Form Lending

What is the Form Lending

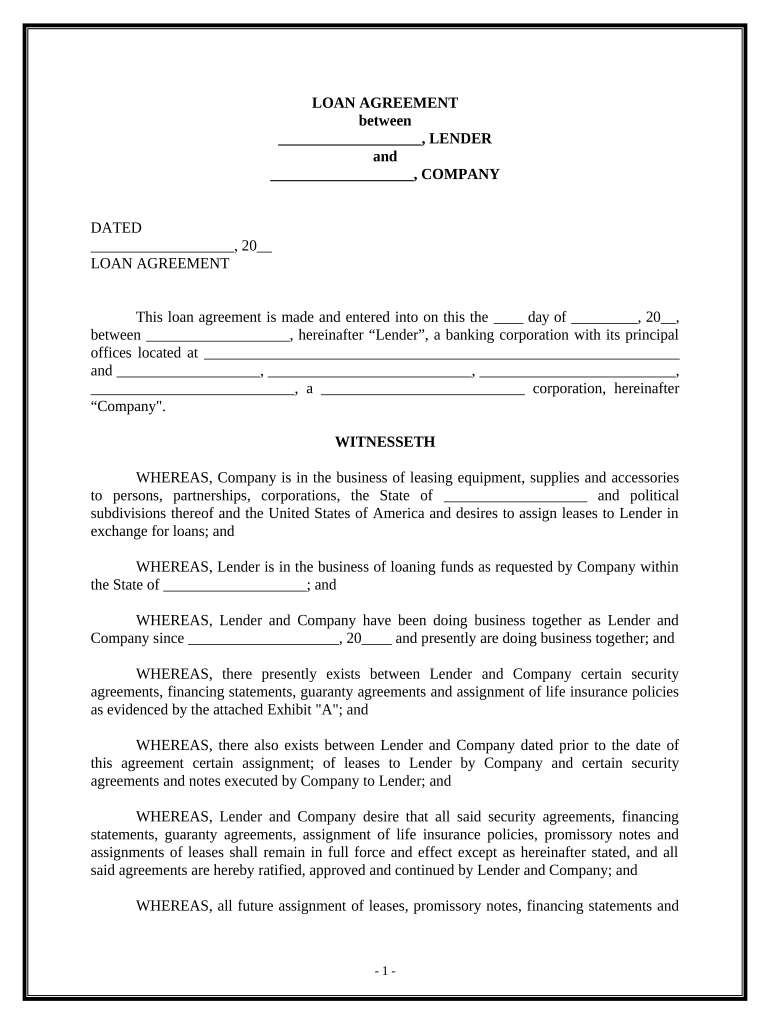

The form lending refers to a structured document that allows individuals or businesses to request a loan or financial assistance. This form typically includes essential information such as the applicant's personal details, the amount of money requested, and the purpose of the loan. Understanding the specific requirements and implications of this form is crucial for both lenders and borrowers, ensuring clarity and compliance throughout the lending process.

How to use the Form Lending

Using the form lending effectively involves several key steps. First, gather all necessary information, including financial details and identification. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. Once the form is filled out, review it for accuracy before submitting it to the lender. Depending on the lender's requirements, you may need to submit additional documentation to support your application.

Steps to complete the Form Lending

Completing the form lending involves a systematic approach:

- Gather required personal and financial information.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Attach any necessary supporting documents.

- Submit the form to the lender through the specified method.

Legal use of the Form Lending

The legal use of the form lending is governed by specific regulations that ensure the legitimacy of the lending process. It is essential that the form is completed in accordance with applicable laws to be considered valid. This includes obtaining the necessary signatures and adhering to any state-specific requirements. Compliance with these legal standards helps protect both the borrower and the lender throughout the transaction.

Key elements of the Form Lending

Several key elements must be included in the form lending to ensure its effectiveness and compliance:

- Borrower's personal information, including name and contact details.

- Loan amount requested and purpose of the loan.

- Income and employment information to assess repayment capability.

- Signature of the borrower, indicating consent and understanding of the terms.

- Any required disclosures or terms related to the loan.

Eligibility Criteria

Eligibility criteria for the form lending can vary based on the lender and the type of loan being requested. Common factors include:

- Minimum age requirement, typically eighteen years or older.

- Proof of income or employment status.

- Credit history assessment to evaluate financial responsibility.

- Residency status, as some lenders may have geographic restrictions.

Quick guide on how to complete form lending

Prepare Form Lending effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed records, as you can access the necessary forms and securely save them online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents promptly without delays. Handle Form Lending on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form Lending with ease

- Locate Form Lending and click Obtain Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically developed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Finish button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Lending and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form lending and how does it work with airSlate SignNow?

Form lending is a streamlined process that allows businesses to create, send, and eSign forms quickly and efficiently. With airSlate SignNow, you can manage form lending through user-friendly templates, ensuring that the signing process is seamless for both senders and recipients.

-

What features does airSlate SignNow offer for form lending?

airSlate SignNow provides a variety of features for form lending, including customizable templates, real-time tracking, and integrated workflows. These features simplify the document management process and enhance collaboration among team members, making form lending straightforward and efficient.

-

How much does airSlate SignNow cost for form lending services?

The pricing for airSlate SignNow's form lending services varies based on the chosen plan. There are different tiers, starting with affordable options for small businesses, allowing users to select a plan that best suits their form lending needs and budget.

-

Can I integrate airSlate SignNow with other applications for form lending?

Yes, airSlate SignNow supports integrations with numerous applications, making it easier to incorporate form lending into your existing workflows. Popular integrations include CRM systems, project management tools, and cloud storage solutions, which enhance the efficiency of your form lending process.

-

What benefits does airSlate SignNow provide for businesses using form lending?

Using airSlate SignNow for form lending offers numerous benefits, including reduced turnaround times, improved accuracy, and enhanced security in document transactions. By digitizing form lending, businesses can foster better communication and speed up their workflows.

-

Is airSlate SignNow secure for handling sensitive form lending documents?

Absolutely! airSlate SignNow employs industry-standard security measures to protect sensitive form lending documents. With encryption, secure data storage, and compliance with regulations, your documents are safeguarded throughout the lending process.

-

How can I create a form lending template in airSlate SignNow?

Creating a form lending template in airSlate SignNow is simple and intuitive. Users can start with a blank template or customize existing ones, adding fields, instructions, and branding, which will streamline the form lending process for future use.

Get more for Form Lending

- Ccisd sports physical form

- Photo consent form suny upstate medical university upstate

- San jacinto college transcript request form

- Oral observation form

- Scrap form

- Lassen community college transcript request form

- Avid community service form

- Intent to withdraw form shelton state community college sheltonstate

Find out other Form Lending

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe