, Form 588 Nonresident Withholding Waiver Request , Form 588, Nonresident Withholding Waiver Request 2023-2026

Understanding the California Withholding Waiver Request

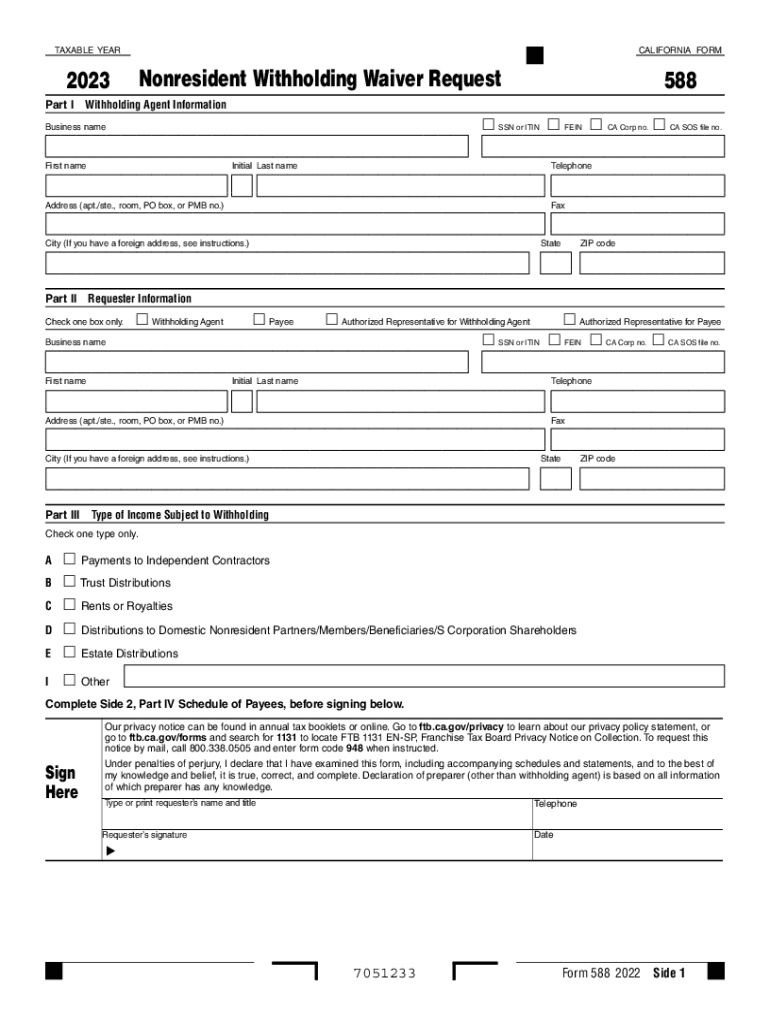

The California Withholding Waiver Request, formally known as Form 588, allows nonresidents to request a waiver of withholding on specific income types. This form is particularly relevant for individuals or entities that receive income from California sources but are not residents of the state. By submitting this form, nonresidents can potentially avoid unnecessary withholding on their earnings, ensuring they receive the full amount due to them without premature tax deductions.

Steps to Complete the California Withholding Waiver Request

Completing the Form 588 requires careful attention to detail to ensure compliance with California tax regulations. Here are the steps to follow:

- Gather Necessary Information: Collect all relevant details, including your name, address, and the type of income for which you are requesting the waiver.

- Fill Out the Form: Accurately complete all sections of the form, providing clear and concise information as required.

- Attach Supporting Documentation: Include any necessary documents that support your request, such as contracts or agreements related to the income.

- Review for Accuracy: Double-check all entries for correctness to avoid delays in processing your request.

- Submit the Form: Send the completed Form 588 to the appropriate California tax authority as instructed on the form.

Eligibility Criteria for the California Withholding Waiver Request

To qualify for a waiver using Form 588, applicants must meet specific criteria. Generally, eligibility includes:

- The applicant must be a nonresident of California.

- The income must be sourced from California but not subject to withholding under certain conditions.

- The applicant must provide valid reasons for the waiver request, supported by appropriate documentation.

Legal Use of the California Withholding Waiver Request

The legal framework surrounding Form 588 ensures that nonresidents can request a waiver without being subjected to excessive withholding. This form is designed to comply with California tax laws and is recognized by the Franchise Tax Board as a legitimate means for nonresidents to manage their tax obligations effectively. Proper use of this form can help prevent over-withholding and ensure that individuals retain more of their income.

Filing Deadlines and Important Dates

Understanding the filing deadlines for Form 588 is crucial for applicants. Typically, the form should be submitted before the income is paid or credited to the nonresident. It is advisable to check the California Franchise Tax Board's guidelines for specific deadlines related to the current tax year, as these dates can vary annually.

Form Submission Methods

Nonresidents can submit Form 588 through various methods, allowing for flexibility based on individual preferences. The available submission methods include:

- Online Submission: Some applicants may have the option to submit the form electronically through the California Franchise Tax Board's online portal.

- Mail: The completed form can be sent via postal service to the designated address provided in the form instructions.

- In-Person Submission: Applicants may also visit a local Franchise Tax Board office to submit their request directly.

Quick guide on how to complete 2023 form 588 nonresident withholding waiver request 2023 form 588 nonresident withholding waiver request

Accomplish , Form 588 Nonresident Withholding Waiver Request , Form 588, Nonresident Withholding Waiver Request effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage , Form 588 Nonresident Withholding Waiver Request , Form 588, Nonresident Withholding Waiver Request on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign , Form 588 Nonresident Withholding Waiver Request , Form 588, Nonresident Withholding Waiver Request with ease

- Obtain , Form 588 Nonresident Withholding Waiver Request , Form 588, Nonresident Withholding Waiver Request and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of your documents or black out sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and eSign , Form 588 Nonresident Withholding Waiver Request , Form 588, Nonresident Withholding Waiver Request to guarantee excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2023 form 588 nonresident withholding waiver request 2023 form 588 nonresident withholding waiver request

Create this form in 5 minutes!

How to create an eSignature for the 2023 form 588 nonresident withholding waiver request 2023 form 588 nonresident withholding waiver request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California withholding and how does it work?

California withholding refers to the state-required practice of deducting a portion of an employee's wages to cover taxes. Employers in California must calculate and withhold this amount based on the employee's earnings and tax bracket to ensure compliance with state tax regulations.

-

How does airSlate SignNow assist with California withholding documentation?

airSlate SignNow streamlines the creation and management of documents required for California withholding. With our eSigning solution, businesses can efficiently prepare withholding forms, obtain necessary signatures, and securely store them, all while ensuring compliance with California tax laws.

-

What features does airSlate SignNow offer for managing California withholding?

airSlate SignNow provides features such as customizable templates, secure eSigning, and easy document sharing tailored to California withholding needs. Our platform ensures that your withholding documentation process is both efficient and compliant, allowing businesses to focus on what matters most.

-

Is airSlate SignNow cost-effective for handling California withholding processes?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing California withholding processes. Our pricing plans are competitive, ensuring that businesses of all sizes can afford effective document management and eSigning without breaking the bank.

-

Can I integrate airSlate SignNow with other software for California withholding?

Absolutely! airSlate SignNow integrates seamlessly with various HR and payroll systems, enabling businesses to automate their California withholding processes. This integration capability minimizes manual entry, reduces errors, and enhances overall productivity.

-

What benefits can I expect from using airSlate SignNow for California withholding?

By using airSlate SignNow for California withholding, you can expect improved efficiency in document processing, enhanced compliance with state tax laws, and reduced paperwork. Our user-friendly interface and powerful features help save time and ensure a smoother workflow.

-

How can airSlate SignNow ensure compliance with California withholding regulations?

airSlate SignNow offers features that allow for the automatic updates of forms and compliance guidelines related to California withholding. By providing standardized templates and reminders, we ensure that your business stays aligned with the latest state requirements.

Get more for , Form 588 Nonresident Withholding Waiver Request , Form 588, Nonresident Withholding Waiver Request

Find out other , Form 588 Nonresident Withholding Waiver Request , Form 588, Nonresident Withholding Waiver Request

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT