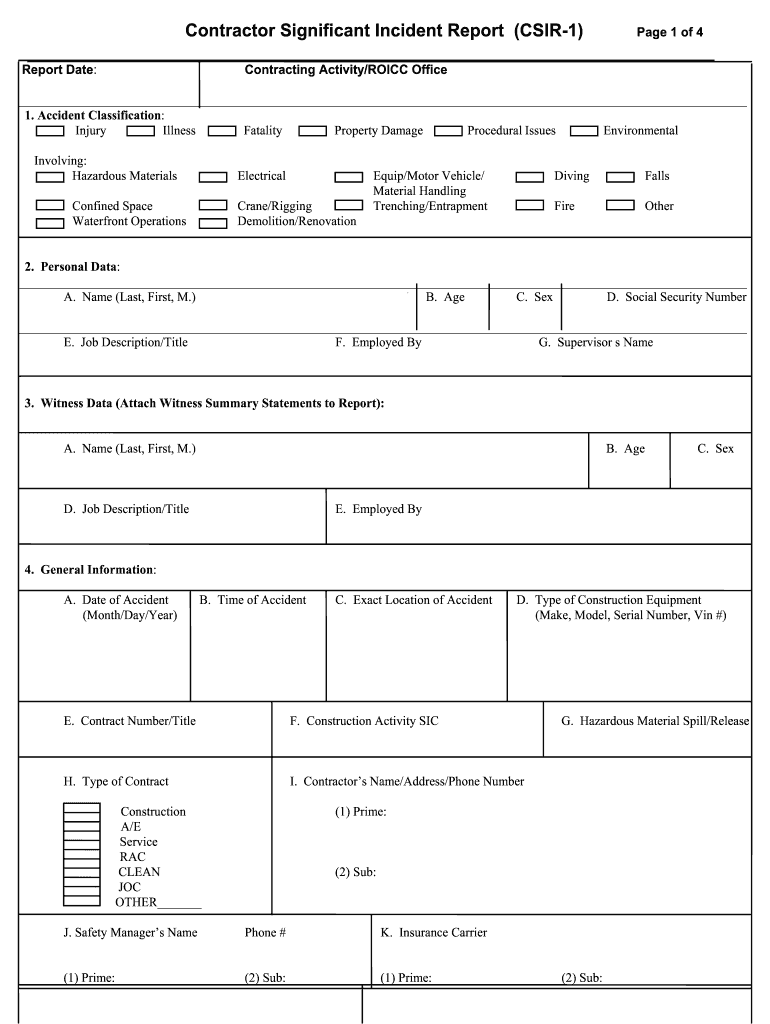

The Contractor Significant Incident Report CSIR 1 is a formal document used to report significant incidents that occur within a contractor's operations. This report is essential for documenting workplace events that may have legal or safety implications. It serves as a record for compliance, investigation, and future prevention of similar incidents. The CSIR 1 is designed to capture critical details about the incident, including the date, time, location, individuals involved, and a description of the event.

How to use the Contractor Significant Incident Report CSIR 1

Using the Contractor Significant Incident Report CSIR 1 involves several straightforward steps. First, ensure that you have the correct template, which can be filled out digitally or printed for manual completion. Gather all relevant information about the incident, including witness statements, photographs, and any other supporting documentation. Complete the report by filling in each section accurately, ensuring that all required fields are addressed. Once completed, the report should be reviewed for accuracy and signed by the appropriate parties to validate the information provided.

Steps to complete the Contractor Significant Incident Report CSIR 1

Completing the Contractor Significant Incident Report CSIR 1 requires careful attention to detail. Follow these steps:

- Begin by entering the date and time of the incident.

- Provide the location where the incident occurred.

- List all individuals involved, including witnesses.

- Describe the incident in detail, focusing on what happened, how it occurred, and any immediate actions taken.

- Include any relevant photographs or documents as attachments.

- Review the completed report for accuracy and completeness.

- Sign and date the report to certify its validity.

Key elements of the Contractor Significant Incident Report CSIR 1

The Contractor Significant Incident Report CSIR 1 includes several key elements that are crucial for effective documentation. These elements typically consist of:

- Date and Time: When the incident occurred.

- Location: Where the incident took place.

- Individuals Involved: Names and roles of those involved in the incident.

- Description of the Incident: A detailed account of what transpired.

- Immediate Actions Taken: Steps taken in response to the incident.

- Follow-Up Actions Required: Recommendations for further action or investigation.

Legal use of the Contractor Significant Incident Report CSIR 1

The Contractor Significant Incident Report CSIR 1 is not only a tool for internal reporting but also serves a legal purpose. It can be used as evidence in investigations related to workplace safety, liability claims, or regulatory compliance. Properly completed reports can demonstrate a contractor's commitment to safety and adherence to industry regulations. It is essential to ensure that the report is filled out accurately and truthfully to maintain its legal integrity.

Examples of using the Contractor Significant Incident Report CSIR 1

There are various scenarios in which the Contractor Significant Incident Report CSIR 1 may be utilized. For instance, if a worker sustains an injury on a construction site, the report can document the circumstances leading to the incident, the nature of the injury, and the immediate response. Similarly, if equipment malfunctions lead to a near-miss incident, the CSIR 1 can be used to analyze the event and implement preventive measures. Each report contributes to a safer work environment by identifying risks and promoting accountability.

Quick guide on how to complete contractor significant incident report csir 1

The optimal method to locate and approve Contractor Significant Incident Report CSIR 1

On the scale of your whole organization, ineffective procedures concerning paper authorizations can consume a signNow amount of work hours. Signing documents such as Contractor Significant Incident Report CSIR 1 is a customary aspect of operations across various sectors, which is why the effectiveness of each agreement's lifecycle signNowly impacts the overall performance of the business. With airSlate SignNow, endorsing your Contractor Significant Incident Report CSIR 1 is as straightforward and swift as possible. This platform provides you with the most recent version of almost any form. Even better, you can sign it immediately without needing to install any external software on your computer or print hard copies.

Steps to obtain and sign your Contractor Significant Incident Report CSIR 1

- Explore our library by category or use the search option to find the form you require.

- Check the form preview by clicking on Learn more to confirm it is the correct one.

- Click Get form to begin editing instantly.

- Fill out your form and input any necessary data using the toolbar.

- Once finished, select the Sign tool to endorse your Contractor Significant Incident Report CSIR 1.

- Choose the signing method that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as needed.

With airSlate SignNow, you have everything required to handle your documents effectively. You can locate, complete, modify, and even dispatch your Contractor Significant Incident Report CSIR 1 within a single tab without any trouble. Enhance your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the contractor significant incident report csir 1

How to create an eSignature for the Contractor Significant Incident Report Csir 1 in the online mode

How to generate an electronic signature for your Contractor Significant Incident Report Csir 1 in Chrome

How to create an eSignature for putting it on the Contractor Significant Incident Report Csir 1 in Gmail

How to create an eSignature for the Contractor Significant Incident Report Csir 1 from your smartphone

How to generate an eSignature for the Contractor Significant Incident Report Csir 1 on iOS devices

How to create an electronic signature for the Contractor Significant Incident Report Csir 1 on Android OS

People also ask

-

What is the incident report csir template provided by airSlate SignNow?

The incident report csir template from airSlate SignNow is a customizable document designed to help businesses efficiently document and manage incidents. It streamlines the reporting process, ensuring that all necessary information is captured clearly and accurately. This template can be easily edited to fit specific organizational requirements.

-

How can I use the incident report csir template effectively?

To use the incident report csir template effectively, simply download the template from airSlate SignNow, fill in the relevant details, and eSign it for approval. You can customize the template fields to include any specific data points required by your organization. Utilizing this template can enhance your incident documentation process signNowly.

-

What are the benefits of using the incident report csir template?

The benefits of using the incident report csir template include improved compliance with reporting standards, streamlined data collection, and enhanced communication among team members. It minimizes errors and reduces the time spent on manual documentation. Furthermore, utilizing our eSignature feature allows for quick approvals and record keeping.

-

Is the incident report csir template customizable?

Yes, the incident report csir template is fully customizable to meet your organization's specific needs. You can edit fields, add your company's branding, and adjust the layout as required. This flexibility ensures that it aligns with your internal reporting and documentation practices.

-

What features does airSlate SignNow offer along with the incident report csir template?

Along with the incident report csir template, airSlate SignNow offers features such as electronic signatures, document tracking, and secure cloud storage. These features enhance document management processes and provide a seamless experience when handling incident reports. Integration with popular tools adds further convenience.

-

Are there any costs involved in using the incident report csir template?

While the incident report csir template is available for use, airSlate SignNow operates on a subscription model that may involve costs depending on the features you choose. There are various pricing plans available, ensuring you can select an option that fits your budget and reporting needs. Check our website for detailed pricing information.

-

Can I integrate other tools with the incident report csir template?

Yes, airSlate SignNow allows integration with numerous third-party applications, making it easy to enhance your incident reporting process. You can connect tools such as CRM systems, project management software, and other productivity apps. These integrations help centralize data and improve workflow efficiency.

Get more for Contractor Significant Incident Report CSIR 1

Find out other Contractor Significant Incident Report CSIR 1

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple