City Tax Forms KCMO Gov 2022-2026

What is the Kansas City Earnings Tax Form RD 109?

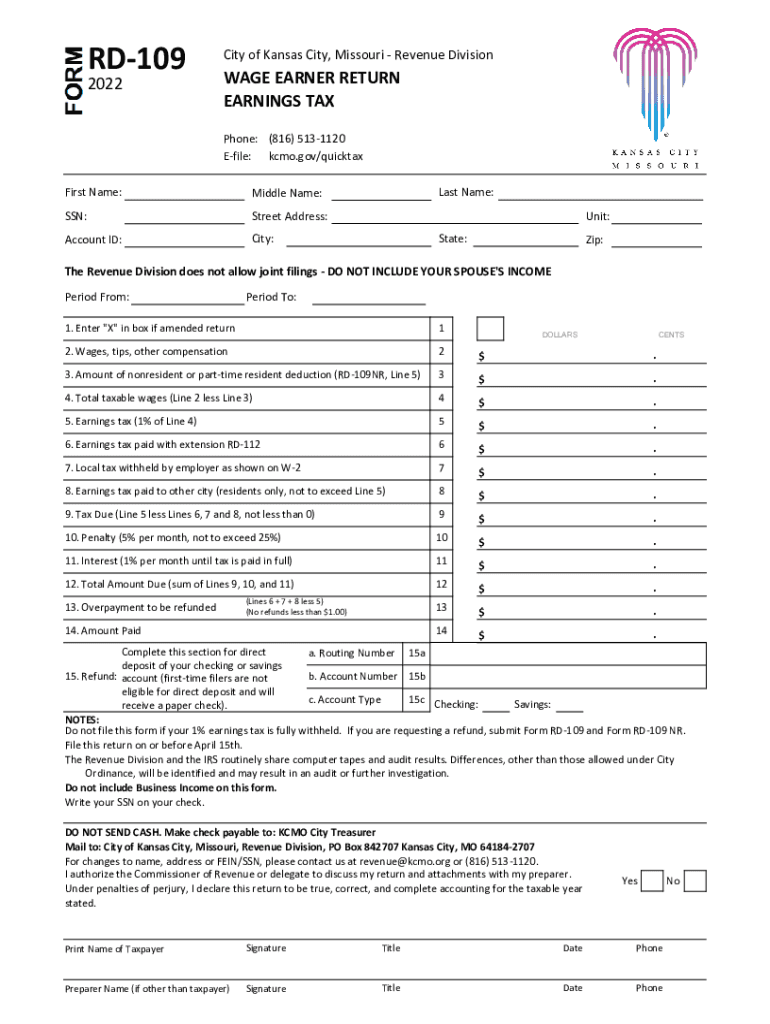

The Kansas City Earnings Tax Form RD 109 is a tax document required for individuals who earn income within the city limits of Kansas City, Missouri. This form is essential for reporting earnings and ensuring compliance with local tax regulations. It is specifically designed for residents and non-residents who have taxable income sourced from Kansas City. Understanding the purpose and requirements of the RD 109 is crucial for accurate tax reporting and avoiding penalties.

Steps to Complete the Kansas City Earnings Tax Form RD 109

Completing the RD 109 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099 forms, and any other relevant income statements. Next, accurately fill out the form, providing details such as your name, address, and total earnings. It is important to calculate the tax owed based on the earnings reported. Finally, review the completed form for any errors before submitting it. Ensure that you retain a copy for your records.

Legal Use of the Kansas City Earnings Tax Form RD 109

The RD 109 is legally binding when completed and submitted according to Kansas City tax regulations. To ensure its validity, the form must be signed and dated by the taxpayer. Additionally, compliance with local tax laws is essential to avoid any legal repercussions. Utilizing a reliable eSignature solution can enhance the legal standing of the form, providing a secure and verifiable method of signing.

Filing Deadlines for the Kansas City Earnings Tax Form RD 109

Filing deadlines for the RD 109 are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the filing schedule to ensure timely submission.

Required Documents for the Kansas City Earnings Tax Form RD 109

When preparing to file the RD 109, certain documents are required to substantiate your income claims. These include W-2 forms from employers, 1099 forms for freelance or contract work, and any other documentation that reflects income earned within Kansas City. Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Penalties for Non-Compliance with the Kansas City Earnings Tax Form RD 109

Failure to file the RD 109 by the deadline or submitting inaccurate information can lead to penalties. The city may impose fines and interest on any unpaid taxes. In severe cases, persistent non-compliance may result in legal action. It is important to adhere to all filing requirements to avoid these potential consequences.

Quick guide on how to complete city tax forms kcmogov

Complete City Tax Forms KCMO gov effortlessly on any device

Electronic document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without hindrances. Manage City Tax Forms KCMO gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign City Tax Forms KCMO gov with ease

- Obtain City Tax Forms KCMO gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize the important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet-ink signature.

- Review all the details and then click the Done button to save your amendments.

- Choose your preferred method for sending your form, whether by email, SMS, or a shareable link, or download it to your computer.

Say goodbye to missing or lost files, the hassle of document searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Alter and eSign City Tax Forms KCMO gov and guarantee effective communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city tax forms kcmogov

Create this form in 5 minutes!

How to create an eSignature for the city tax forms kcmogov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kansas City earnings tax form?

The Kansas City earnings tax form is a document required for residents and workers in Kansas City to report their earnings. This form helps to determine the amount of earnings tax owed to the city. Understanding this form is essential for compliance with local tax regulations.

-

How do I complete the Kansas City earnings tax form using airSlate SignNow?

To complete the Kansas City earnings tax form with airSlate SignNow, you can easily upload your document and fill it out electronically. Our user-friendly interface allows you to add necessary information effortlessly. Once completed, you can eSign the document and send it directly to the city or keep it for your records.

-

Is there a fee for using airSlate SignNow to process the Kansas City earnings tax form?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses that regularly need to manage documents like the Kansas City earnings tax form. Our plans provide great value and allow unlimited signing and storage of documents. Be sure to check our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other software for managing the Kansas City earnings tax form?

Absolutely! airSlate SignNow integrates seamlessly with various popular software solutions. This allows you to streamline your workflow when managing the Kansas City earnings tax form and other important documents, enhancing operational efficiency and reducing manual data entry.

-

What are the benefits of using airSlate SignNow for the Kansas City earnings tax form?

Using airSlate SignNow for the Kansas City earnings tax form simplifies the filing process. The platform offers features like eSigning, templates, and cloud storage, which ensure that your documents are secure and easily accessible. This reduces the risk of errors and saves you time during tax season.

-

How secure is my information when I use airSlate SignNow for the Kansas City earnings tax form?

Your data security is our top priority. When you use airSlate SignNow for the Kansas City earnings tax form, we utilize encryption and secure servers to protect your information. You can trust that your sensitive data is safe while using our platform.

-

What types of documents can I manage besides the Kansas City earnings tax form with airSlate SignNow?

In addition to the Kansas City earnings tax form, airSlate SignNow allows you to manage a wide range of documents, including contracts, agreements, and consent forms. Whether for personal or business use, our platform caters to all your digital document needs.

Get more for City Tax Forms KCMO gov

Find out other City Tax Forms KCMO gov

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple