FORM 725 K I ENTUCKY NDIVIDUALLY Department of Revenue 2021

What is the FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue

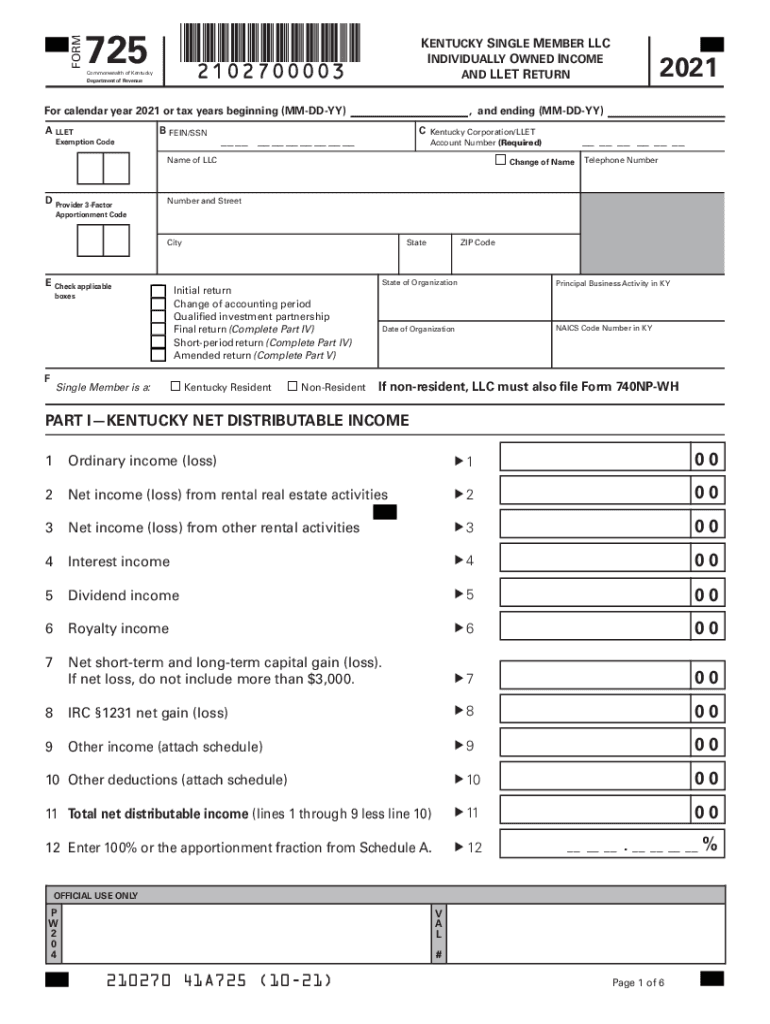

The FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue is a tax form used by individual taxpayers in Kentucky to report their income and calculate their tax liability. This form is essential for ensuring compliance with state tax regulations. It typically includes sections for personal information, income details, deductions, and credits. Proper completion of this form is crucial for accurate tax assessment and avoiding potential penalties.

Steps to complete the FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue

Completing the FORM 725 K I ENTUCKY NDIVIDUALLY involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income in the designated section, ensuring all sources are included.

- Claim any deductions or credits you qualify for, which can help reduce your taxable income.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Sign and date the form before submission.

How to obtain the FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue

The FORM 725 K I ENTUCKY NDIVIDUALLY can be obtained through the Kentucky Department of Revenue's official website. It is typically available in a downloadable PDF format, allowing taxpayers to print and fill it out manually. Additionally, some tax preparation software may include this form as part of their offerings, simplifying the process of obtaining and completing it.

Legal use of the FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue

The legal use of the FORM 725 K I ENTUCKY NDIVIDUALLY is governed by Kentucky state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated filing deadline. Failure to comply with these regulations can result in penalties or fines. It is important to ensure that all information provided is truthful and complete, as discrepancies can lead to audits or legal issues.

Required Documents

When completing the FORM 725 K I ENTUCKY NDIVIDUALLY, several documents are required to ensure accurate reporting:

- W-2 forms from employers, detailing your annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, such as receipts for medical expenses or charitable contributions.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the FORM 725 K I ENTUCKY NDIVIDUALLY. Typically, individual tax returns must be filed by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions or additional deadlines that may apply to specific circumstances.

Quick guide on how to complete form 725 k i entucky ndividually department of revenue

Effortlessly Prepare FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any delays. Manage FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue with Ease

- Find FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 725 k i entucky ndividually department of revenue

Create this form in 5 minutes!

People also ask

-

What is FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue?

FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue is a specific tax form used by individuals in Kentucky to report certain tax information. Understanding this form is crucial for compliance with state tax regulations and ensuring correct filing.

-

How can I complete FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue online?

You can easily complete FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue online using airSlate SignNow. Our platform provides a user-friendly interface that guides you through the process, allowing for efficient document preparation and submission.

-

What are the pricing options for using airSlate SignNow with FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, providing flexibility depending on your frequency of use for FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue and other documents.

-

What features does airSlate SignNow offer for managing FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue?

Our platform includes robust features such as electronic signatures, document templates, and automated reminders. These features help streamline the entire process of managing FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue, making it more efficient.

-

What are the benefits of using airSlate SignNow for FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue?

Using airSlate SignNow for FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue ensures a smooth and legally compliant way to sign and send documents. It saves time, reduces paper usage, and enhances collaboration among users.

-

Can airSlate SignNow integrate with other software for FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue?

Yes, airSlate SignNow offers seamless integrations with various software and applications. This flexibility allows you to work with existing systems while managing FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue efficiently.

-

How secure is my information when using airSlate SignNow for FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption methods to protect your information while processing FORM 725 K I KENTUCKY INDIVIDUALLY Department Of Revenue, ensuring compliance with industry standards.

Get more for FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue

- Letters of recommendation package oklahoma form

- Oklahoma construction or mechanics lien package individual oklahoma form

- Oklahoma construction or mechanics lien package corporation oklahoma form

- Storage business package oklahoma form

- Child care services package oklahoma form

- Special or limited power of attorney for real estate sales transaction by seller oklahoma form

- Ok limited form

- Limited power of attorney where you specify powers with sample powers included oklahoma form

Find out other FORM 725 K I ENTUCKY NDIVIDUALLY Department Of Revenue

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form