Living Trust for Individual Who is Single, Divorced or Widow or Wwidower with Children Oregon Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon

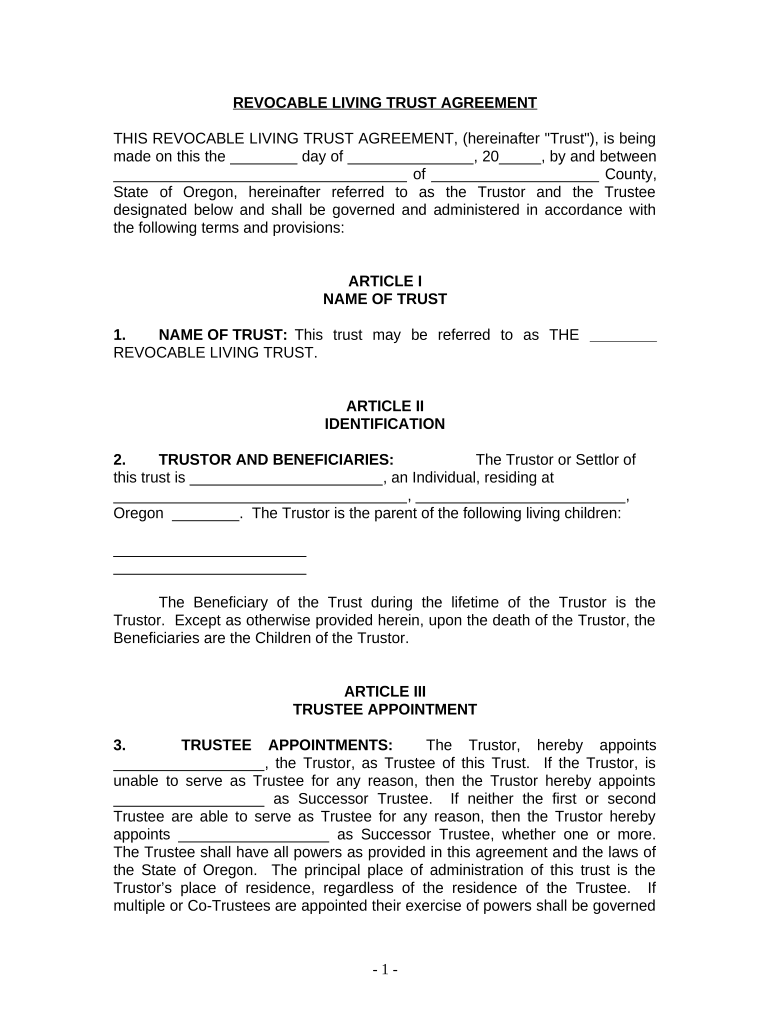

A living trust for individuals who are single, divorced, or widowed with children in Oregon is a legal document that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust can help avoid probate, ensuring a smoother transition of assets to beneficiaries. It can be particularly beneficial for single parents, as it allows them to designate guardians for their children and manage financial resources effectively.

Steps to Complete the Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon

Completing a living trust involves several key steps:

- Identify your assets: List all properties, bank accounts, investments, and personal belongings you wish to include in the trust.

- Choose a trustee: Select a trustworthy individual or institution to manage the trust. This can be yourself or another person.

- Draft the trust document: Create a comprehensive document outlining how your assets will be managed and distributed. It is advisable to consult a legal professional for this step.

- Sign the document: Ensure that the trust is signed in accordance with Oregon state laws, which may require witnesses or notarization.

- Fund the trust: Transfer ownership of your assets into the trust to ensure they are managed according to your wishes.

Legal Use of the Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon

The legal use of a living trust in Oregon allows individuals to maintain control over their assets while providing clear instructions for their distribution upon death. It is recognized by the state as a valid estate planning tool, offering benefits such as avoiding probate and maintaining privacy regarding asset distribution. In cases where minor children are involved, the trust can also designate guardians and manage funds for their benefit until they reach adulthood.

State-Specific Rules for the Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon

In Oregon, specific rules govern the creation and execution of living trusts. These include:

- Trustee requirements: The trustee must be a competent adult or a legal entity capable of managing the trust.

- Witnesses and notarization: Oregon law may require that the trust document be signed in the presence of witnesses or notarized to ensure its validity.

- Revocation rights: As the creator of the trust, you retain the right to amend or revoke the trust at any time, provided you follow the proper legal procedures.

Key Elements of the Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon

Key elements of a living trust include:

- Trustor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust's assets.

- Beneficiaries: Individuals or entities designated to receive the trust's assets upon the trustor's death.

- Asset description: A detailed list of assets included in the trust.

- Distribution instructions: Clear guidelines on how and when beneficiaries will receive their inheritance.

How to Obtain the Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon

To obtain a living trust, individuals can follow these steps:

- Consult a legal professional: Seek advice from an attorney who specializes in estate planning to ensure the trust meets your specific needs and complies with Oregon laws.

- Use online resources: Many legal websites offer templates and guidance for creating a living trust.

- Attend workshops: Some community organizations provide workshops on estate planning, which can help you understand the process better.

Quick guide on how to complete living trust for individual who is single divorced or widow or wwidower with children oregon

Effortlessly prepare Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without setbacks. Manage Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to modify and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon with ease

- Acquire Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon and select Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to distribute your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for individuals who are single, divorced, or widowed with children in Oregon?

A Living Trust for individuals who are single, divorced, or widowed with children in Oregon is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed upon your death. It helps in avoiding probate, ensuring that your children receive inheritance seamlessly while also allowing you to maintain control over your assets.

-

How does a Living Trust benefit single, divorced, or widowed individuals with children in Oregon?

Creating a Living Trust can provide signNow benefits for single, divorced, or widowed individuals with children in Oregon, such as protecting your assets, simplifying the transfer process after your passing, and reducing estate taxes. It also offers peace of mind knowing that your children will be taken care of according to your wishes.

-

What features does airSlate SignNow offer for managing a Living Trust in Oregon?

AirSlate SignNow offers various features that enhance the management of a Living Trust for individuals who are single, divorced, or widowed with children in Oregon. These features include eSignature capabilities, document templates tailored for trusts, and secure cloud storage for easy access to your legal documents.

-

What is the cost associated with creating a Living Trust for individuals in Oregon?

The cost of creating a Living Trust for individuals who are single, divorced, or widowed with children in Oregon can vary based on the complexity and amount of assets involved. However, using airSlate SignNow can signNowly reduce these costs by providing a more affordable, user-friendly solution for setting up and managing your trust documentation.

-

How can I customize my Living Trust using airSlate SignNow?

With airSlate SignNow, you can easily customize your Living Trust to meet your specific needs as a single, divorced, or widowed individual with children in Oregon. The platform offers various templates and tools that allow you to add specific provisions, designate guardians for children, and clearly outline your distribution preferences.

-

Can I update my Living Trust after it has been created?

Yes, you can update your Living Trust even after it has been created. It is important for individuals who are single, divorced, or widowed with children in Oregon to regularly review and amend their trust documents through airSlate SignNow to reflect any changes in circumstances, such as birth, divorce, or changes in asset ownership.

-

What integrations does airSlate SignNow offer that can help with managing my Living Trust?

AirSlate SignNow integrates with various tools and platforms that can assist you in managing your Living Trust effectively. These integrations facilitate document sharing, workflow automation, and secure storage solutions, making it easier for single, divorced, or widowed individuals with children in Oregon to oversee their estate planning.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon

- Panera order form

- Employee evaluation form skyline ultdcom

- Aa quickclean warranty form

- Blue cross of idaho additional services requested form fillable pdf

- Mclb barstow vetting form mccs barstow

- Employeramp39s report of injury brickstreet insurance form

- Employment application form elite medical transport

- Cfd fire drill report charmeck form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children Oregon

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple