Form 8879 K Kentucky Individual Income Tax Declaration for Electronic 2022

What is the Form 8879 K Kentucky Individual Income Tax Declaration For Electronic

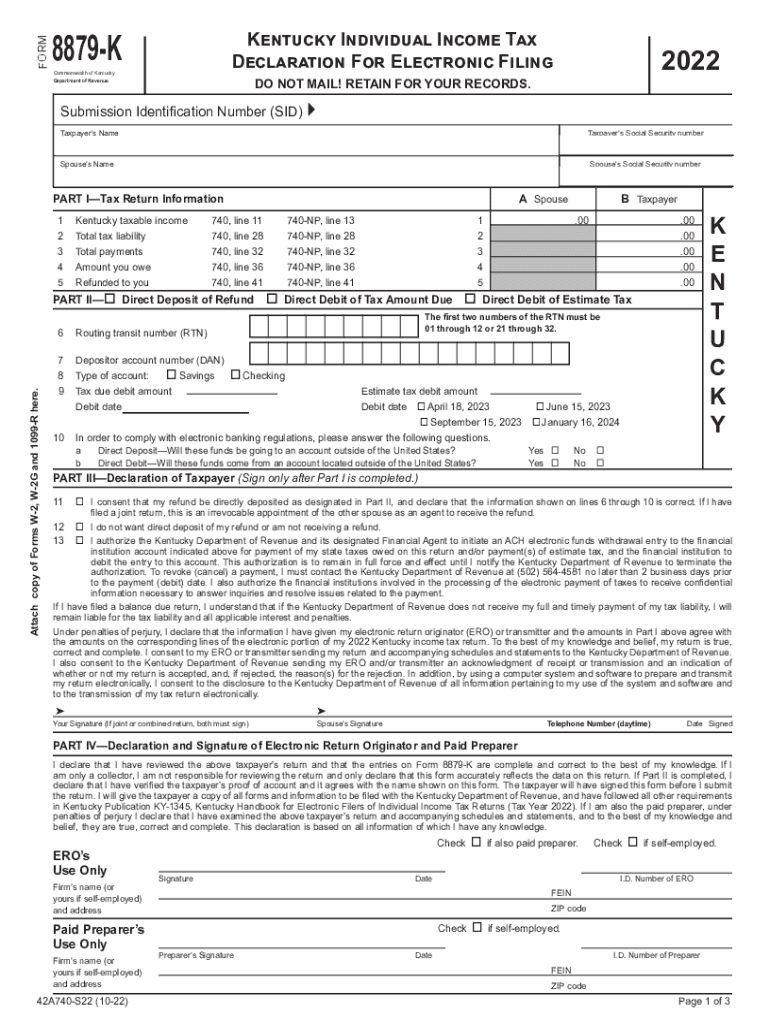

The Form 8879 K is a crucial document used by taxpayers in Kentucky to authorize the electronic filing of their individual income tax returns. This form serves as a declaration that the information provided in the tax return is accurate and complete. By signing this form, taxpayers confirm their intent to file electronically, ensuring compliance with state tax regulations. The form captures essential details such as the taxpayer's name, Social Security number, and the tax year for which the return is being filed.

How to use the Form 8879 K Kentucky Individual Income Tax Declaration For Electronic

Using the Form 8879 K involves several straightforward steps. First, taxpayers need to complete their individual income tax return, ensuring all information is accurate. Once the return is prepared, the taxpayer must fill out the Form 8879 K, providing necessary identification details. After reviewing the information for accuracy, the taxpayer must sign the form electronically. This signature is crucial as it authorizes the tax preparer to submit the return on their behalf. Finally, the completed form should be securely stored for future reference, as it may be required by the Kentucky Department of Revenue.

Steps to complete the Form 8879 K Kentucky Individual Income Tax Declaration For Electronic

Completing the Form 8879 K involves a few key steps:

- Prepare your individual income tax return using reliable tax software or a tax professional.

- Obtain the Form 8879 K, which can typically be found within your tax software or from the Kentucky Department of Revenue’s website.

- Fill in your personal details, including your name, Social Security number, and the tax year.

- Review the information for accuracy to ensure it matches your tax return.

- Sign the form electronically to authorize the e-filing of your tax return.

