St 105 Form 2005

What is the St 105 Form

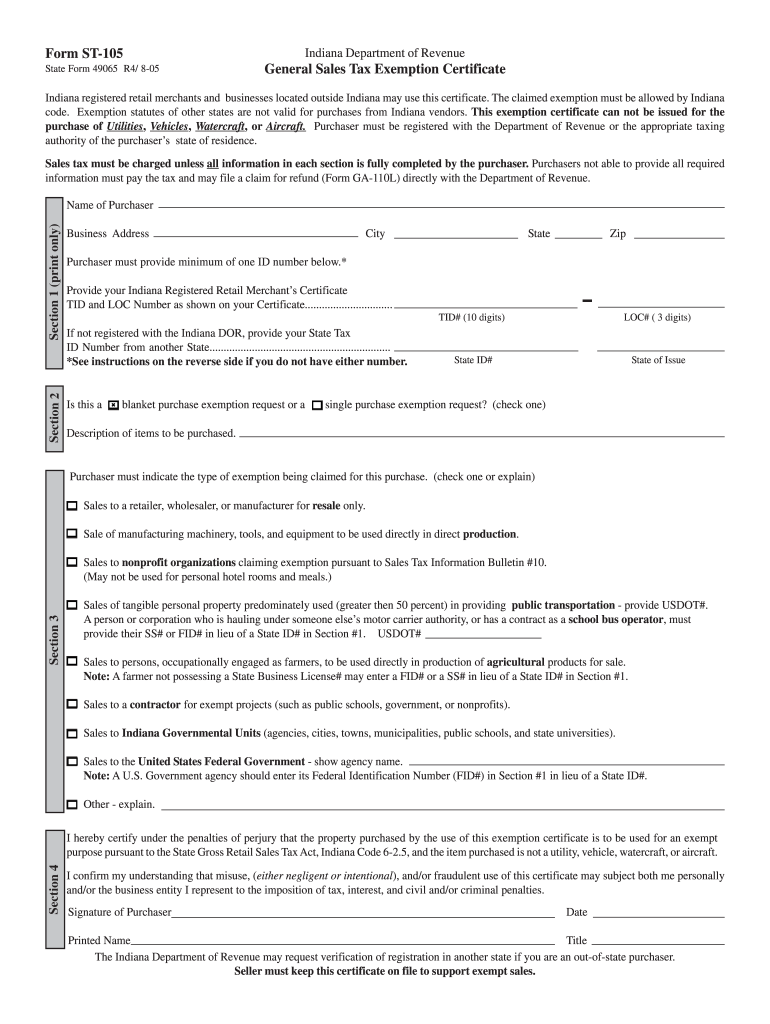

The St 105 Form is a sales tax exemption certificate used in the United States, specifically in New York. This form allows eligible purchasers to buy goods or services without paying sales tax, provided that the items are intended for resale or for specific exempt purposes. The St 105 Form is crucial for businesses and individuals who qualify for tax exemptions, as it helps streamline the purchasing process and ensures compliance with state tax regulations.

How to use the St 105 Form

To use the St 105 Form, individuals or businesses must complete the form accurately and present it to the seller at the time of purchase. The form requires specific information, including the purchaser's name, address, and the reason for the exemption. It is essential to ensure that the details provided are correct, as inaccuracies may lead to complications or denial of the exemption. Sellers are responsible for retaining a copy of the completed form for their records, which may be required for tax audits.

Steps to complete the St 105 Form

Completing the St 105 Form involves several straightforward steps:

- Begin by downloading the St 105 Form from the appropriate state tax authority website.

- Fill in the purchaser's name and address accurately.

- Indicate the type of exemption being claimed, such as resale or other qualifying reasons.

- Provide the seller's name and address.

- Sign and date the form to validate the information provided.

Once completed, present the form to the seller to finalize the tax-exempt purchase.

Legal use of the St 105 Form

The St 105 Form is legally binding when completed correctly. It must be used in accordance with state laws governing sales tax exemptions. The purchaser is responsible for ensuring that they qualify for the exemption claimed. Misuse of the form, such as using it for non-exempt purchases, may result in penalties, including back taxes, interest, and potential fines. Therefore, understanding the legal implications and maintaining accurate records is essential for compliance.

Who Issues the Form

The St 105 Form is issued by the New York State Department of Taxation and Finance. This agency oversees the administration of sales tax and provides the necessary forms and guidelines for taxpayers. Individuals and businesses can access the St 105 Form through the department's official website or by contacting their offices for assistance.

Examples of using the St 105 Form

The St 105 Form can be utilized in various scenarios. For instance:

- A retailer purchasing inventory for resale can present the St 105 Form to suppliers to avoid sales tax on those items.

- A nonprofit organization may use the form when acquiring goods for charitable activities, ensuring they do not incur sales tax on exempt purchases.

These examples illustrate the practical application of the St 105 Form in facilitating tax-exempt transactions.

Quick guide on how to complete st 105 form 2005

Complete St 105 Form effortlessly on any device

Digital document management has become increasingly favored by enterprises and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage St 105 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign St 105 Form with ease

- Obtain St 105 Form and click Get Form to begin.

- Make use of the tools we provide to fill in your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, laborious form searches, or mistakes that require printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Modify and eSign St 105 Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 105 form 2005

Create this form in 5 minutes!

How to create an eSignature for the st 105 form 2005

How to make an electronic signature for the St 105 Form 2005 in the online mode

How to make an electronic signature for your St 105 Form 2005 in Chrome

How to generate an electronic signature for signing the St 105 Form 2005 in Gmail

How to generate an electronic signature for the St 105 Form 2005 from your smart phone

How to create an eSignature for the St 105 Form 2005 on iOS devices

How to make an eSignature for the St 105 Form 2005 on Android OS

People also ask

-

What is the St 105 Form and how is it used?

The St 105 Form is a crucial document used for sales tax exemption in various states. It allows eligible purchasers to buy goods without paying sales tax, provided they fill out the form correctly. By using the St 105 Form, businesses can streamline their purchasing process and ensure compliance with tax regulations.

-

How can I easily eSign the St 105 Form using airSlate SignNow?

With airSlate SignNow, eSigning the St 105 Form is simple and efficient. Our platform allows you to upload the form, add your electronic signature, and send it to other parties for their signatures. This digital solution ensures that your St 105 Form is signed quickly, securely, and without the hassle of printing.

-

Is airSlate SignNow affordable for businesses needing the St 105 Form?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to meet the needs of businesses that require the St 105 Form. With flexible subscription options, companies can choose the plan that best fits their budget while enjoying unlimited eSigning capabilities. This makes it an economical choice for frequent users of the St 105 Form.

-

What features does airSlate SignNow offer for managing the St 105 Form?

airSlate SignNow provides a range of features to enhance your experience with the St 105 Form. You can create templates for the form, set signing orders, and track the status of your documents in real-time. These tools help ensure that your St 105 Form is processed efficiently and that all parties are on the same page.

-

Can I integrate airSlate SignNow with other applications for the St 105 Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to manage your St 105 Form alongside other business tools. Whether you're using CRM systems, accounting software, or cloud storage services, integration capabilities ensure that your workflow remains uninterrupted.

-

What are the benefits of using airSlate SignNow for the St 105 Form?

Using airSlate SignNow for the St 105 Form offers numerous benefits, including improved efficiency and enhanced security. The platform allows you to store, send, and eSign documents securely while reducing the time spent on paperwork. Additionally, the convenience of digital signatures means you can complete transactions from anywhere.

-

How secure is the St 105 Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling important documents like the St 105 Form. Our platform uses advanced encryption standards to protect your data during transmission and storage. You can trust that your St 105 Form and other documents are safe from unauthorized access.

Get more for St 105 Form

- Individual amp family plans hipaa ppo guaranteed issue form

- Bp a0629 form

- Pr application costco form

- Fatburger application form

- Migrant and seasonal agricultural worker protection act spanish dol form

- Notice and acknowledgement of pay rate and paydayaviso y labor ny form

- Income in kind verification form

- Checks word templates page 26 form

Find out other St 105 Form

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template