Oklahoma Calculation Garnishment Form

What is the Oklahoma Calculation Garnishment

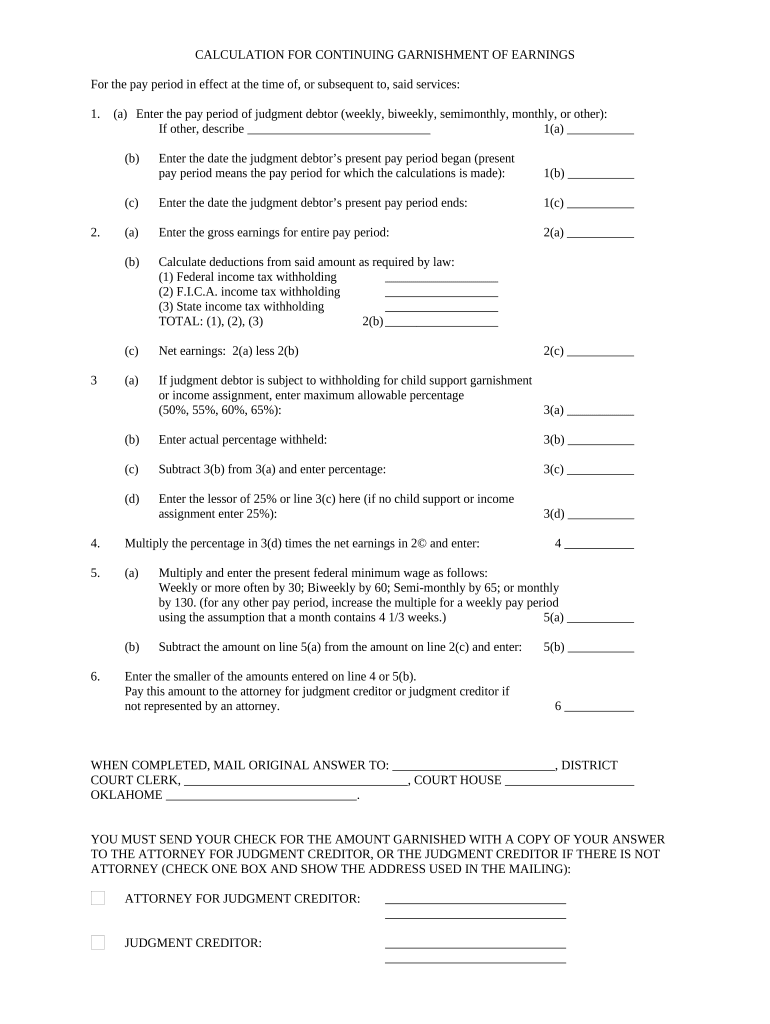

The Oklahoma calculation garnishment is a legal process that allows creditors to collect debts directly from a debtor's wages or bank accounts. This form is specifically designed for use in the state of Oklahoma and outlines the necessary calculations to determine the amount that can be garnished from an individual's earnings. Understanding this process is essential for both creditors seeking to recover funds and debtors who need to be aware of their rights and obligations under state law.

Steps to complete the Oklahoma Calculation Garnishment

Completing the Oklahoma calculation garnishment involves several key steps:

- Gather necessary financial information, including income details and any existing debts.

- Fill out the calculation garnishment form accurately, ensuring all required fields are completed.

- Calculate the allowable garnishment amount based on Oklahoma state guidelines, which typically consider disposable income.

- Submit the completed form to the appropriate court or agency, following any specific submission guidelines.

- Keep copies of all submitted documents for your records.

Legal use of the Oklahoma Calculation Garnishment

The legal use of the Oklahoma calculation garnishment is governed by state laws that dictate how and when garnishments can be enforced. Creditors must adhere to these regulations to ensure that the garnishment is valid. This includes following proper procedures for notifying the debtor and obtaining court approval before initiating the garnishment process. Understanding these legal requirements helps both creditors and debtors navigate the garnishment process effectively.

Key elements of the Oklahoma Calculation Garnishment

Several key elements are essential for the Oklahoma calculation garnishment:

- Debtor Information: Accurate details about the debtor, including name, address, and Social Security number.

- Creditor Information: Information about the creditor seeking the garnishment, including contact details.

- Income Details: A breakdown of the debtor's income, including wages, bonuses, and any other sources of income.

- Calculation Method: A clear explanation of how the garnishment amount is calculated based on state guidelines.

How to obtain the Oklahoma Calculation Garnishment

To obtain the Oklahoma calculation garnishment form, you can visit the official state court website or contact your local court clerk's office. The form may also be available through legal aid organizations or online legal resources. Ensure that you have the most current version of the form to avoid any issues during the submission process.

Form Submission Methods

The Oklahoma calculation garnishment form can typically be submitted through various methods:

- Online: Some courts may offer an online submission option through their official websites.

- Mail: You can send the completed form via postal mail to the appropriate court.

- In-Person: Submitting the form in person at the local court can provide immediate confirmation of receipt.

Quick guide on how to complete oklahoma calculation garnishment

Effortlessly Prepare Oklahoma Calculation Garnishment on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without hindrance. Manage Oklahoma Calculation Garnishment from any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Oklahoma Calculation Garnishment with Ease

- Find Oklahoma Calculation Garnishment and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new paper copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Oklahoma Calculation Garnishment and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Oklahoma continuing garnishment?

Oklahoma continuing garnishment is a legal process that enables creditors to collect debts from a debtor's wages until the debt is fully paid. This process requires a court order and provides a structured way for creditors to secure payments. Understanding this process is crucial for both creditors and debtors to navigate their obligations properly.

-

How can airSlate SignNow help with Oklahoma continuing garnishment documents?

airSlate SignNow simplifies the creation and signing of necessary legal documents related to Oklahoma continuing garnishment. With our user-friendly interface, you can quickly draft, send, and eSign documents securely. This ensures that your garnishment processes are efficient and compliant with state laws.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our plans are designed to provide you with the features you need to efficiently manage Oklahoma continuing garnishment documents without breaking the bank. Review our pricing page to find the best plan that fits your needs.

-

Are there any specific features for managing garnishment processes in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed to enhance the management of garnishment processes, including templates, automated workflows, and real-time tracking. These features allow users to efficiently handle Oklahoma continuing garnishment documents through a streamlined system, reducing potential errors and saving time.

-

Is airSlate SignNow compliant with Oklahoma garnishment laws?

Absolutely! airSlate SignNow is committed to compliance with all relevant laws, including those governing Oklahoma continuing garnishment. We ensure that our templates and processes adhere to state regulations, giving you peace of mind as you manage your legal documents.

-

Can I integrate airSlate SignNow with other tools for better garnishment management?

Yes, airSlate SignNow seamlessly integrates with a variety of business tools and software to enhance your overall garnishment management. These integrations help you maintain a cohesive workflow that simplifies tracking and processing of Oklahoma continuing garnishment tasks efficiently.

-

What benefits does airSlate SignNow provide for businesses dealing with garnishments?

Using airSlate SignNow for Oklahoma continuing garnishment offers numerous benefits including increased efficiency, reduced paperwork, and improved accuracy. Our platform allows you to quickly send and eSign necessary documents, which helps expedite the garnishment process while ensuring compliance and security.

Get more for Oklahoma Calculation Garnishment

Find out other Oklahoma Calculation Garnishment

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document