Account Trust Form

What is the Account Trust

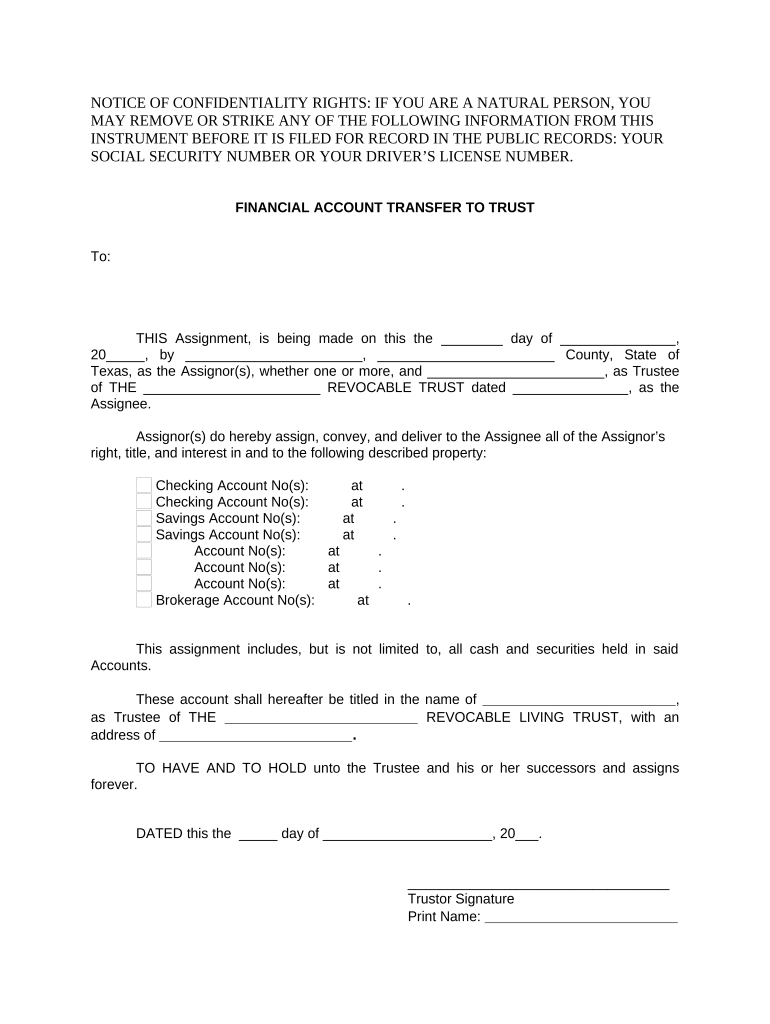

An account trust is a legal arrangement in which one party holds assets on behalf of another. This structure is often used for estate planning, asset protection, and managing funds for beneficiaries. The trust outlines the terms under which the assets are managed and distributed, ensuring that the intentions of the trustor are honored. In the United States, account trusts can take various forms, including revocable and irrevocable trusts, each serving different purposes based on the needs of the trustor.

How to use the Account Trust

Using an account trust involves several steps to ensure it operates effectively. First, the trustor must define the assets to be placed in the trust and identify the beneficiaries. Next, the trust document should be drafted, detailing the terms of the trust, including how assets will be managed and distributed. Once established, the trustor can transfer ownership of the assets into the trust. It is essential to appoint a reliable trustee who will manage the assets according to the trust's terms. Regular reviews of the trust may also be necessary to ensure it continues to meet the trustor's goals.

Steps to complete the Account Trust

Completing an account trust involves a systematic approach:

- Identify the assets to be included in the trust.

- Choose beneficiaries who will receive the assets.

- Draft the trust document, specifying terms and conditions.

- Designate a trustee responsible for managing the trust.

- Transfer ownership of the assets into the trust.

- Review and update the trust periodically to reflect any changes in circumstances.

Legal use of the Account Trust

The legal use of an account trust is governed by state laws, which dictate how trusts must be established and administered. For a trust to be legally valid, it must meet specific requirements, such as having a clear purpose, identifiable beneficiaries, and a designated trustee. Additionally, the trust must comply with relevant tax laws and regulations, ensuring that it serves its intended purpose without legal complications. Understanding these legal frameworks is crucial for trustors to ensure their account trust is enforceable and effective.

Key elements of the Account Trust

Several key elements define an account trust:

- Trustor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust's assets according to the trust document.

- Beneficiaries: Individuals or entities that will receive benefits from the trust.

- Trust Document: A legal document that outlines the terms, conditions, and purpose of the trust.

- Assets: Property or funds placed into the trust for management and distribution.

Eligibility Criteria

Eligibility to establish an account trust typically requires the trustor to be of legal age and possess the mental capacity to create a trust. Additionally, the trustor must have assets to place into the trust. While there are no specific income or asset thresholds, the trustor should consider the complexity of their estate and the needs of the beneficiaries when determining whether an account trust is appropriate. It's advisable to consult with a legal professional to ensure compliance with state laws and regulations.

Quick guide on how to complete account trust

Complete Account Trust effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to locate the right form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage Account Trust on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to alter and eSign Account Trust without hassle

- Obtain Account Trust and click on Retrieve Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow portions of your documents or obscure confidential information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Finished button to save your modifications.

- Choose how you'd like to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Account Trust and ensure remarkable communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is account trust and why is it important for my business?

Account trust refers to the reliability and security of your digital transaction environment. For businesses using airSlate SignNow, establishing account trust is crucial as it ensures that your documents are signed and shared safely. This enhances your confidence in the eSigning process and fosters stronger relationships with clients.

-

How does airSlate SignNow enhance account trust for document transactions?

airSlate SignNow enhances account trust through advanced security protocols, such as encryption and multi-factor authentication. These features protect your documents and identities during the signing process. By using airSlate SignNow, you can be sure that your transactions are secure and verifiable.

-

What pricing plans are available for airSlate SignNow, and how do they impact account trust?

airSlate SignNow offers several pricing plans designed to fit different business needs. Choosing the right plan can help you maximize account trust by providing access to enhanced security features and integrations. By selecting a plan that meets your organization's requirements, you can ensure that your eSigning solutions are both effective and secure.

-

Can airSlate SignNow integrate with other platforms to maintain account trust?

Yes, airSlate SignNow seamlessly integrates with various platforms, such as Google Drive and Salesforce, to maintain account trust. These integrations allow for a smoother transaction process while ensuring that your documents remain secure and easily accessible. By using trusted third-party applications, you enhance the overall trustworthiness of your document management system.

-

What features in airSlate SignNow specifically support account trust?

Key features in airSlate SignNow that support account trust include audit trails, tamper-proof seals, and customizable workflows. These features ensure all transactions are trackable and verifiable, enhancing trust for both you and your clients. With these security measures, you can confidently manage and sign documents knowing that they are protected.

-

How does airSlate SignNow ensure compliance with industry regulations to maintain account trust?

airSlate SignNow complies with various industry regulations, such as eIDAS and ESIGN Act, to maintain account trust. This compliance means that your electronic signatures are legally valid and recognized across jurisdictions. By adhering to these regulations, airSlate SignNow assures you that your document transactions are legitimate and secure.

-

What benefits do I gain by using airSlate SignNow for account trust?

Using airSlate SignNow offers numerous benefits for enhancing account trust, including time savings, increased security, and improved workflow efficiencies. This platform allows businesses to implement eSigning solutions that are both reliable and quick, helping you maintain a trustworthy relationship with your clients. Additionally, a streamlined signing process boosts productivity within your organization.

Get more for Account Trust

Find out other Account Trust

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors