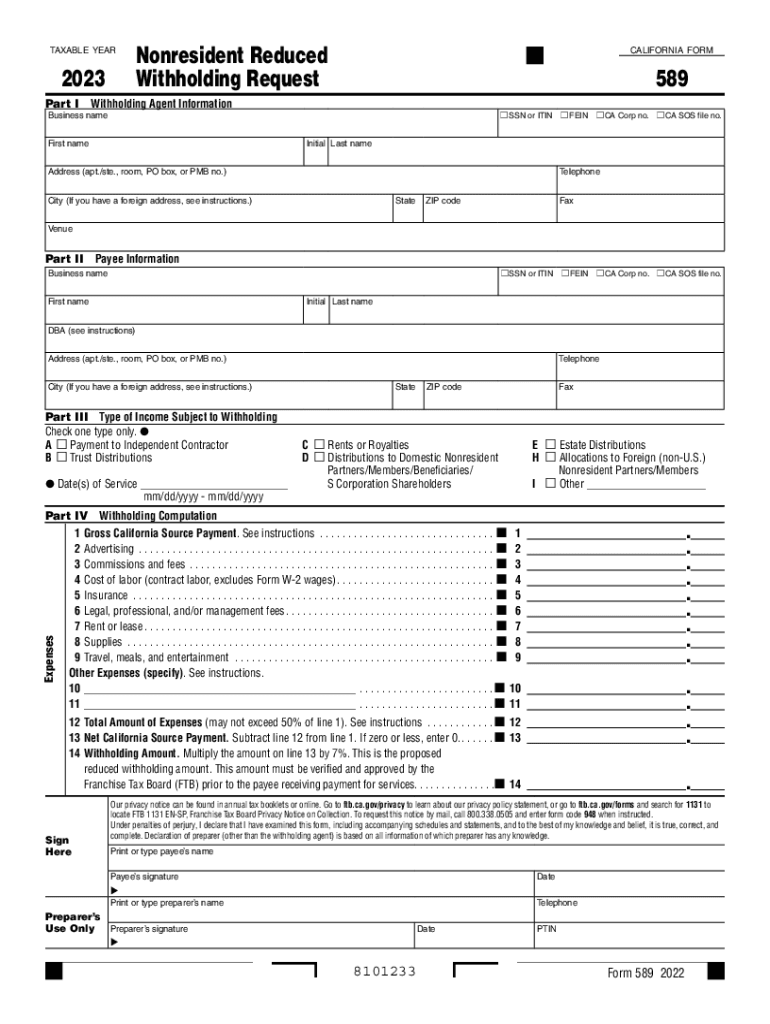

California Form 589 Nonresident Reduced Withholding Request , California Form 589, Nonresident Reduced Withholding Request 2023

Understanding the California Form 589 Nonresident Reduced Withholding Request

The California Form 589 is a crucial document for nonresidents seeking to reduce withholding on income earned in California. This form allows taxpayers to request a lower withholding rate based on specific criteria, such as their residency status and the nature of their income. By submitting this form, nonresidents can ensure that they are not over-withheld on taxes, which can help manage their cash flow effectively.

Steps to Complete the California Form 589 Nonresident Reduced Withholding Request

Completing the California Form 589 involves several key steps:

- Gather necessary information, including your taxpayer identification number and details about the income you are receiving.

- Fill out the form accurately, ensuring that you provide all required information, such as your name, address, and the reason for the reduced withholding request.

- Review the completed form for accuracy to avoid delays in processing.

- Submit the form to the appropriate California tax authority, either electronically or via mail, as per the submission guidelines.

Legal Use of the California Form 589 Nonresident Reduced Withholding Request

The California Form 589 is legally recognized under state tax laws, allowing nonresidents to formally request a reduction in withholding. It is important to understand that the form must be filled out correctly and submitted in accordance with California tax regulations to be considered valid. Proper use of this form can help ensure compliance with state tax laws while minimizing potential tax liabilities.

Eligibility Criteria for the California Form 589 Nonresident Reduced Withholding Request

To be eligible to use the California Form 589, applicants must meet certain criteria:

- You must be a nonresident of California.

- The income for which you are requesting reduced withholding must be subject to California state tax.

- You must provide valid reasons for the request, such as being eligible for certain deductions or credits that would lower your overall tax liability.

Who Issues the California Form 589 Nonresident Reduced Withholding Request

The California Form 589 is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's income tax laws, including the processing of withholding requests from nonresidents. The FTB provides guidelines and resources to assist taxpayers in completing the form accurately and efficiently.

Form Submission Methods for the California Form 589 Nonresident Reduced Withholding Request

There are several methods available for submitting the California Form 589:

- Online Submission: Taxpayers can submit the form electronically through the California Franchise Tax Board's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the FTB.

- In-Person Submission: Taxpayers may also choose to submit the form in person at designated FTB offices.

Quick guide on how to complete 2023 california form 589 nonresident reduced withholding request 2023 california form 589 nonresident reduced withholding

Effortlessly Prepare California Form 589 Nonresident Reduced Withholding Request , California Form 589, Nonresident Reduced Withholding Request on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the proper form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle California Form 589 Nonresident Reduced Withholding Request , California Form 589, Nonresident Reduced Withholding Request on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

How to Modify and eSign California Form 589 Nonresident Reduced Withholding Request , California Form 589, Nonresident Reduced Withholding Request with Ease

- Locate California Form 589 Nonresident Reduced Withholding Request , California Form 589, Nonresident Reduced Withholding Request and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides especially for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign California Form 589 Nonresident Reduced Withholding Request , California Form 589, Nonresident Reduced Withholding Request and guarantee outstanding communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2023 california form 589 nonresident reduced withholding request 2023 california form 589 nonresident reduced withholding

Create this form in 5 minutes!

How to create an eSignature for the 2023 california form 589 nonresident reduced withholding request 2023 california form 589 nonresident reduced withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CA Form 589 and why is it important?

CA Form 589, also known as the Nonresident Tax Withholding Statement, is essential for nonresident individuals and entities earning income in California. It helps ensure that the appropriate taxes are withheld and reported, safeguarding both the taxpayer and the state. Understanding CA Form 589 is crucial for compliance and avoiding tax issues.

-

How can airSlate SignNow simplify the signing process for CA Form 589?

airSlate SignNow streamlines the signing process for CA Form 589 by allowing users to eSign documents digitally, eliminating the need for printing and mailing. Our platform provides a secure and intuitive interface that makes signing official documents quick and hassle-free. This efficiency can save businesses valuable time and resources.

-

Is there a cost associated with using airSlate SignNow for CA Form 589?

Yes, there is a cost to use airSlate SignNow, but it offers competitive pricing tailored for various business needs. The investment in our service provides signNow value by reducing administrative burdens and enhancing document management efficiency, particularly for forms like CA Form 589. Check our pricing page for specific plans that suit your requirements.

-

Can airSlate SignNow integrate with other software for CA Form 589 management?

Absolutely! airSlate SignNow easily integrates with a variety of third-party applications, allowing seamless management of CA Form 589 and other documents. Whether you use CRM, accounting, or project management tools, our integrations enhance your workflow and ensure you manage CA Form 589 effortlessly.

-

What features does airSlate SignNow offer for managing CA Form 589?

Some key features of airSlate SignNow include customizable templates, automatic reminders, and audit trails that track all actions taken on your CA Form 589. These features enhance the efficiency of document handling and ensure compliance with all necessary regulations. Moreover, our mobile-friendly platform ensures easy access on-the-go.

-

How secure is airSlate SignNow when handling CA Form 589?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols to protect all documents, including CA Form 589, ensuring that sensitive information is safe from unauthorized access. Additionally, we comply with industry standards to keep your documents and data secure at all times.

-

Can I track the status of my CA Form 589 with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your CA Form 589. You can easily monitor who has signed or viewed the document and receive notifications when actions are completed. This feature enhances transparency and helps you manage your documents more effectively.

Get more for California Form 589 Nonresident Reduced Withholding Request , California Form 589, Nonresident Reduced Withholding Request

Find out other California Form 589 Nonresident Reduced Withholding Request , California Form 589, Nonresident Reduced Withholding Request

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document