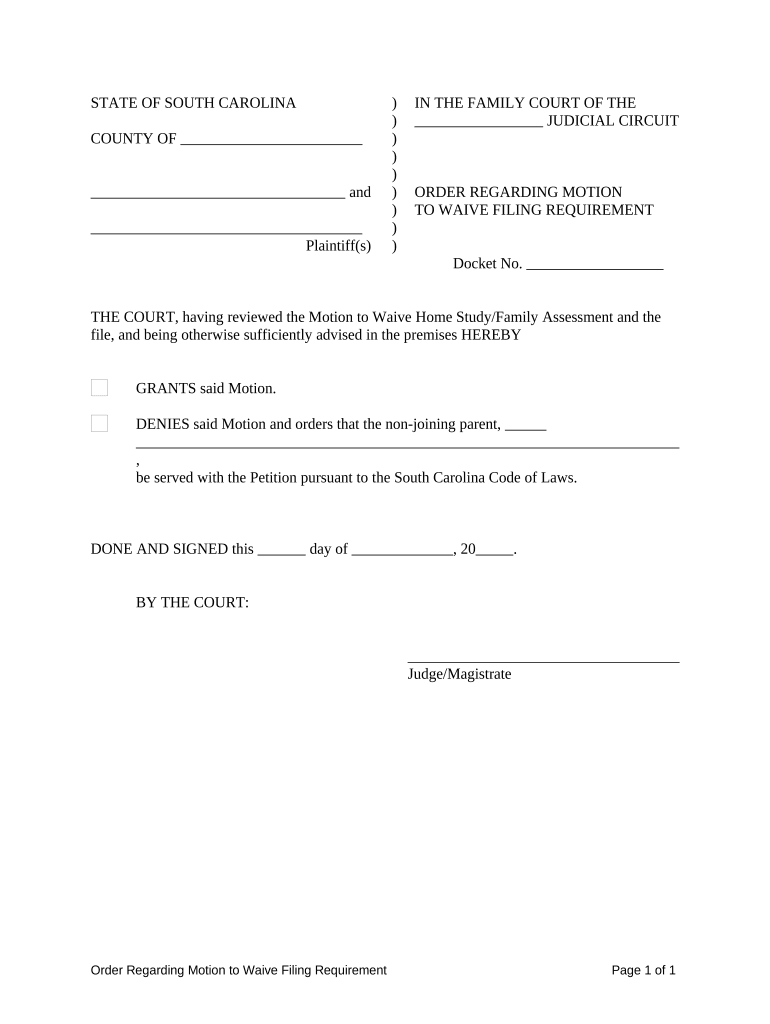

South Carolina Filing Form

What is the South Carolina Filing

The South Carolina filing for a minor name change is a legal document that allows a minor's name to be officially changed in the state. This process is typically initiated by a parent or legal guardian who wishes to amend the child's name for various reasons, such as marriage, divorce, or personal preference. The filing is essential to ensure that the new name is recognized by state authorities, schools, and other institutions.

Steps to complete the South Carolina Filing

Completing the South Carolina minor name change form involves several important steps:

- Obtain the form: Acquire the South Carolina minor name change form from the appropriate court or online resources.

- Fill out the form: Provide all required information, including the current name of the minor, the desired new name, and the reasons for the change.

- Gather supporting documents: Collect necessary documents, such as the minor's birth certificate and any legal documents that support the name change.

- File the form: Submit the completed form along with the supporting documents to the appropriate court in South Carolina.

- Attend the hearing: If required, attend a court hearing where a judge will review the application and may ask questions regarding the name change.

Required Documents

When filing for a minor name change in South Carolina, certain documents are typically required:

- The completed minor name change form.

- A certified copy of the minor's birth certificate.

- Any court orders or legal documents that pertain to the name change.

- Proof of residency for the parent or guardian filing the request.

Legal use of the South Carolina Filing

The legal use of the South Carolina minor name change filing ensures that the name change is recognized by government entities and private organizations. Once the court approves the name change, the new name can be used on legal documents, school records, and identification. This legal recognition is crucial for the minor's identity and can prevent future complications related to their name.

Eligibility Criteria

To file for a minor name change in South Carolina, specific eligibility criteria must be met:

- The applicant must be a parent or legal guardian of the minor.

- The minor must be under the age of eighteen.

- The name change must be in the best interest of the minor.

- There should be no pending legal issues regarding the minor's name.

Who Issues the Form

The South Carolina minor name change form is typically issued by the local family court or probate court in the jurisdiction where the minor resides. It is important to file the form in the correct court to ensure proper processing and legal recognition of the name change.

Quick guide on how to complete south carolina filing

Effortlessly Prepare South Carolina Filing on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hassle. Manage South Carolina Filing on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign South Carolina Filing with Ease

- Locate South Carolina Filing and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Select relevant sections of your files or conceal sensitive information using tools that airSlate SignNow provides explicitly for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Alter and eSign South Carolina Filing to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for an SC minor name change using airSlate SignNow?

The process for an SC minor name change with airSlate SignNow is straightforward. You can easily prepare the necessary documents for a name change, sign them electronically, and submit them as required by the South Carolina courts. Our platform ensures that all steps are compliant with legal standards and simplifies the entire process.

-

How much does airSlate SignNow charge for services related to SC minor name changes?

airSlate SignNow offers competitive pricing for its services, including SC minor name change documentation. You can choose from various subscription plans that fit your business needs, ensuring you get the best value for your money. Additionally, you can take advantage of free trials to test the platform before committing.

-

What features does airSlate SignNow provide for SC minor name changes?

airSlate SignNow provides several features tailored for SC minor name changes, such as customizable templates, eSign capabilities, and secure document storage. These features simplify the management of legal documents, making it easier to track changes and maintain compliance throughout the process.

-

Can airSlate SignNow assist with submitting documents for an SC minor name change?

Yes, airSlate SignNow can assist you with preparing and organizing the documents needed for an SC minor name change. While we provide the tools to eSign and manage your documents, we also offer guidance on how to submit them correctly to the relevant South Carolina authorities to avoid any delays.

-

Is airSlate SignNow secure for managing SC minor name change documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, including those related to SC minor name changes. Our platform utilizes advanced encryption and security protocols, ensuring that all sensitive information is protected against unauthorized access.

-

Are there any integrations available with airSlate SignNow for SC minor name changes?

Yes, airSlate SignNow offers seamless integrations with popular software tools that can enhance your experience with SC minor name changes. These integrations allow you to sync data with other platforms, increasing efficiency and streamlining your document management processes.

-

How quickly can I complete an SC minor name change using airSlate SignNow?

By using airSlate SignNow for your SC minor name change, you can signNowly reduce the time it takes to complete the necessary documentation. The eSigning process is fast and efficient, allowing you to finalize and submit your name change documents swiftly, depending on your readiness and local filing requirements.

Get more for South Carolina Filing

- Philmont staff application boy scouts of america scouting form

- Additional information for children in foster care and children

- Cdl road test application registry of motor vehicles form

- Fingerprint referral form new york city department of education schools nyc

- New york claim form

- Office of the comptroller nyc personal injury claim form

- Vr203 form

- Nyc 204 ez instructions 2013 form

Find out other South Carolina Filing

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast