South Carolina Satisfaction Mortgage Form

What is the South Carolina Satisfaction Mortgage

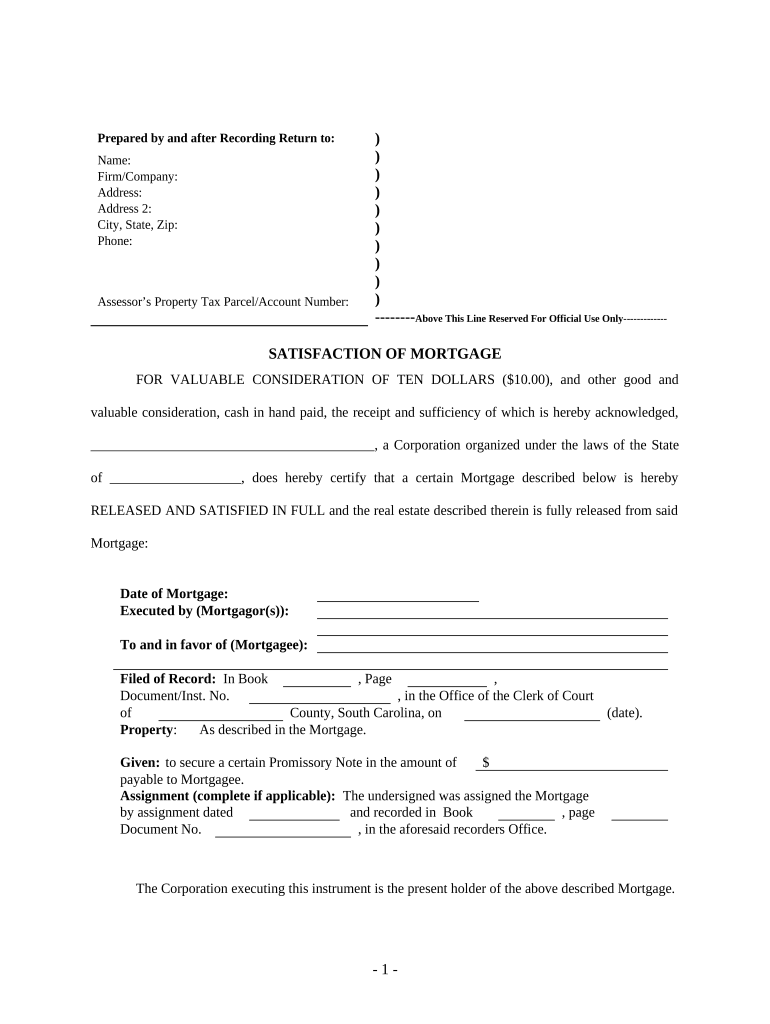

The South Carolina Satisfaction Mortgage is a legal document that confirms the full repayment of a mortgage loan. Once the borrower fulfills their financial obligations, this form serves to release the lender's claim on the property. It is essential for homeowners to obtain this document to clear their title and ensure that there are no lingering debts associated with the property.

How to use the South Carolina Satisfaction Mortgage

Using the South Carolina Satisfaction Mortgage involves several steps. First, the borrower must ensure that all mortgage payments have been made in full. Next, the lender will prepare the satisfaction document, which must be signed by an authorized representative. After signing, the document should be filed with the appropriate county office to officially update the property records.

Steps to complete the South Carolina Satisfaction Mortgage

Completing the South Carolina Satisfaction Mortgage requires a systematic approach:

- Verify that all mortgage payments are complete.

- Request the satisfaction document from the lender.

- Ensure the document is signed by the lender's authorized representative.

- File the signed document with the county register of deeds.

- Obtain a copy of the filed document for personal records.

Legal use of the South Carolina Satisfaction Mortgage

The legal use of the South Carolina Satisfaction Mortgage is crucial for protecting property rights. This document must be executed in accordance with state laws, ensuring that it meets all legal requirements for validity. It serves as proof that the mortgage has been satisfied, which is important for future property transactions or refinancing efforts.

Key elements of the South Carolina Satisfaction Mortgage

Key elements of the South Carolina Satisfaction Mortgage include:

- The names of the borrower and lender.

- A description of the property being released.

- The date of the original mortgage agreement.

- A statement confirming that the mortgage has been paid in full.

- The signature of the lender's authorized representative.

State-specific rules for the South Carolina Satisfaction Mortgage

South Carolina has specific rules governing the Satisfaction Mortgage. It must be filed within a certain timeframe after the mortgage is paid off, typically within thirty days. Additionally, the document must be notarized to ensure its authenticity. Failure to comply with these regulations may result in delays or complications in property ownership.

Quick guide on how to complete south carolina satisfaction mortgage

Prepare South Carolina Satisfaction Mortgage effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage South Carolina Satisfaction Mortgage on any device using the airSlate SignNow Android or iOS applications and enhance your document-centered processes today.

The easiest way to edit and eSign South Carolina Satisfaction Mortgage with ease

- Find South Carolina Satisfaction Mortgage and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow has specifically designed for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose how you want to submit your form—via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunts, or mistakes that necessitate printing new copies of paperwork. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign South Carolina Satisfaction Mortgage to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a South Carolina satisfaction mortgage?

A South Carolina satisfaction mortgage is a legal document that confirms a mortgage has been paid off, thereby releasing the borrower from the mortgage obligation. This document protects the borrower’s credit and prevents any potential future disputes over the mortgage status. Using airSlate SignNow, you can easily create and eSign this important document.

-

How does airSlate SignNow streamline the satisfaction mortgage process in South Carolina?

airSlate SignNow simplifies the satisfaction mortgage process by allowing users to send, sign, and manage documents electronically. This efficient platform reduces paperwork, minimizes mistakes, and accelerates the overall process. With robust features, it ensures your South Carolina satisfaction mortgage is completed quickly and securely.

-

What are the costs associated with obtaining a South Carolina satisfaction mortgage?

The costs for obtaining a South Carolina satisfaction mortgage typically include recording fees and possibly attorney fees, which can vary by county. Utilizing airSlate SignNow can help you save on administrative costs by eliminating the need for physical paperwork and streamlining the signing process. Our cost-effective solution allows you to manage these financial aspects efficiently.

-

Are there any benefits to using airSlate SignNow for South Carolina satisfaction mortgages?

Yes, utilizing airSlate SignNow for South Carolina satisfaction mortgages offers numerous benefits, including increased efficiency, enhanced security, and reduced turnaround times. The platform allows you to eSign documents from anywhere at any time, providing flexibility and convenience. Additionally, it helps maintain compliance with local regulations seamlessly.

-

What features does airSlate SignNow offer for managing satisfaction mortgages?

airSlate SignNow provides robust features such as customizable templates, automated workflows, and instant alerts for document status. These tools allow users to manage their South Carolina satisfaction mortgage documents with ease and precision. The user-friendly interface ensures a smooth experience from creation to completion.

-

Can I integrate airSlate SignNow with other tools for managing mortgages?

Absolutely! airSlate SignNow offers integrations with various CRM systems, cloud storage solutions, and productivity tools, making it easy to incorporate into your existing workflow. This means that managing your South Carolina satisfaction mortgage can be part of a larger suite of tools you already use, enhancing overall efficiency and data management.

-

How secure is the process of eSigning a South Carolina satisfaction mortgage with airSlate SignNow?

The eSigning process with airSlate SignNow is highly secure, featuring advanced encryption and authentication protocols. Your sensitive documents, including South Carolina satisfaction mortgage agreements, are protected to ensure confidentiality and integrity. This means you can sign documents with confidence, knowing they are safeguarded against unauthorized access.

Get more for South Carolina Satisfaction Mortgage

- Uti mutual fund online empanelment form

- Instructions for family care leave fcl of absence application cwa1109 form

- Ccf silk road form

- Credit card authorization form lifesavers lifesaversconference

- Lab using activity form

- Hud survey instructions and surveyors report 202and811guide form

- Mankind the story of all of us episode 3 worksheet answers form

- Mankind story if us episode 11 questions form

Find out other South Carolina Satisfaction Mortgage

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word