Living Trust for Husband and Wife with One Child South Dakota Form

What is the Living Trust For Husband And Wife With One Child South Dakota

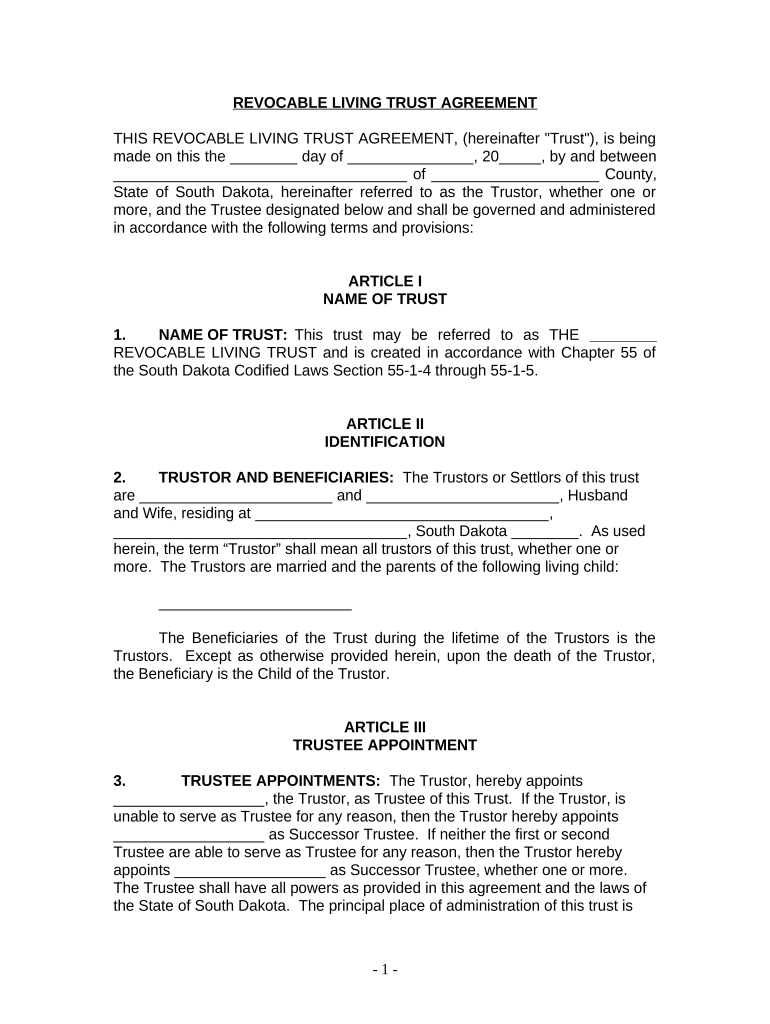

A living trust for husband and wife with one child in South Dakota is a legal document that allows couples to manage their assets during their lifetime and specify how those assets will be distributed after their passing. This type of trust is particularly beneficial for ensuring that the couple's child receives their inheritance without the need for probate, which can be a lengthy and costly process. The trust can hold various assets, including real estate, bank accounts, and investments, providing flexibility and control over asset management.

Key Elements of the Living Trust For Husband And Wife With One Child South Dakota

Several key elements define a living trust for husband and wife with one child in South Dakota:

- Trustees: Typically, both spouses act as trustees, managing the trust assets during their lifetime.

- Beneficiaries: The couple's child is usually named as the primary beneficiary, ensuring they inherit the assets upon the death of both parents.

- Revocability: Most living trusts are revocable, allowing the couple to make changes or dissolve the trust as needed.

- Asset Protection: The trust can protect assets from creditors and legal claims, providing peace of mind for the family.

Steps to Complete the Living Trust For Husband And Wife With One Child South Dakota

Completing a living trust involves several important steps:

- Gather Information: Collect details about all assets, including property, bank accounts, and investments.

- Draft the Trust Document: Create the trust document, outlining the terms, trustees, and beneficiaries.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to ensure its legality.

- Fund the Trust: Transfer ownership of the assets into the trust, which may involve changing titles and account names.

Legal Use of the Living Trust For Husband And Wife With One Child South Dakota

The legal use of a living trust in South Dakota is governed by state laws that outline the requirements for creating and managing trusts. A properly executed living trust is recognized as a valid legal instrument, allowing the couple to dictate how their assets are distributed. It is essential to comply with South Dakota's specific regulations to ensure that the trust remains valid and enforceable. This includes adhering to signing requirements and ensuring that the trust document is clear and comprehensive.

State-Specific Rules for the Living Trust For Husband And Wife With One Child South Dakota

In South Dakota, there are specific rules that govern living trusts:

- Trustee Requirements: Trustees must be competent individuals or institutions capable of managing the trust assets.

- Witnesses and Notarization: The trust document must be signed in front of a notary public, and witnesses may be required depending on the type of trust.

- Tax Implications: While living trusts do not typically incur taxes, it is crucial to understand any potential tax obligations related to the trust assets.

How to Obtain the Living Trust For Husband And Wife With One Child South Dakota

Obtaining a living trust can be done through various means:

- Legal Assistance: Consulting with an attorney who specializes in estate planning can provide personalized guidance and ensure compliance with state laws.

- Online Resources: There are online platforms that offer templates and guidance for creating a living trust, making the process more accessible.

- Financial Institutions: Some banks and financial advisors provide services to help couples set up living trusts as part of their estate planning services.

Quick guide on how to complete living trust for husband and wife with one child south dakota

Complete Living Trust For Husband And Wife With One Child South Dakota with ease on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed papers, as you can access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Living Trust For Husband And Wife With One Child South Dakota on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Living Trust For Husband And Wife With One Child South Dakota effortlessly

- Locate Living Trust For Husband And Wife With One Child South Dakota and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Living Trust For Husband And Wife With One Child South Dakota while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child in South Dakota?

A Living Trust For Husband And Wife With One Child in South Dakota is a legal arrangement that allows couples to manage their assets during their lifetime and seamlessly transfer them to their sole child upon their passing. This trust helps avoid the lengthy probate process and ensures a smoother transition of assets.

-

What are the benefits of establishing a Living Trust For Husband And Wife With One Child in South Dakota?

The primary benefits include avoiding probate, maintaining privacy regarding asset distribution, and providing clear directives on asset management for your child. Additionally, it safeguards your estate from potential disputes, ensuring that your wishes are honored as intended.

-

How does pricing work for creating a Living Trust For Husband And Wife With One Child in South Dakota?

Pricing for establishing a Living Trust For Husband And Wife With One Child in South Dakota can vary based on the complexity of the estate and the services provided. Many providers, including airSlate SignNow, offer competitive rates that cater to diverse needs while ensuring a cost-effective solution for creating your trust.

-

Can I modify my Living Trust For Husband And Wife With One Child in South Dakota after it's created?

Yes, one of the advantages of a Living Trust For Husband And Wife With One Child in South Dakota is that you can modify its terms at any time during your lifetime. This flexibility allows you to adjust the trust as circumstances change, such as the birth of additional children or changes in asset ownership.

-

What documents do I need to gather to create a Living Trust For Husband And Wife With One Child in South Dakota?

To create a Living Trust For Husband And Wife With One Child in South Dakota, you will typically need to gather documents related to your assets, such as deeds, bank statements, and investment records. Additionally, personal identification documents and information regarding any liabilities are also important to ensure comprehensive planning.

-

How does airSlate SignNow integrate into the process of creating a Living Trust For Husband And Wife With One Child in South Dakota?

airSlate SignNow simplifies the process of creating a Living Trust For Husband And Wife With One Child in South Dakota by providing easy-to-use eSignature and document management tools. This integration ensures that all necessary documents can be signed and stored securely, making the process efficient and streamlined.

-

Are there any tax implications I should be aware of with a Living Trust For Husband And Wife With One Child in South Dakota?

In general, a Living Trust For Husband And Wife With One Child in South Dakota does not create tax obligations on its own, as it is considered a 'revocable trust.' However, it’s important to consult with a tax professional to understand how your specific assets and decisions may impact your tax situation.

Get more for Living Trust For Husband And Wife With One Child South Dakota

- The postpartum plan dona international dona form

- Ocfs ldss 0792 day care registration form day care registration form this is the quick reference card that day care providers

- Intyg fr student i behov av srskilt std vid arcada studentens namn utbildning studentkod och fdelsedatum studenten har p basen form

- Acupuncture new patient intake form 2doc

- Endangered animals english worksheets land form

- Convention parentale cdad37fr form

- Employee tuition assistance bapplicationb duke university hr duke form

- Form n 648 2017 2019

Find out other Living Trust For Husband And Wife With One Child South Dakota

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free