Texas Demand Payment Form

What is the Texas Demand Payment

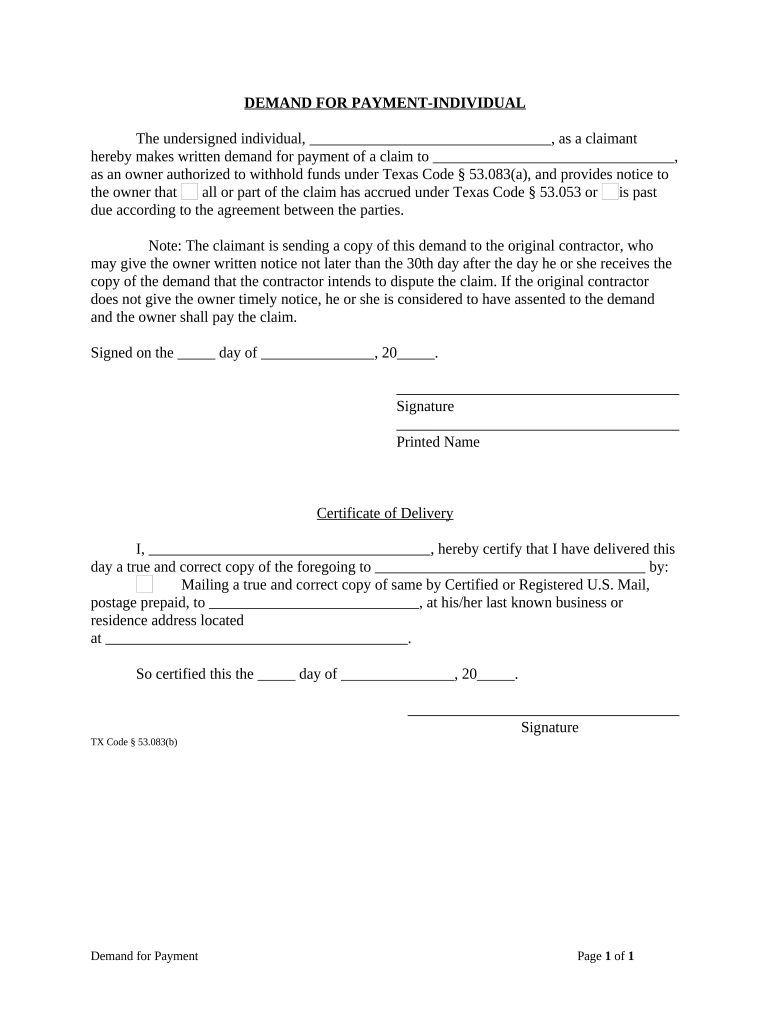

The Texas Demand Payment is a formal request made by a creditor to a debtor, seeking payment for a specific amount owed. This document serves as a critical tool for businesses and individuals in Texas to ensure timely payment for goods or services rendered. It outlines the details of the debt, including the amount due, the nature of the transaction, and any applicable payment terms. Understanding this form is essential for both creditors and debtors to navigate financial obligations effectively.

How to Use the Texas Demand Payment

Utilizing the Texas Demand Payment involves several key steps. First, the creditor should clearly state the amount owed and provide any relevant details about the transaction. This includes dates, invoice numbers, and descriptions of goods or services provided. Next, the creditor must deliver the demand payment to the debtor, which can be done through various methods such as mail, email, or in-person delivery. It is advisable to keep a record of this communication for future reference, especially if legal action becomes necessary.

Steps to Complete the Texas Demand Payment

Completing the Texas Demand Payment requires careful attention to detail. Here are the essential steps:

- Gather all relevant information about the debt, including the amount owed and transaction details.

- Draft the demand payment document, ensuring it includes all necessary information, such as the creditor's contact details and a clear statement of the amount due.

- Specify a deadline for payment to encourage prompt action from the debtor.

- Choose a delivery method that ensures the debtor receives the document, maintaining proof of delivery.

- Retain a copy of the demand payment for your records.

Legal Use of the Texas Demand Payment

The Texas Demand Payment is legally recognized as a formal request for payment. To ensure its enforceability, it must adhere to specific legal standards. This includes providing accurate information and following the proper delivery protocols. If the debtor fails to respond or make payment, the creditor may use the demand payment as evidence in court if further legal action is required. Understanding the legal implications of this document helps both parties navigate their rights and responsibilities effectively.

Key Elements of the Texas Demand Payment

Several key elements must be included in the Texas Demand Payment to ensure its effectiveness:

- Creditor Information: Name, address, and contact details of the creditor.

- Debtor Information: Name and address of the debtor.

- Amount Due: The total amount owed, including any applicable fees or interest.

- Payment Terms: Clear instructions on how and when the payment should be made.

- Deadline: A specific date by which the payment must be received.

Examples of Using the Texas Demand Payment

There are various scenarios where the Texas Demand Payment can be utilized effectively. For instance, a small business may issue a demand payment to a client who has not paid an invoice for services rendered. Similarly, an individual may use this form to request payment for a loan given to a friend or family member. Each example highlights the importance of clear communication and documentation in financial transactions, ensuring that both parties understand their obligations.

Quick guide on how to complete texas demand payment 497327303

Complete Texas Demand Payment effortlessly on any device

Managing documents online has gained immense popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow supplies you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Texas Demand Payment across any platform using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The easiest way to modify and eSign Texas Demand Payment without hassle

- Locate Texas Demand Payment and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns regarding lost or mislaid files, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Texas Demand Payment and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas demand payment?

A Texas demand payment is a formal request for payment that obliges the debtor to clear their dues. This document is essential for businesses seeking to collect outstanding debts efficiently. Utilizing airSlate SignNow, you can create and eSign a Texas demand payment quickly, ensuring it meets legal requirements.

-

How can airSlate SignNow help with Texas demand payment processing?

airSlate SignNow streamlines the process of creating and sending Texas demand payment documents. Our platform allows you to generate customizable templates that save time while ensuring compliance. With electronic signatures, you can finalize agreements swiftly, reducing the time spent on collections.

-

Is there a cost associated with using airSlate SignNow for Texas demand payment?

Yes, airSlate SignNow offers competitive pricing for businesses looking to manage Texas demand payment documents. We provide various subscription plans catering to different business sizes and needs, ensuring you get the best value. Each plan includes features that enhance document management and streamline payment requests.

-

What features does airSlate SignNow offer for Texas demand payment documents?

With airSlate SignNow, you can create, edit, and send Texas demand payment documents efficiently. Our platform includes features such as electronic signatures, document storage, and automated reminders. This comprehensive functionality makes tracking and managing your payment requests easier.

-

Can I integrate airSlate SignNow with other software for Texas demand payment management?

Absolutely! airSlate SignNow offers integrations with various software and applications, enhancing your payment management capabilities. Whether you use CRM, accounting software, or other business tools, our solution can connect seamlessly to facilitate your Texas demand payment processes.

-

What are the benefits of using airSlate SignNow for a Texas demand payment?

Using airSlate SignNow for Texas demand payment brings multiple benefits, including efficiency and legal compliance. The platform allows you to track document status in real-time, ensuring that you are updated with the payment process. Moreover, the ease of eSigning fosters quicker responses from debtors.

-

Is the Texas demand payment form customizable in airSlate SignNow?

Yes, the Texas demand payment form in airSlate SignNow is fully customizable. You can tailor the document to fit your specific needs, including adding your company logo and necessary legal language. This flexibility helps ensure that your demands effectively communicate your terms and expectations.

Get more for Texas Demand Payment

Find out other Texas Demand Payment

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now