- Keep a copy of the signed form for your records.

Legal use of the Form 8879 K Kentucky Individual Income Tax Declaration For Electronic

The legal use of the Form 8879 K is governed by state tax laws which recognize electronic signatures as valid. When the form is signed electronically, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures carry the same weight as traditional handwritten signatures, provided that the signer has consented to use electronic records and signatures. This legal standing is vital for maintaining the integrity of the electronic filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8879 K align with the standard deadlines for individual income tax returns in Kentucky. Typically, the deadline for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of any specific extensions that may apply, such as those for military personnel or individuals affected by natural disasters. Staying informed about these deadlines is essential to avoid penalties and ensure timely compliance.

Required Documents

To complete the Form 8879 K, taxpayers will need several key documents:

- Your completed individual income tax return, including all relevant schedules and forms.

- Personal identification information, such as your Social Security number.

- Income statements, such as W-2s or 1099s, that detail your earnings for the tax year.

- Any additional documentation that supports deductions or credits claimed on your return.

Quick guide on how to complete form 8879 k kentucky individual income tax declaration for electronic

Manage Form 8879 K Kentucky Individual Income Tax Declaration For Electronic effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 8879 K Kentucky Individual Income Tax Declaration For Electronic on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Form 8879 K Kentucky Individual Income Tax Declaration For Electronic effortlessly

- Locate Form 8879 K Kentucky Individual Income Tax Declaration For Electronic and then click Obtain Form to begin.

- Use the tools we offer to fill in your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then select the Complete button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Form 8879 K Kentucky Individual Income Tax Declaration For Electronic and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8879 k kentucky individual income tax declaration for electronic

Create this form in 5 minutes!

People also ask

-

What is 8879 k and how does it relate to airSlate SignNow?

8879 k is a term used to refer to specific functionalities within airSlate SignNow. It highlights the program's capabilities in handling document workflows efficiently. By understanding 8879 k, businesses can leverage airSlate SignNow for enhanced electronic signature processes.

-

How much does airSlate SignNow cost for those interested in 8879 k?

Pricing for airSlate SignNow varies depending on the plan you choose. The features pertaining to 8879 k are included in all tiers, making it a cost-effective solution for businesses looking to streamline their document signing process. You can find detailed pricing information on our website.

-

What features are included in airSlate SignNow's 8879 k functionality?

The 8879 k functionality includes advanced eSignature capabilities, customizable templates, and secure document management. These features empower users to send, sign, and track documents effortlessly. Additionally, integration with other tools enhances the overall efficiency of your workflows.

-

What are the benefits of using airSlate SignNow with 8879 k?

Using airSlate SignNow with 8879 k allows businesses to increase productivity by reducing the time spent on manual signing processes. It improves accuracy and compliance while offering a user-friendly interface that is accessible to everyone. These benefits lead to more streamlined operations and higher customer satisfaction.

-

Can I integrate airSlate SignNow with other software if I focus on 8879 k?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance the 8879 k experience. Whether it’s CRM platforms, cloud storage solutions, or productivity tools, these integrations help automate workflows and improve efficiency. Check our integration options for more details.

-

Is airSlate SignNow secure for handling documents related to 8879 k?

Absolutely! airSlate SignNow employs best-in-class security measures to ensure that all documents, including those related to 8879 k, are protected. Data encryption and secure access protocols guarantee the safety and confidentiality of your important documents during the signing process.

-

How can businesses get started with airSlate SignNow using 8879 k?

To get started with airSlate SignNow and utilize the 8879 k functionalities, simply sign up for a free trial on our website. The user-friendly interface will guide you through the setup process and help you explore all available features. Our support team is also available to assist with any queries.

Get more for Form 8879 K Kentucky Individual Income Tax Declaration For Electronic

- Ok identity form

- Oklahoma identity form

- Oklahoma identity theft form

- Identity theft by known imposter package oklahoma form

- Organizing your personal assets package oklahoma form

- Essential documents for the organized traveler package oklahoma form

- Essential documents for the organized traveler package with personal organizer oklahoma form

- Postnuptial agreements package oklahoma form

Find out other Form 8879 K Kentucky Individual Income Tax Declaration For Electronic

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim