Deferred Compensation Agreement Sample Form

What is the Deferred Compensation Agreement Sample

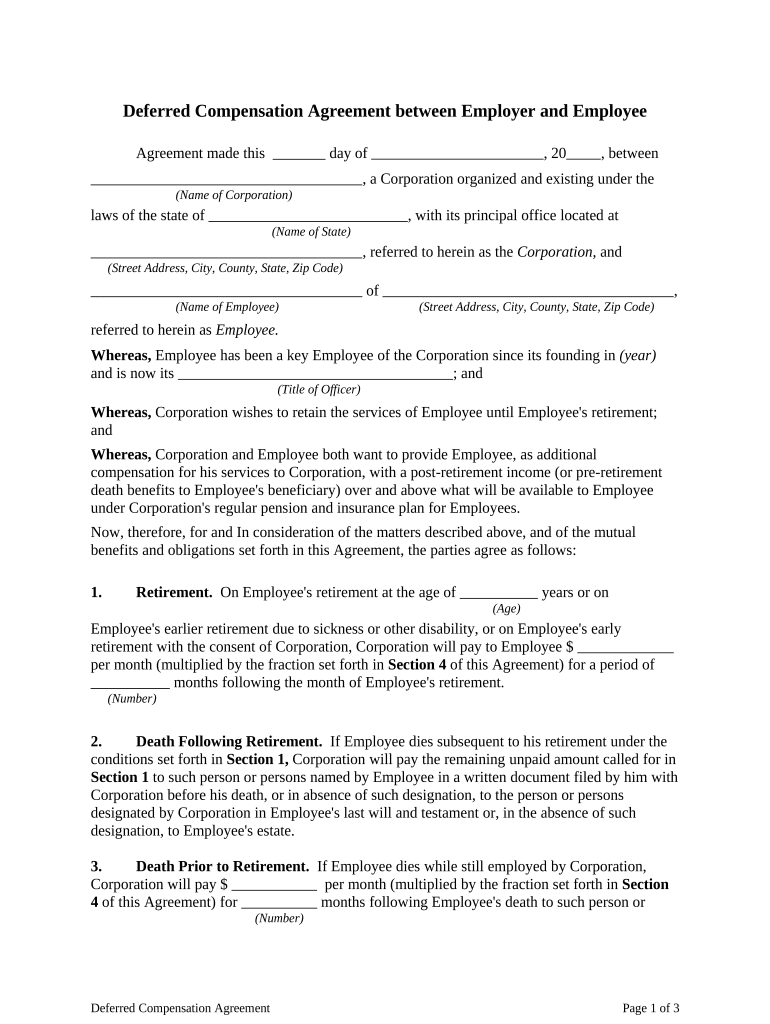

A deferred compensation agreement is a legal document that outlines the terms under which an employer agrees to pay an employee a portion of their earnings at a later date. This type of agreement is often used to provide tax advantages for both the employer and employee. The deferred compensation agreement sample serves as a template that can be customized to meet specific needs, ensuring compliance with federal and state laws while protecting the rights of both parties involved.

Key elements of the Deferred Compensation Agreement Sample

Understanding the key elements of a deferred compensation agreement is crucial for its effectiveness. Important components typically include:

- Parties Involved: Identification of the employer and employee.

- Compensation Amount: Details regarding the amount of compensation being deferred.

- Payment Schedule: Timeline for when the deferred amounts will be paid out.

- Conditions for Payment: Any conditions that must be met for the employee to receive the deferred compensation.

- Tax Implications: Information on how the deferred compensation will be taxed upon payout.

Steps to complete the Deferred Compensation Agreement Sample

Completing a deferred compensation agreement sample involves several key steps to ensure its validity and effectiveness. Follow these steps:

- Review the Template: Familiarize yourself with the sample and its components.

- Customize the Document: Fill in specific details relevant to the employer and employee.

- Legal Review: Have the agreement reviewed by a legal professional to ensure compliance with applicable laws.

- Obtain Signatures: Ensure both parties sign the agreement to make it legally binding.

- Store Securely: Keep a copy of the signed agreement in a secure location for future reference.

Legal use of the Deferred Compensation Agreement Sample

For a deferred compensation agreement to be legally enforceable, it must comply with various federal and state regulations. Key legal considerations include:

- Compliance with ERISA: If applicable, ensure the agreement meets the requirements of the Employee Retirement Income Security Act.

- Tax Regulations: Adhere to IRS guidelines regarding deferred compensation to avoid penalties.

- Written Agreement: A written document is necessary to establish the terms clearly and avoid disputes.

How to use the Deferred Compensation Agreement Sample

Using a deferred compensation agreement sample effectively involves understanding its purpose and how to adapt it for specific situations. This sample can be utilized as follows:

- As a Starting Point: Use the sample as a foundation to create a customized agreement tailored to your organization’s needs.

- For Training Purposes: Educate HR personnel and management on the essential components of deferred compensation agreements.

- For Legal Compliance: Ensure that the customized agreement meets all legal requirements to protect both the employer and employee.

Examples of using the Deferred Compensation Agreement Sample

Deferred compensation agreements can be utilized in various scenarios, such as:

- Executive Compensation: High-level executives often use these agreements to defer a portion of their salary for tax benefits.

- Retirement Planning: Employees may agree to defer compensation as part of their retirement strategy, allowing for tax-deferred growth.

- Incentive Programs: Companies may offer deferred compensation as part of an incentive program to retain key employees.

Quick guide on how to complete deferred compensation agreement sample

Easily prepare Deferred Compensation Agreement Sample on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your files quickly without any hold-ups. Manage Deferred Compensation Agreement Sample across any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Deferred Compensation Agreement Sample effortlessly

- Find Deferred Compensation Agreement Sample and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a standard ink signature.

- Review the details and click on the Done button to save your adjustments.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Deferred Compensation Agreement Sample and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a compensation agreement?

A compensation agreement is a legal document that outlines the terms of compensation between parties, typically in an employment or contractual context. It specifies the payment details, conditions, and expectations. airSlate SignNow makes it easy to create and eSign these agreements, ensuring clarity and compliance.

-

How does airSlate SignNow facilitate compensation agreements?

airSlate SignNow provides an intuitive platform that allows users to easily create, customize, and send compensation agreements. With our user-friendly interface and eSigning capabilities, you can streamline the process and ensure that all parties can review and sign quickly and securely.

-

Is there a cost associated with using airSlate SignNow for compensation agreements?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs, making it a cost-effective solution for managing compensation agreements. Our plans provide flexibility, allowing you to choose the features that best suit your requirements without breaking the bank.

-

What are the benefits of using airSlate SignNow for compensation agreements?

Using airSlate SignNow for your compensation agreements brings numerous benefits, including enhanced efficiency, reduced paperwork, and improved tracking of document statuses. The platform also increases accuracy in terms of signatures and document completion, mitigating the risks associated with manual processes.

-

Can airSlate SignNow integrate with other applications for managing compensation agreements?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications such as CRMs, project management tools, and other business solutions. This integration enhances your workflow and ensures that your compensation agreements are part of a larger, more efficient system.

-

What security measures does airSlate SignNow have for compensation agreements?

airSlate SignNow prioritizes the security of your compensation agreements by implementing robust encryption and authentication measures. This ensures that all documents are stored safely and only accessible to authorized users, providing peace of mind for both you and the other party involved.

-

Can I customize my compensation agreement templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize compensation agreement templates according to your specific business needs. With our easy editing tools, you can adjust various elements to fit your unique requirements, making your agreements both professional and tailored to your operations.

Get more for Deferred Compensation Agreement Sample

- Fitness bootcamp informed consent liability waiver

- Student parking application landstown high school form

- State of nevada tax forms 2016 2019

- Band karate jefferson bb brown sb form

- Saif form 2016 2019

- Volunteer sample formpdf

- Rosemead ca your electricity bill form

- Chargemortgage of land form 2 6260 on 201603

Find out other Deferred Compensation Agreement Sample

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online