Texas Widow Form

What is the Texas Widow

The Texas Widow form is a legal document used in the state of Texas to establish the status and rights of a widow regarding her deceased spouse's estate. This form is essential for navigating the complexities of estate management, particularly in matters related to inheritance, property distribution, and claims against the estate. Understanding the Texas Widow form is crucial for ensuring that the widow's rights are recognized and protected under Texas law.

How to use the Texas Widow

Using the Texas Widow form involves several steps to ensure it is completed accurately and submitted correctly. First, gather all necessary information regarding the deceased spouse, including their full name, date of birth, and date of death. Next, provide details about the marriage, such as the marriage certificate and any relevant documentation that supports the widow's claim to the estate. Finally, ensure that the form is signed and dated appropriately, as this will validate its legal standing.

Steps to complete the Texas Widow

Completing the Texas Widow form requires careful attention to detail. Start by filling in personal information about both the widow and the deceased spouse. Include the date of marriage and any pertinent details about the estate. Once all information is entered, review the form for accuracy. It is advisable to consult with a legal professional to ensure compliance with Texas estate laws. After finalizing the form, submit it to the appropriate court or agency as required.

Legal use of the Texas Widow

The legal use of the Texas Widow form is governed by state laws that outline the rights of a widow in relation to her deceased spouse's estate. This form serves as a formal declaration of the widow's status and is often required in probate proceedings. Properly executing the Texas Widow form can help protect the widow's interests and ensure that she receives her rightful inheritance according to Texas law.

Key elements of the Texas Widow

Several key elements must be included in the Texas Widow form to ensure its validity. These elements typically include the full names of both spouses, the date of marriage, the date of death of the deceased spouse, and any relevant information about the estate. Additionally, the form may require the widow's signature and possibly notarization to enhance its legal credibility. Ensuring these elements are present is critical for the form's acceptance in legal proceedings.

Eligibility Criteria

Eligibility to use the Texas Widow form is primarily based on the marital relationship between the widow and the deceased. The individual must be legally recognized as the spouse of the deceased at the time of death. Additionally, the widow must not have remarried prior to completing the form. Understanding these criteria is essential for ensuring that the form is applicable and that the widow's rights are upheld in estate matters.

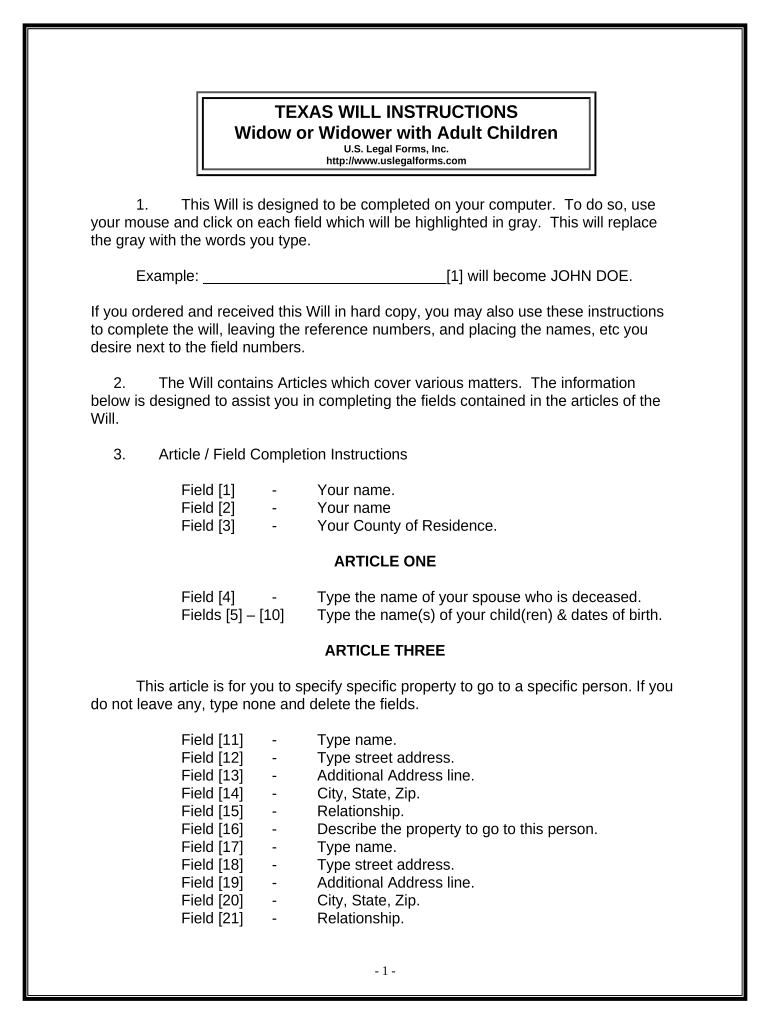

Quick guide on how to complete texas widow

Complete Texas Widow effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and electronically sign your documents promptly without delays. Handle Texas Widow on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign Texas Widow seamlessly

- Obtain Texas Widow and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to finalize your changes.

- Select how you wish to send your form, whether through email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Texas Widow and ensure optimal communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the cost of using airSlate SignNow for a texas widow?

airSlate SignNow offers competitive pricing plans to accommodate the needs of a texas widow. Our solutions are designed to be cost-effective, allowing you to access essential eSigning features without breaking the bank. You can choose from different subscription tiers based on the volume of documents and features you require.

-

What features does airSlate SignNow provide for a texas widow?

airSlate SignNow is equipped with a variety of features that cater to a texas widow, including easy electronic signatures, document templates, and secure cloud storage. These features help streamline your document workflow and ensure that all your important files are easily accessible and safely stored.

-

How can airSlate SignNow benefit a texas widow?

For a texas widow, airSlate SignNow provides a simple way to manage legal documents and contracts without the hassle of physical signatures. The platform increases efficiency and reduces turnaround time, allowing you to focus on other important matters while we handle your documentation needs.

-

Is airSlate SignNow user-friendly for a texas widow?

Absolutely! airSlate SignNow is designed with ease of use in mind, making it accessible for a texas widow, even if you are not tech-savvy. The intuitive interface guides users through the eSigning process step-by-step, ensuring that you can complete transactions smoothly and efficiently.

-

Can a texas widow integrate airSlate SignNow with other tools?

Yes, airSlate SignNow offers seamless integrations with various tools and applications that a texas widow may already be using. You can connect our eSigning solution with platforms like Google Drive, Dropbox, and CRM systems to create a more streamlined document management experience.

-

How secure is airSlate SignNow for a texas widow's documents?

Security is a top priority for airSlate SignNow, ensuring that a texas widow's documents are protected at all times. We employ advanced encryption and secure servers to safeguard your sensitive data, giving you peace of mind when handling important legal and financial documents.

-

What support does airSlate SignNow offer for a texas widow?

airSlate SignNow provides excellent customer support tailored for a texas widow. Whether you have questions about your account or need assistance with features, our dedicated support team is available to help you navigate the platform and resolve any issues.

Get more for Texas Widow

- Box 7228 form

- Court visitor name form

- Final judgment of dissolution of marriage with property but no dependent or minor children uncontested this cause came before form

- Answering a complaint in probate ampamp family court masslegalhelp form

- Tenancy summons and return of service r 62 1 nj judiciary form

- Foreclosure by sale committee deed connecticut judicial branch jud ct form

- Fl 276 response to notice of motion to set aside judgment of paternity family law governmental judicial council forms courts ca

- Form mt 51519mortgage recording tax returnmt15

Find out other Texas Widow

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple