Living Trust for Husband and Wife with One Child South Carolina Form

What is the Living Trust For Husband And Wife With One Child South Carolina

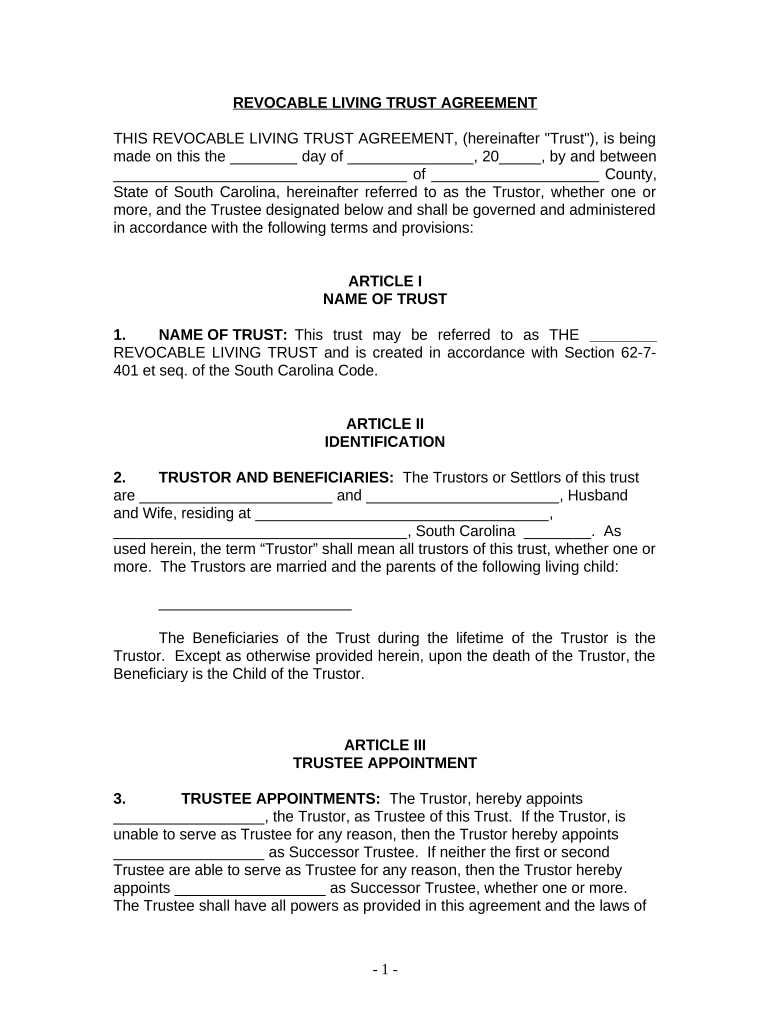

A living trust for husband and wife with one child in South Carolina is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed after their passing. This type of trust can help avoid the probate process, making the transfer of assets smoother and more efficient. In South Carolina, a living trust can be revocable, meaning the couple can alter the terms or dissolve the trust as needed. It typically includes provisions for the couple’s child, ensuring their needs are met and assets are protected.

Key elements of the Living Trust For Husband And Wife With One Child South Carolina

Several key elements define a living trust for husband and wife with one child in South Carolina. These include:

- Grantors: The husband and wife who create the trust.

- Trustee: Often, one or both spouses serve as trustees, managing the trust assets.

- Beneficiaries: The couple’s child is typically the primary beneficiary, with provisions for other heirs if necessary.

- Assets: The trust can include various assets such as real estate, bank accounts, and investments.

- Distribution Terms: Specific instructions on how and when the assets should be distributed to the child.

Steps to complete the Living Trust For Husband And Wife With One Child South Carolina

Completing a living trust involves several important steps:

- Identify Assets: List all assets to be included in the trust.

- Select a Trustee: Decide who will manage the trust, typically one or both spouses.

- Draft the Trust Document: Create a legal document outlining the terms of the trust.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary.

- Fund the Trust: Transfer ownership of assets into the trust to ensure they are managed according to the trust terms.

