TRANSMITTAL FORM for W 2s or 1099s SUBMITTED by 2022

What is the transmittal form for W-2s or 1099s submitted by?

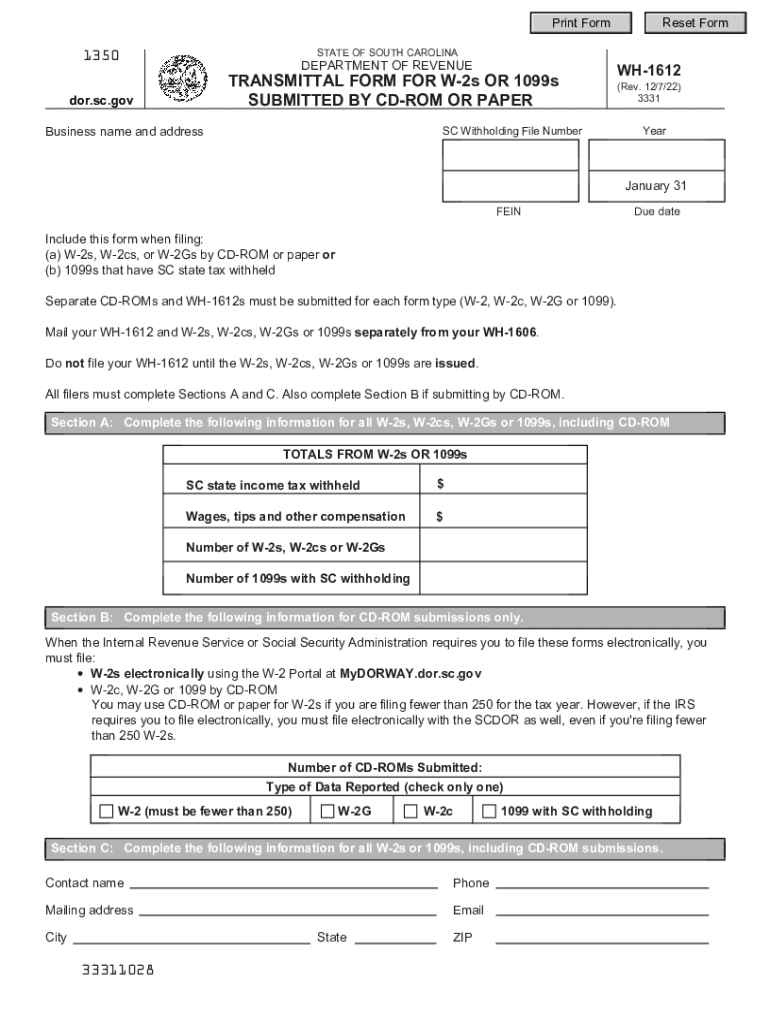

The transmittal form for W-2s or 1099s is a crucial document that accompanies these tax forms when they are submitted to the IRS. This form serves to summarize the information contained in the W-2 or 1099 forms and ensures that the IRS can accurately process the reported income. For employers and businesses, this form is essential for compliance with federal tax regulations, as it provides a clear record of the income reported for each employee or contractor.

Steps to complete the transmittal form for W-2s or 1099s submitted by

Completing the transmittal form involves several important steps:

- Gather all necessary information from your W-2 or 1099 forms, including the total number of forms being submitted.

- Fill out the transmittal form with your business details, including your name, address, and Employer Identification Number (EIN).

- Indicate the total amount of wages, tips, and other compensation reported on the W-2 forms, or the total amount reported on the 1099 forms.

- Review the completed form for accuracy to ensure all information is correct.

- Sign and date the form before submission.

Legal use of the transmittal form for W-2s or 1099s submitted by

The legal use of the transmittal form is governed by IRS regulations. It is required for businesses to submit this form when filing W-2s or 1099s to ensure compliance with federal tax laws. Failure to submit the transmittal form can lead to penalties and complications during tax audits. It is important to understand that this form must be completed accurately and submitted on time to avoid any legal issues.

Filing deadlines / Important dates

It is essential to be aware of the filing deadlines for the transmittal form. Typically, the deadline for submitting W-2 forms to the IRS is January thirty-first of the following year. For 1099 forms, the deadline can vary based on the type of 1099 being filed. Keeping track of these important dates helps ensure timely compliance and avoids potential penalties.

