Texas Payment Contractor Form

What is the Texas Payment Contractor?

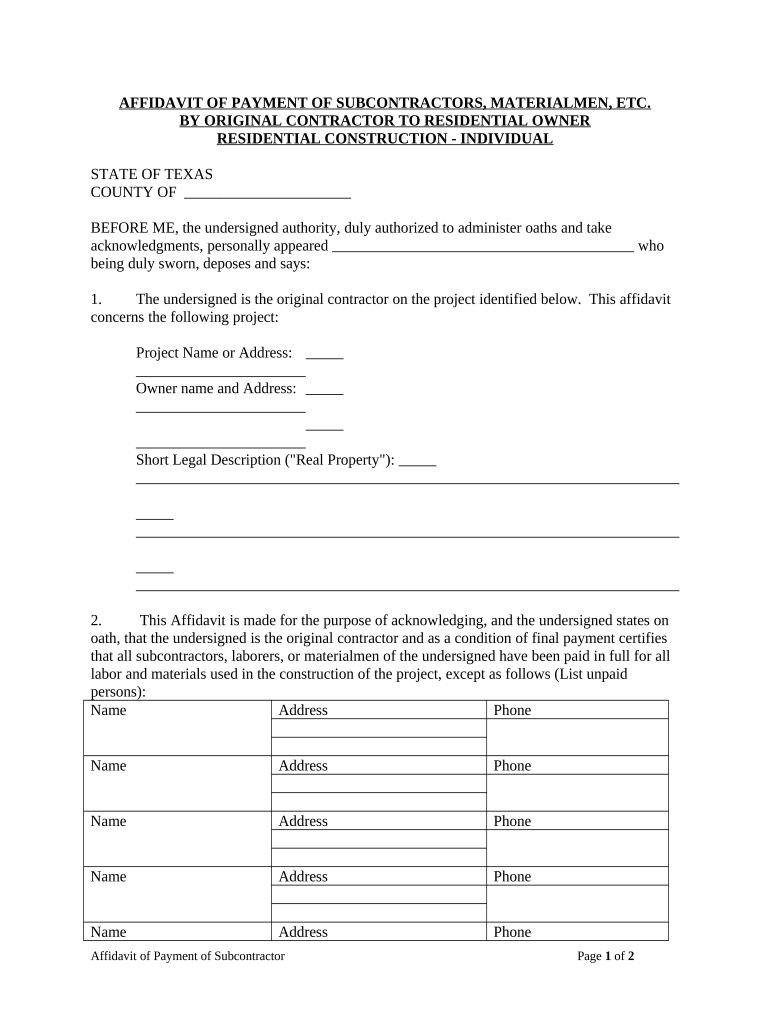

The Texas payment contractor form is a legal document used primarily in the construction industry. It facilitates the payment process between contractors and clients, ensuring that all parties are clear on the terms of payment for services rendered. This form outlines the specifics of the contract, including payment amounts, schedules, and conditions under which payments will be made. By using this form, contractors can establish a formal agreement that protects their rights and ensures compliance with Texas state laws.

How to use the Texas Payment Contractor

Using the Texas payment contractor form involves several key steps. First, both parties should review the terms of the contract to ensure mutual understanding. Next, the contractor fills out the form with relevant details, including the scope of work, payment amounts, and deadlines. Once completed, both the contractor and client should sign the document, ideally using a secure electronic signature solution to enhance legal validity. This process ensures that the agreement is binding and can be referenced in case of disputes.

Steps to complete the Texas Payment Contractor

Completing the Texas payment contractor form requires attention to detail. Here are the essential steps:

- Gather necessary information, including contractor and client details.

- Clearly outline the scope of work and payment terms.

- Fill in the form accurately, ensuring all sections are completed.

- Review the document for any errors or omissions.

- Both parties should sign the form electronically to ensure legal compliance.

- Keep a copy of the signed document for your records.

Legal use of the Texas Payment Contractor

The legal use of the Texas payment contractor form hinges on compliance with state laws governing contracts and electronic signatures. Under Texas law, electronic signatures are recognized as valid, provided they meet specific criteria, such as the intention to sign and consent to use electronic means. It is essential for both parties to understand their rights and obligations as outlined in the form, ensuring that it is executed properly to avoid potential legal issues.

Key elements of the Texas Payment Contractor

Several key elements must be included in the Texas payment contractor form to ensure its effectiveness:

- Contractor Information: Name, address, and contact details of the contractor.

- Client Information: Name, address, and contact details of the client.

- Scope of Work: A detailed description of the services to be provided.

- Payment Terms: Amount due, payment schedule, and accepted payment methods.

- Signatures: Signatures of both parties, ideally with electronic verification.

State-specific rules for the Texas Payment Contractor

Texas has specific rules governing the use of payment contractor forms, which include compliance with state contract laws and adherence to regulations regarding electronic signatures. It is crucial for contractors and clients to be aware of these rules to ensure that their agreements are enforceable. Additionally, understanding local laws regarding lien rights and payment disputes can further protect both parties in the contractual relationship.

Quick guide on how to complete texas payment contractor

Effortlessly Prepare Texas Payment Contractor on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to craft, modify, and eSign your documents rapidly without complications. Handle Texas Payment Contractor on any device using airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

How to Modify and eSign Texas Payment Contractor with Ease

- Obtain Texas Payment Contractor and then click Get Form to begin.

- Make use of the tools we supply to fill out your form.

- Highlight pertinent portions of the documents or conceal sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the data and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate reprinting new copies. airSlate SignNow fully addresses your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Texas Payment Contractor and ensure seamless communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What services does airSlate SignNow offer for Texas payment contractors?

airSlate SignNow provides a comprehensive e-signature solution that simplifies document management for Texas payment contractors. With our user-friendly platform, you can easily send, sign, and manage payment contracts, ensuring a quick and secure transaction process.

-

How can Texas payment contractors benefit from using airSlate SignNow?

Texas payment contractors can signNowly benefit from using airSlate SignNow by enhancing their operational efficiency. Our platform streamlines the signing process, reducing turnaround times, and allowing contractors to focus more on their projects rather than paperwork.

-

What are the pricing plans available for Texas payment contractors?

airSlate SignNow offers several pricing plans tailored to meet the needs of Texas payment contractors. We provide flexible options, including monthly and annual subscriptions, ensuring you can choose a plan that fits your budget and operational needs.

-

Is airSlate SignNow compliant with Texas laws for payment contractors?

Yes, airSlate SignNow is fully compliant with Texas e-signature laws, making it a reliable choice for Texas payment contractors. Our platform adheres to legal standards, ensuring that all electronic signatures are valid and enforceable.

-

Can airSlate SignNow integrate with other tools used by Texas payment contractors?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications commonly used by Texas payment contractors. This includes popular tools for project management and invoicing, enhancing your overall workflow and efficiency.

-

How does airSlate SignNow ensure the security of documents for Texas payment contractors?

Security is a top priority for airSlate SignNow. We implement industry-leading encryption and authentication measures to protect the documents of Texas payment contractors, ensuring that sensitive information remains secure throughout the signing process.

-

What features does airSlate SignNow provide that are specifically beneficial for Texas payment contractors?

airSlate SignNow offers features such as templates for quick document creation, automated reminders, and mobile accessibility that are particularly beneficial for Texas payment contractors. These features help streamline operations, reduce administrative overhead, and enhance customer satisfaction.

Get more for Texas Payment Contractor

Find out other Texas Payment Contractor

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online