Legal use of the Living Trust For Husband And Wife With One Child South Carolina

The legal use of a living trust in South Carolina is governed by state laws, which allow couples to create a revocable trust that can be amended or revoked at any time. This flexibility is beneficial for adapting to changing circumstances. The trust must comply with South Carolina’s legal requirements, including proper execution and funding. It is essential to ensure that the trust document clearly outlines the intentions of the grantors to avoid disputes among beneficiaries.

State-specific rules for the Living Trust For Husband And Wife With One Child South Carolina

In South Carolina, specific rules govern the creation and management of living trusts. These include:

- Revocability: Trusts can be revocable, allowing changes during the grantors' lifetime.

- Notarization: The trust document must be signed in front of a notary public to be legally binding.

- Asset Transfer: Assets must be formally transferred into the trust to be protected under its terms.

- Tax Implications: A living trust does not typically affect the grantors' tax status, as they retain control over the assets.

How to obtain the Living Trust For Husband And Wife With One Child South Carolina

Obtaining a living trust for husband and wife with one child in South Carolina involves several steps. Couples can choose to draft the trust themselves using templates or hire an attorney specializing in estate planning. Engaging a legal professional can ensure that the trust complies with state laws and meets the couple’s specific needs. Once the trust is drafted, the couple should review it carefully before signing and funding it.

Quick guide on how to complete living trust for husband and wife with one child south carolina

Complete Living Trust For Husband And Wife With One Child South Carolina effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Living Trust For Husband And Wife With One Child South Carolina on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The simplest way to edit and eSign Living Trust For Husband And Wife With One Child South Carolina without hassle

- Obtain Living Trust For Husband And Wife With One Child South Carolina and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign Living Trust For Husband And Wife With One Child South Carolina to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child in South Carolina?

A Living Trust For Husband And Wife With One Child in South Carolina is a legal document that allows you to manage your assets during your lifetime and designate how they will be distributed after your death. This type of trust can help avoid probate and ensure a smooth transfer of assets to your child.

-

What are the benefits of setting up a Living Trust For Husband And Wife With One Child in South Carolina?

Establishing a Living Trust For Husband And Wife With One Child in South Carolina offers several benefits, including privacy, flexibility in managing assets, and the ability to control distributions to your child. It can also help minimize estate taxes and ensure that your wishes are followed without the delays of probate.

-

How much does it cost to create a Living Trust For Husband And Wife With One Child in South Carolina?

The cost of creating a Living Trust For Husband And Wife With One Child in South Carolina varies based on complexity and whether you work with an attorney or use an online service. Generally, you can expect to pay between $500 to $2,500, making it a cost-effective solution for long-term asset management.

-

Can I customize my Living Trust For Husband And Wife With One Child in South Carolina?

Yes, you can customize your Living Trust For Husband And Wife With One Child in South Carolina to meet your specific needs and preferences. You can specify which assets go to your child, set conditions for distributions, and appoint a trustee to manage the trust on your behalf.

-

How does a Living Trust For Husband And Wife With One Child in South Carolina integrate with my overall estate plan?

A Living Trust For Husband And Wife With One Child in South Carolina can seamlessly integrate with your overall estate plan by coordinating with wills, financial powers of attorney, and healthcare directives. This comprehensive approach ensures that all your assets are managed according to your wishes and provides clarity for your loved ones.

-

Is it necessary to hire a lawyer for a Living Trust For Husband And Wife With One Child in South Carolina?

While it's not strictly necessary to hire a lawyer for a Living Trust For Husband And Wife With One Child in South Carolina, having professional guidance can be beneficial. An attorney can help ensure that all legal requirements are met and that your trust is tailored to your specific situation, providing peace of mind.

-

What assets should I include in my Living Trust For Husband And Wife With One Child in South Carolina?

In your Living Trust For Husband And Wife With One Child in South Carolina, you can include various types of assets such as real estate, bank accounts, investments, and personal property. By transferring these assets into the trust, you ensure they are managed according to your wishes and can avoid the complications of probate.

Get more for Living Trust For Husband And Wife With One Child South Carolina

- Pre authorized debit plan p rancho management services form

- Official form 106j

- Dws osd 354 utah department of health health utah form

- St 389 2016 form

- Celebrate recovery inventory worksheet form

- Md rule 9 203 a mdcourts form

- Free tenancy agreement templates to download rentfair form

- Agreement to waive financial disclosure form

Find out other Living Trust For Husband And Wife With One Child South Carolina

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word