Form submission methods (Online / Mail / In-Person)

The transmittal form can be submitted through various methods:

- Online: Many businesses choose to file electronically using IRS-approved software, which simplifies the process and ensures faster processing times.

- Mail: The form can be printed and mailed to the IRS. Ensure that it is sent to the correct address based on your location.

- In-Person: Some businesses may opt to deliver the forms in person at designated IRS offices, although this method is less common.

IRS guidelines

The IRS provides specific guidelines for completing and submitting the transmittal form. These guidelines include detailed instructions on the information required, formatting specifications, and submission methods. Familiarizing yourself with these guidelines is crucial for ensuring compliance and avoiding errors that could lead to delays or penalties.

Quick guide on how to complete transmittal form for w 2s or 1099s submitted by

Effortlessly Prepare TRANSMITTAL FORM FOR W 2s OR 1099s SUBMITTED BY on Any Device

Web-based document management has gained prominence among organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly, without delays. Manage TRANSMITTAL FORM FOR W 2s OR 1099s SUBMITTED BY on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Way to Alter and Electronically Sign TRANSMITTAL FORM FOR W 2s OR 1099s SUBMITTED BY with Ease

- Locate TRANSMITTAL FORM FOR W 2s OR 1099s SUBMITTED BY and click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and possesses the same legal standing as a traditional signature made with ink.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, and errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign TRANSMITTAL FORM FOR W 2s OR 1099s SUBMITTED BY to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct transmittal form for w 2s or 1099s submitted by

Create this form in 5 minutes!

People also ask

-

What is the 2014 fillable wh1612 form?

The 2014 fillable wh1612 form is a document used for tax purposes in Australia, allowing individuals to report specific financial information. It is designed to be easy to fill out and submit, streamlining the process for users. This form can be easily accessed and completed online, improving overall efficiency.

-

How can airSlate SignNow help with the 2014 fillable wh1612?

AirSlate SignNow allows you to easily eSign and send your 2014 fillable wh1612 form, ensuring fast and secure document management. Our platform simplifies the process of preparing and signing forms, saving you time and resources. Enjoy a seamless experience from start to finish with our user-friendly interface.

-

Is there a cost associated with using the 2014 fillable wh1612 on airSlate SignNow?

Using airSlate SignNow for the 2014 fillable wh1612 comes with flexible pricing plans tailored to various business needs. We offer competitive rates that reflect the value of our document signing solutions. Explore our pricing page to find the plan that best suits your requirements.

-

Are there any key features available for the 2014 fillable wh1612 on airSlate SignNow?

Yes, airSlate SignNow provides several features that enhance the use of the 2014 fillable wh1612 form, including templates and automation tools. Users can customize their documents, track signers, and set reminders, making the process efficient. These features help simplify the management of important tax documents.

-

What benefits can users expect when using airSlate SignNow for the 2014 fillable wh1612?

Users can expect signNow time savings and reduced errors when using airSlate SignNow for the 2014 fillable wh1612. Our digital solution eliminates the need for physical paperwork, allowing for quick electronic submissions. This ultimately leads to a more organized and hassle-free experience.

-

Can I integrate airSlate SignNow with other software for the 2014 fillable wh1612?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, enhancing your experience with the 2014 fillable wh1612 form. Popular integrations include CRM systems, cloud storage services, and project management tools, streamlining your document workflows.

-

Is it safe to use airSlate SignNow for the 2014 fillable wh1612?

Yes, security is a top priority at airSlate SignNow. When using the 2014 fillable wh1612 form, your documents are protected with industry-standard encryption and compliance measures. We ensure that your sensitive information remains confidential and secure at all times.

Get more for TRANSMITTAL FORM FOR W 2s OR 1099s SUBMITTED BY

- Plumbing contractor package oklahoma form

- Brick mason contractor package oklahoma form

- Roofing contractor package oklahoma form

- Electrical contractor package oklahoma form

- Sheetrock drywall contractor package oklahoma form

- Flooring contractor package oklahoma form

- Trim carpentry contractor package oklahoma form

- Fencing contractor package oklahoma form

Find out other TRANSMITTAL FORM FOR W 2s OR 1099s SUBMITTED BY

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast