Pledge Stock Form

What is the Pledge Stock

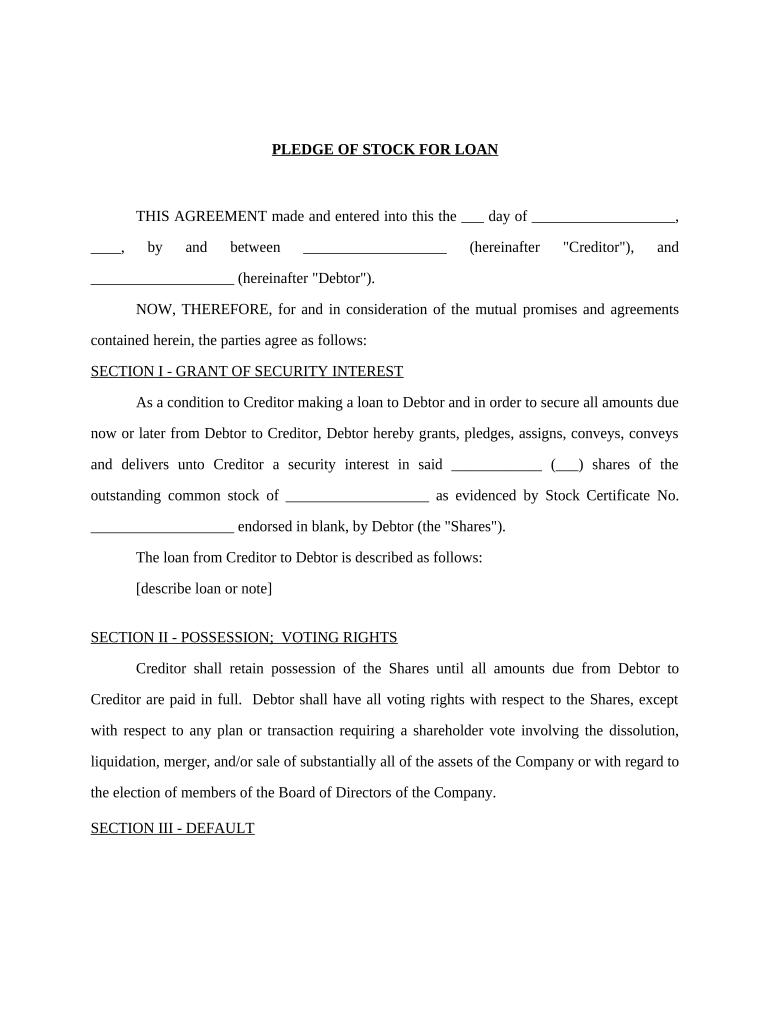

The pledge stock is a legal document that signifies a commitment to provide shares or ownership interests in a company as collateral for a loan or obligation. This form is often used in business transactions where a lender requires assurance that the borrower has a vested interest in the company. By pledging stock, the borrower offers a form of security that can be claimed by the lender if the borrower defaults on their obligations. Understanding the nature of pledge stock is essential for both parties involved in the transaction.

How to Use the Pledge Stock

Using the pledge stock involves several steps to ensure that the document is executed correctly and meets legal requirements. First, the parties must agree on the terms of the pledge, including the number of shares and the conditions under which the stock can be claimed. Next, both parties should fill out the pledge stock form accurately, providing necessary details such as names, addresses, and the specifics of the stock being pledged. Finally, the document must be signed by both parties, ideally in the presence of a witness or notary, to enhance its legal standing.

Steps to Complete the Pledge Stock

Completing the pledge stock form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the names of the pledger and pledgee, stock details, and any relevant agreements.

- Fill out the pledge stock form, ensuring that all fields are completed accurately.

- Review the document for any errors or omissions before signing.

- Have the form signed by both parties, and consider having it notarized for additional legal protection.

- Keep copies of the signed pledge stock for both parties' records.

Legal Use of the Pledge Stock

The pledge stock serves as a legally binding agreement when executed properly. To ensure its legal enforceability, the document must comply with relevant state laws and regulations. This includes providing accurate information, obtaining the necessary signatures, and adhering to any specific requirements outlined by state law. It is advisable to consult with a legal professional to confirm that the pledge stock meets all legal standards and adequately protects the interests of both parties.

Key Elements of the Pledge Stock

Several key elements must be included in the pledge stock to ensure its effectiveness:

- Identification of Parties: Clearly state the names and addresses of the pledger and pledgee.

- Description of Stock: Include details about the shares being pledged, such as the type and number of shares.

- Terms of the Pledge: Outline the conditions under which the pledge may be enforced.

- Signatures: Ensure that both parties sign the document to validate the agreement.

- Date: Include the date of signing to establish a timeline for the pledge.

Examples of Using the Pledge Stock

Pledge stock can be utilized in various scenarios, such as:

- A startup pledging shares to secure a loan from a bank.

- An investor using their stock holdings as collateral for a personal loan.

- A business owner pledging company shares to raise funds for expansion.

These examples illustrate how pledge stock can facilitate financial transactions while providing security for lenders.

Quick guide on how to complete pledge stock

Complete Pledge Stock effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct forms and securely store them online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Pledge Stock on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Pledge Stock without hassle

- Obtain Pledge Stock and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Choose how you want to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Pledge Stock and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is pledge stock and how can airSlate SignNow help?

Pledge stock refers to shares or equity that are used as collateral for loans or obligations. With airSlate SignNow, businesses can easily create, sign, and manage documents related to pledge stock transactions, streamlining the process and ensuring compliance.

-

What are the pricing options for using airSlate SignNow for pledge stock agreements?

airSlate SignNow offers competitive pricing plans tailored to your business needs. Whether you’re a startup or a large enterprise, you can find a plan that accommodates your volume of document transactions related to pledge stock, ensuring you remain cost-effective.

-

Can airSlate SignNow integrate with other platforms for managing pledge stock?

Yes, airSlate SignNow offers seamless integrations with various platforms, enhancing your workflow for managing pledge stock. Whether you use CRM systems or cloud storage solutions, our integrations allow for easy document transfers and streamlined processes.

-

What features does airSlate SignNow provide for managing pledge stock documents?

airSlate SignNow includes a range of features designed to simplify the management of pledge stock documents. Key functionalities include eSigning, document templates, real-time tracking, and secure sharing, ensuring that your transactions are efficient and secure.

-

How does airSlate SignNow ensure security for pledge stock agreements?

Security is paramount when handling sensitive documents like pledge stock agreements. airSlate SignNow employs robust encryption, secure cloud storage, and advanced user authentication measures to protect your documents and ensure compliance with industry standards.

-

What are the benefits of using airSlate SignNow for pledge stock documentation?

Using airSlate SignNow for pledge stock documentation brings several benefits, including increased accuracy, time savings, and improved collaboration. Our platform streamlines the signing process, allowing you to focus on your business while maintaining a high level of professionalism.

-

Is it easy to eSign pledge stock documents with airSlate SignNow?

Yes, eSigning pledge stock documents with airSlate SignNow is straightforward and user-friendly. Our intuitive interface allows users to sign documents electronically in just a few clicks, making the process quick and efficient for all parties involved.

Get more for Pledge Stock

Find out other Pledge Stock

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe