Pa Debtor Form

What is the PA Debtor?

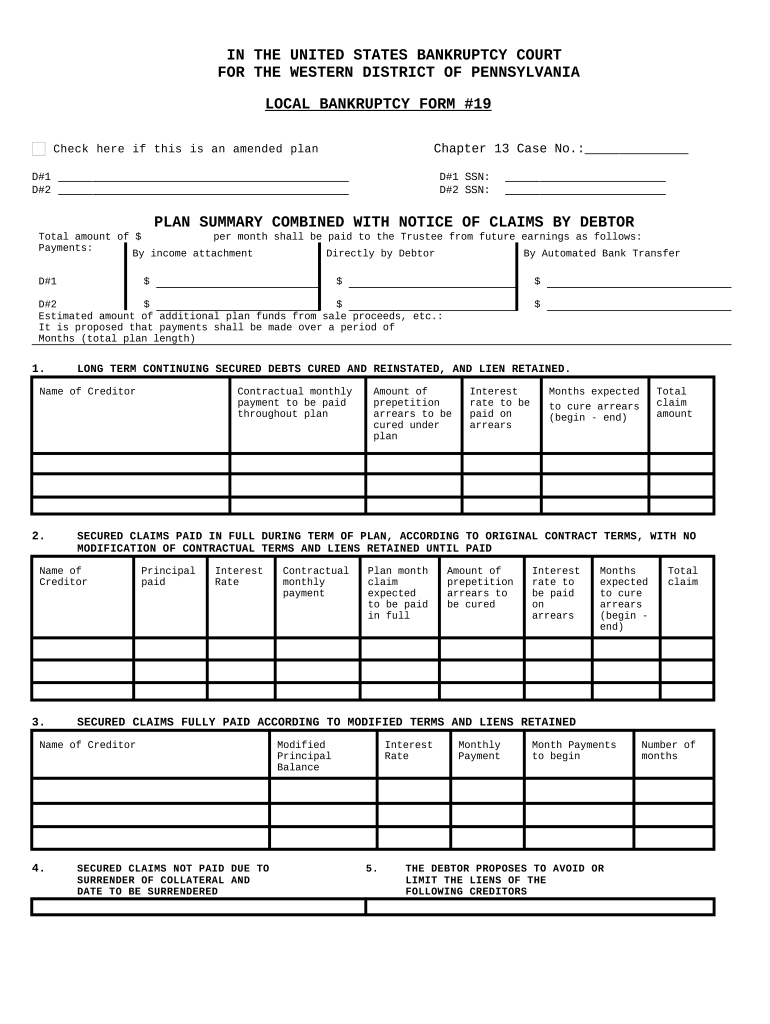

The PA debtor form is a legal document used in the state of Pennsylvania to outline the financial obligations of an individual or entity that owes money. This form is essential for individuals who are involved in bankruptcy proceedings or debt restructuring, as it provides a clear record of debts owed. By accurately completing the PA debtor form, individuals can ensure that their financial situation is properly documented, which is crucial for legal and financial processes.

How to Use the PA Debtor

Using the PA debtor form involves several steps. First, gather all necessary financial information, including debts, assets, and income. Next, fill out the form with accurate details regarding your financial situation. It is important to be thorough and honest, as inaccuracies can lead to legal complications. Once completed, the form should be submitted to the appropriate court or agency as part of your bankruptcy or debt resolution process. Utilizing electronic tools for this process can streamline submission and enhance security.

Steps to Complete the PA Debtor

Completing the PA debtor form requires careful attention to detail. Follow these steps for accuracy:

- Gather all financial documents, including statements of debts, assets, and income.

- Fill in personal information, including your name, address, and social security number.

- List all debts, specifying the creditor's name, amount owed, and any relevant account numbers.

- Detail your assets, including property, bank accounts, and other valuables.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the PA Debtor

The PA debtor form is legally binding when completed correctly. It serves as an official declaration of your financial obligations and is used in court proceedings related to bankruptcy or debt restructuring. Compliance with state laws and regulations is crucial for the form to hold legal weight. It is advisable to consult with a legal professional to ensure that all aspects of the form meet legal requirements.

Key Elements of the PA Debtor

Several key elements must be included in the PA debtor form to ensure its validity:

- Personal Information: Full name, address, and contact details.

- Debt Details: Comprehensive listing of all debts, including amounts and creditor information.

- Asset Information: Detailed account of assets owned, including real estate and personal property.

- Signature: The form must be signed and dated by the debtor to confirm accuracy and authenticity.

Examples of Using the PA Debtor

Examples of situations where the PA debtor form is utilized include:

- Individuals filing for Chapter Seven bankruptcy to discharge unsecured debts.

- Debtors seeking to negotiate a repayment plan with creditors.

- Individuals involved in debt consolidation efforts to manage multiple debts more effectively.

Quick guide on how to complete pa debtor

Complete Pa Debtor seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Pa Debtor on any platform with airSlate SignNow Android or iOS apps and enhance any document-based process today.

How to edit and eSign Pa Debtor effortlessly

- Find Pa Debtor and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Pa Debtor and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a PA debtor, and how does it relate to airSlate SignNow?

A PA debtor refers to an individual or entity that owes money in the state of Pennsylvania. With airSlate SignNow, managing documents related to PA debtors becomes seamless, allowing businesses to eSign contracts and agreements efficiently. This helps in maintaining compliance and ensuring proper documentation when dealing with PA debtors.

-

What features does airSlate SignNow offer for managing PA debtor agreements?

AirSlate SignNow provides features such as customizable templates, real-time tracking, and advanced security measures tailored for managing PA debtor agreements. These features enhance the document workflow process, ensuring that all necessary signatures and approvals are obtained promptly. By streamlining these workflows, businesses can focus more on their core operations.

-

Can I integrate airSlate SignNow with other tools I use for managing PA debtors?

Yes, airSlate SignNow supports integrations with various CRM and accounting software that help manage PA debtor relationships. This integration ensures that your document workflows are connected, making it easier to track communications and record keeping. By utilizing these integrations, businesses can optimize their operations regarding PA debtors.

-

How does airSlate SignNow help ensure compliance when dealing with PA debtors?

AirSlate SignNow adheres to the legal standards required for electronic signatures in Pennsylvania, ensuring compliance when managing PA debtor documents. This includes providing an audit trail and encryption for sensitive information, which helps protect both your organization and the PA debtor. By using a compliant solution, you can reduce the risks associated with electronic document handling.

-

What pricing options are available for using airSlate SignNow for PA debtor documentation?

airSlate SignNow offers various pricing plans to suit different business needs, making it budget-friendly for managing PA debtor documentation. Each plan includes essential features for eSigning, document creation, and storage. Prospective customers can choose a plan that aligns with their requirements without overspending.

-

What benefits can I expect when using airSlate SignNow to manage PA debtors?

Using airSlate SignNow to manage PA debtors can yield signNow benefits, including time savings, improved accuracy, and better customer relationships. The platform enhances communication and collaboration through efficient document handling, which can lead to faster resolution of debtor matters. By simplifying the process, businesses can reduce costs and increase satisfaction.

-

Is airSlate SignNow user-friendly for managing PA debtor documents?

Yes, airSlate SignNow is designed to be intuitive and user-friendly, making it easy to manage PA debtor documents. With a straightforward interface, users can quickly navigate through features for sending, signing, and storing documents. This eases the learning curve and allows users to become productive from day one.

Get more for Pa Debtor

- F027cp state of connecticut key ctgov ct form

- Prevailing wage report back older version thecontractorsgroup bb form

- Whistleblower retaliation complaint form ctgov ct

- Pnmi application form

- Greensheet contract to close keller williams realty form

- Ccm n008 1 28 04 ccm n008 1 28 04 form

- 2621 receipt on distribution form

- Fsco family law 7 form

Find out other Pa Debtor

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple