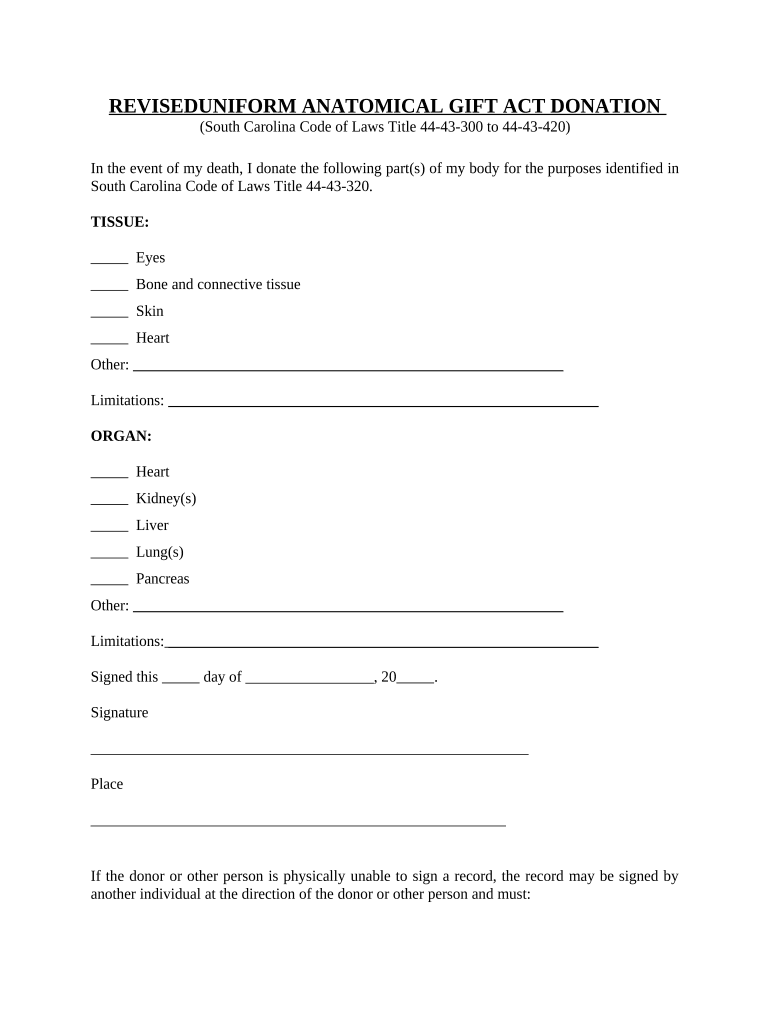

Gift Act Form

What is the Gift Act

The Gift Act is a legal framework that governs the transfer of property or assets from one individual to another without any expectation of receiving something in return. This act is essential for ensuring that such transfers are documented properly and are legally binding. It is particularly relevant in the context of estate planning and tax implications, as gifts can affect both the giver and the recipient in terms of tax liabilities.

Key elements of the Gift Act

Understanding the key elements of the Gift Act is crucial for anyone considering making a gift. These elements include:

- Intent: The giver must intend to make a gift.

- Delivery: The property must be delivered to the recipient.

- Acceptance: The recipient must accept the gift.

- Documentation: Proper documentation is necessary to validate the gift, especially for tax purposes.

Steps to complete the Gift Act

Completing the Gift Act involves several important steps to ensure that the transfer is legally recognized. These steps include:

- Determine the value of the gift.

- Document the intent to give the gift.

- Transfer ownership of the property or asset.

- Have the recipient acknowledge acceptance of the gift.

- File any necessary tax forms, such as the IRS Form 709, if applicable.

Legal use of the Gift Act

To legally use the Gift Act, it is important to comply with federal and state regulations. This includes understanding the tax implications of the gift, such as annual exclusion limits and lifetime gift tax exemptions. Additionally, ensuring that the gift is properly documented can help avoid disputes and provide clarity for both parties involved.

IRS Guidelines

The IRS provides specific guidelines regarding the taxation of gifts. Under current regulations, individuals can give gifts up to a certain amount each year without incurring gift tax. It is essential to be aware of these limits and to report any gifts that exceed them using the appropriate IRS forms, such as Form 709. Understanding these guidelines helps in planning and executing gifts effectively.

Examples of using the Gift Act

Examples of using the Gift Act can range from simple cash gifts to more complex transfers of property. Common scenarios include:

- Parents gifting money to their children for education.

- Transferring ownership of a family home to a relative.

- Donating to charitable organizations.

Each example illustrates how the act can be applied in various contexts, highlighting the importance of proper documentation and compliance with legal requirements.

Quick guide on how to complete gift act

Complete Gift Act effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed forms, as you can easily locate the needed document and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Gift Act on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Gift Act without hassle

- Find Gift Act and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information using features that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious searches for forms, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Gift Act and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the gift act and how does it relate to document signing?

The gift act refers to laws governing the giving of gifts, which can include financial transactions or property transfers. At airSlate SignNow, we provide an easy-to-use platform to manage the documentation involved in a gift act, ensuring that you can eSign and send necessary forms quickly and securely.

-

How does airSlate SignNow facilitate the gift act documentation process?

airSlate SignNow streamlines the gift act documentation process by allowing you to create, send, and eSign documents effortlessly. Our platform ensures that all parties can review and agree to the terms of the gift act electronically, leading to a more efficient and legally binding contract.

-

What features does airSlate SignNow offer for managing a gift act?

Key features of airSlate SignNow for managing a gift act include customizable templates, remote eSigning, and real-time document tracking. With our user-friendly interface, you can easily create or adapt a gift act document that suits your specific needs and share it with recipients seamlessly.

-

Are there any costs associated with using airSlate SignNow for a gift act?

Yes, there are pricing plans tailored for different business needs on airSlate SignNow. These plans are cost-effective and allow you to manage your gift act documentation without breaking the bank, offering flexibility to choose the package that best suits your budget and usage.

-

Can airSlate SignNow integrate with other tools for managing gift acts?

Absolutely! airSlate SignNow can integrate with a variety of applications such as CRM, accounting, and project management tools. This makes it easier for businesses to manage all aspects related to a gift act, keeping everything organized and accessible in one place.

-

What are the benefits of using airSlate SignNow for gift acts?

Using airSlate SignNow for gift acts provides numerous benefits, including enhanced efficiency, reduced paperwork, and improved security for your sensitive documents. Our platform also ensures compliance with legal standards, making the process smoother and more reliable for all parties involved.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning and gift acts?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for anyone, regardless of their technical expertise. Our intuitive interface guides users through the eSigning and documentation process for gift acts, ensuring a hassle-free experience.

Get more for Gift Act

- Valparaiso high school chapter valparaiso community schools form

- Scr traveling allowance application form ga31

- Ga19 accidentincident report citb form

- Ga08 method statement citb form

- Nutrition assessing form

- Housekeepers checklist sunridge management form

- Anthem application supplement form

- Hpapeahp home sales contract addendum gwul form

Find out other Gift Act

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document